Are Realtor.com Leads Worth It in 2025? Real Costs & ROI Breakdown

The complete guide every real estate agent needs before investing a single dollar

Realtor.com leads only pay off if you can respond within five minutes, nurture for 12–24 months, and keep cost-per-closing around $2.5k–$8k. Most lists include 60–75% low-intent contacts. If your average commission is under $6k or you lack a follow-up system, you’ll get better ROI from brand and referrals.

Thinking about putting five hundred dollars a month into Realtor.com leads? Whether this works has less to do with what you pay and more to do with how fast and how well you work the leads you get. Online lead ROI hinges on speed to lead, follow-up depth, and the portal’s business model. Responding inside five minutes can increase contact odds by up to 100 times vs thirty minutes, with qualification odds up to 21 times higher. Agents who respond in under five minutes and run a disciplined follow-up plan see a very different ROI than those who do not.

This guide shows exactly how to evaluate Realtor.com’s programs, what to expect in 2025, and the playbook top teams use to turn these leads into predictable revenue. You’ll discover exactly what works, what doesn’t, and how top-performing agents turn these leads into predictable income streams. By the end, you’ll know whether these leads fit your business model and have a clear action plan to maximize your investment.

Here’s what you’ll gain from this deep dive: proven conversion strategies from successful agents, detailed cost analysis with real ROI calculations, and a step-by-step system for evaluating lead quality before you spend a dime.

Understanding the Realtor.com Lead Ecosystem

The Platform’s Strategic Foundation

Realtor.com built its reputation on a fundamental advantage over competitors like Zillow. Since launching in 1994, the platform has maintained direct relationships with over 890 Multiple Listing Service (MLS) systems across the United States. This connection means their database updates every 15 minutes, dramatically reducing the frustrating experience of consumers calling about sold properties.

This MLS-centric approach creates a crucial difference in lead quality. While Zillow casts a wider net with For-Sale-By-Owner listings and estimates, Realtor.com attracts users who are typically further along in their buying journey. They’re looking at actual available properties, not browsing theoretical home values.

The platform’s 2018 acquisition of Opcity marked a strategic shift toward referral-based programs, fundamentally changing how agents access and pay for leads. This evolution created the tiered system we see today, each designed for different business models and risk tolerances.

Breaking Down Lead Product Options

| Product | Core Model | Fee Structure | Best For |

|---|---|---|---|

| Connections Plus | Upfront subscription for shared buyer leads, CRM integrations via Lead Delivery API | ZIP code-based subscription | Agents who want immediate access and can handle competition |

| ReadyConnect Concierge | Referral model with no upfront fee. Leads are pre-screened and live-transferred | Fee paid only at closing, commonly 30-35% range | Risk-averse agents who prefer performance-based pricing |

| Market VIP | Brokerage-level exclusivity in selected ZIPs, marketed as converting up to 3x above industry averages | High fixed cost for exclusive access | Teams that can absorb higher costs to remove competition |

Program Chooser

You want control and can staff fast response → Start with Connections Plus, integrate API, measure for 90 days.

You want pay-at-close and pre-screening → ReadyConnect Concierge, expect a referral fee at closing.

You run a team and need predictable volume → Market VIP, trade higher fixed cost for exclusivity and less competition.

Connections℠ Plus: The Traditional Approach

This upfront-cost program targets agents who want immediate access to buyer leads in their local market. You pay a monthly subscription based on your ZIP code’s average home values, typically starting around $200 per month for shared leads.

The system includes automated communication tools, lead nurturing capabilities, and a centralized dashboard for managing follow-ups. The value proposition centers on speed and efficiency, giving you tools to respond immediately when leads come in.

However, shared leads mean competition. Multiple agents receive the same contact information, creating a race to connect first. Success depends entirely on your response time and follow-up system.

ReadyConnect℠ Concierge: The Performance Model

Formerly known as Opcity, this referral-based approach eliminates upfront costs entirely. A concierge team pre-screens leads and connects qualified prospects with compatible agents via live phone calls.

You only pay when you close a deal, typically 25-35% of your commission. This model appeals to agents who prefer performance-based pricing and want someone else handling initial lead qualification.

The trade-off? Less control over lead flow and timing. You’re dependent on the concierge team’s assessment of lead quality and their matching process.

Market VIP (MVIP): The Exclusive Territory Model

Designed for high-growth brokerages and established teams, MVIP provides exclusive access to leads within specific ZIP codes. This exclusivity reportedly increases conversion rates up to 3 times above industry averages.

The Reality Check: Common Pain Points and Frustrations

Lead Quality Concerns

Agent complaints about Realtor.com leads consistently focus on quality issues. Reviews frequently mention fake contact information, duplicate leads, and prospects who claim they never submitted inquiries.

Part of this stems from how leads are generated. When consumers click “contact agent” buttons, they don’t always realize their information will be shared with multiple agents. This creates confusion and frustration on both sides.

The platform’s official response is that they automatically filter spam and duplicates, but agents report these systems aren’t foolproof. Success requires accepting that not every lead will be viable and building conversion systems that account for this reality.

The Competition Problem

Standard lead programs create intense competition environments. When five agents receive the same lead simultaneously, success goes to whoever responds fastest with the most compelling message.

This “speed to lead” race can be exhausting and expensive. Agents report feeling pressured to respond within minutes, even during family time or vacations. The constant urgency can lead to burnout and poor work-life balance.

Exclusive programs solve this problem but at significantly higher costs. Many desirable ZIP codes have waiting lists for exclusive access, making this option unavailable regardless of budget.

Contract and Cancellation Challenges

Long-term contracts create financial risk for agents testing the platform. Before signing, request specific information on:

Contract Checklist:

- Written terms on cancellation window and process

- Auto-renewal clauses and notification requirements

- Service-level changes allowed mid-term

- Expected monthly lead volume by ZIP with look-back period

- Dispute and refund policy for invalid or duplicate leads

- Whether exclusivity is ZIP-wide or listing-level

- Email recap of every verbal promise

Agent reviews document difficulty canceling services, including continued charges after requested terminations and unresponsive customer service. Understanding contract terms upfront prevents costly surprises later.

The business model depends on long-term commitments rather than individual agent success. This alignment issue explains many frustrations agents experience with service quality and support responsiveness.

The Financial Reality: Smarter ROI Analysis

ROI Calculation Framework

Rather than chasing outdated cost-per-lead comparisons that vary dramatically by market, successful agents track these inputs and compute real ROI with current data:

Track Inputs:

- Monthly subscription or referral fees

- Tech stack costs (CRM, automation tools)

- Time investment cost

Track Funnel:

- Leads received

- Contact rate (leads you actually reach)

- Appointment rate

- Close rate

- Average commission per deal

Compute ROI: (Gross Commission − Total Costs) ÷ Total Costs

Benchmark against your own last 90 days and the same ZIP codes, not national averages.

Remember: Speed to lead is the multiplier that changes everything. Respond inside five minutes.

Understanding Market-Based Costs

Pricing varies dramatically based on local market conditions. ZIP codes with higher average home values command premium pricing, with exclusive programs typically costing 2-3 times more than shared access.

Beyond subscription costs, factor in:

- CRM system integration and management

- Automated follow-up tool subscriptions

- Time investment in lead nurturing

- Opportunity costs of focusing on purchased leads versus organic marketing

Mastering Lead Conversion: The Success Framework

The 90-Day Test Plan

Day 0 Setup:

- CRM with Realtor.com Lead Delivery API enabled

- Instant SMS plus call routing, voicemail drop, and email action plan

- Scripts for first call, text, email

- Tracking sheet with weekly targets and simple win-loss reason codes

Weeks 1-4:

- Goal: 95% of leads contacted within five minutes

- Eight touch attempts across 7 days per new lead

- Weekly review of speed-to-contact and appointment rate

Weeks 5-8:

- Double down on winning time windows, improve scripting

- Add video introductions to email sequences

- Build a “hot list” of engaged leads for same-day tours

Weeks 9-12:

- Tune budgets or territories based on performance data

- Decide to scale up, hold, or kill based on net contribution margin, not just conversion rate

Ready-to-Use Speed Scripts

First 5 Minutes – Text: “Hi {Name}, I just got your inquiry about {123 Main St}. I can share disclosures and schedule a tour today or tomorrow. What time works best?”

Voicemail: “Hi {Name}, this is {Your Name} with {Brokerage}. I saw your request on Realtor.com for {123 Main St}. I will text you the details now and can show it today if helpful.”

First Email: Subject: Quick info on {123 Main St} + 2 similar options Body: One line about the property, two comparable suggestions, one clear next step.

The Follow-Up System

Converting online leads requires persistent, multi-channel follow-up campaigns. Industry data suggests the average lead needs 6-8 contact attempts before responding.

Day 1 Protocol:

- Phone call within 5 minutes of lead receipt

- Text message with introduction and availability

- Email with local market information and credentials

Days 2-7 Follow-up:

- Alternate between phone calls, texts, and emails

- Provide valuable content in each interaction

- Maintain professional persistence without being pushy

Long-term Nurturing:

- Monthly market updates for non-responsive leads

- Automated drip campaigns with helpful buying information

- Periodic check-ins to assess timeline changes

The key is providing value in every interaction rather than just asking for business. Successful agents become trusted advisors before they become transaction partners.

Technology Stack Requirements

Effective lead management requires robust technology infrastructure:

Customer Relationship Management (CRM): Essential for tracking lead interactions, scheduling follow-ups, and measuring conversion rates. Popular options include Follow Up Boss, Chime, and KvCORE.

Marketing Automation: Tools like Mailchimp or Market Leader help maintain consistent communication with large lead databases without manual effort.

Communication Tools: Services like Slybroadcast enable efficient voicemail delivery, while platforms like BombBomb add personal video messages to email campaigns.

Lead Integration: Realtor.com’s Lead Delivery API provides direct CRM integration, eliminating manual data entry and reducing response times.

Investment in technology pays dividends through improved efficiency and higher conversion rates. Agents spending $200-500 monthly on automation tools often see 2-3x improvement in lead management capacity.

| Market Tier | Monthly Budget | Avg CPL | Leads to Close | Cost Per Closing | Min Commission |

|---|---|---|---|---|---|

| Suburban, Mid-Price | $600–$1,200 | $25–$60 | 40–70 | $2,500–$5,000 | ≥ $6,000 |

| Urban, Competitive | $1,200–$2,500 | $40–$90 | 50–90 | $3,500–$7,000 | ≥ $8,000 |

| Luxury, High Price | $2,000–$4,000+ | $60–$120+ | 60–100 | $5,000–$8,000+ | ≥ $12,000 |

Realtor.com vs Zillow vs Homes.com in 2025

Current Market Position

Traffic Reality Check:

- Zillow reported about 243 million average monthly unique users in Q2 2025

- News Corp said Realtor.com averaged about 72 million in the same period

- Homes.com’s owner CoStar has publicly claimed ~104 million average monthly unique visitors in Q1 2025

Strategic Comparison

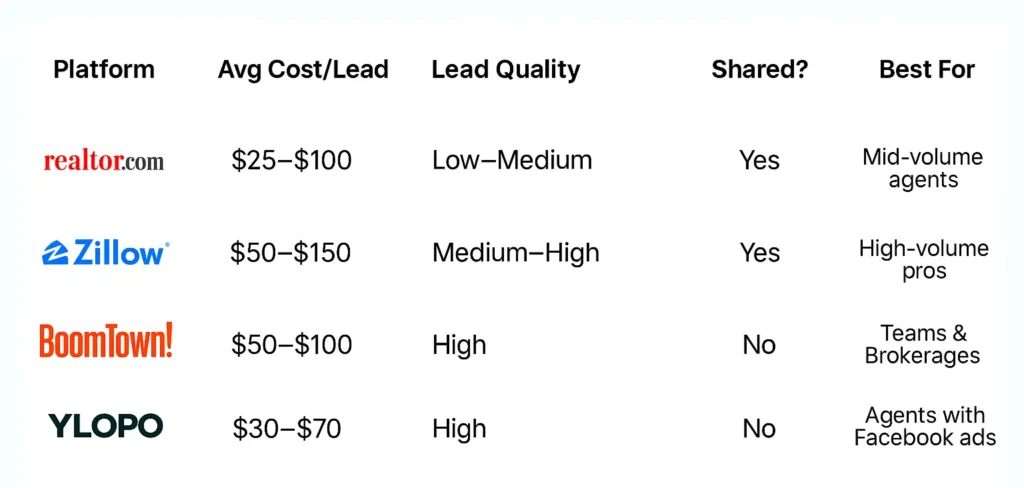

Platform Comparison 2025

How the major real estate portals stack up

Realtor.com

Zillow

Homes.com

Business Model Implications

Zillow’s Reach vs. Intent: Zillow’s massive audience includes casual browsers researching property values and users exploring neighborhoods. This creates volume but potentially longer sales cycles and lower initial intent.

Realtor.com’s MLS Advantage: The MLS-based approach typically attracts users actively shopping for available homes rather than browsing estimates or sold data. This can translate to shorter sales cycles but requires faster response capabilities.

Homes.com’s Agent-First Approach: Their “Your Listing, Your Lead” philosophy eliminates competition on listing inquiries, giving listing agents direct access to prospects interested in their specific properties.

The AI Revolution: Future of Real Estate Lead Generation

Predictive Analytics and Lead Scoring

Artificial intelligence is transforming how agents evaluate and prioritize leads. Modern AI systems analyze hundreds of data points including:

- Online browsing behavior patterns

- Social media engagement indicators

- Financial pre-qualification factors

- Geographic and demographic markers

This analysis creates lead scores helping agents focus time on highest-probability prospects. Rather than treating all leads equally, AI enables targeted resource allocation for maximum conversion rates.

Automated Communication and Qualification

AI chatbots handle initial lead interactions 24/7, qualifying prospects and scheduling appointments with human agents. This automation ensures immediate response while filtering out unqualified inquiries.

Advanced systems use natural language processing to understand lead intent and provide personalized responses. This technology bridges the gap between immediate response requirements and human agent availability.

Personalization at Scale

AI tools like GPT-based writing assistants help agents create personalized communication for large lead databases. Rather than generic follow-up messages, agents can provide customized market insights and property recommendations for each prospect.

This personalization improves engagement rates and conversion probability while reducing the time investment required for effective lead nurturing.

Frequently Asked Questions

What’s the real monthly cost for Realtor.com leads?

Costs vary significantly by ZIP code and program type. Connections Plus typically requires monthly subscriptions based on local market values, while ReadyConnect Concierge operates on a referral-only model with no upfront cost.

For exclusive Market VIP access, expect significantly higher monthly commitments. Remember to factor in supporting costs like CRM subscriptions, automation tools, and time investment when calculating your true monthly expense.

Does Realtor.com integrate with my CRM?

Yes. The Lead Delivery API pushes leads directly to supported CRMs for faster response and richer data. This integration eliminates manual data entry and can significantly improve your response times compared to email-forwarding methods.

Supported CRM platforms include most major real estate systems. Check with your CRM provider for specific integration capabilities before signing up.

How long should I test before scaling?

Run a 90-day test with strict speed-to-lead and follow-up targets. Scale based on net margin, not just conversion rate.

Your test period should include at least one full market cycle and enough lead volume to establish meaningful conversion patterns. Track detailed metrics from day one and set specific performance benchmarks for continuation decisions.

How do I know if my market is oversaturated with competing agents?

Request specific data on agent competition in your target ZIP codes before signing contracts. Ask for the number of active participants and average lead distribution ratios.

Markets with more than 10 competing agents per ZIP code typically show lower conversion rates and increased costs. Consider targeting adjacent areas with less competition if your primary market is oversaturated.

What conversion rate should I expect from purchased leads?

Industry averages range from 3-8% for online real estate leads, but successful agents often achieve 10-15% through disciplined follow-up systems.

Your conversion rate depends on:

- Response time to initial inquiries

- Quality and persistence of follow-up campaigns

- Local market conditions and competition levels

- Your experience and sales skills

Track your metrics monthly and compare against your own historical performance rather than industry averages.

Should new agents invest in paid lead programs?

New agents face unique challenges with purchased leads, including limited experience in conversion techniques and tight budgets that can’t sustain long learning curves.

However, structured lead programs can accelerate business development if you:

- Have sufficient budget for 6-12 month commitments

- Invest equally in conversion training and technology

- Work with a mentor or coach experienced in online lead management

- Can commit to immediate response requirements

Consider starting with lower-cost platforms or referral-based programs that don’t require upfront investment.

How do I avoid getting locked into unfavorable contracts?

Read all contract terms carefully before signing, paying special attention to:

- Cancellation policies and required notice periods

- Automatic renewal clauses

- Lead volume guarantees and remedies for underdelivery

- Geographic exclusivity terms and competitor restrictions

Negotiate shorter initial terms when possible, even if it means higher monthly costs. Document all verbal promises in writing and maintain records of lead quality and volume for potential disputes.

What’s the difference between warm and cold leads from these platforms?

Warm leads have typically:

- Submitted specific property inquiries

- Provided complete contact information willingly

- Indicated current buying timelines

- Engaged with multiple listings or market research

Cold leads often result from:

- Broad market research activities

- Accidental form submissions

- Information exchanges for general content access

- Old inquiries redistributed due to agent inactivity

Focus your immediate attention on warm leads while developing longer-term nurturing campaigns for cold prospects.

How should I integrate purchased leads with organic marketing?

Successful agents balance purchased leads with organic strategies to reduce dependency on any single source:

Short-term: Use purchased leads for immediate revenue generation while building organic systems Medium-term: Develop referral programs and past client marketing to reduce reliance on purchased leads Long-term: Establish yourself as a local market expert through content marketing and community involvement

Aim for no more than 40-50% of your business coming from purchased leads to maintain a sustainable and resilient income stream.

What technology setup do I need before buying leads?

Essential infrastructure includes:

- CRM system with lead capture and automation capabilities

- Mobile apps for immediate lead notifications

- Email marketing platform for nurturing campaigns

- Call tracking system for measuring conversion sources

- Website with lead capture forms and market information

Budget $200-500 monthly for technology stack before investing in lead generation. Poor systems will waste even the highest-quality leads.

How do I measure success beyond simple conversion rates?

Track these advanced metrics for comprehensive performance analysis:

Speed to Contact: Average time from lead receipt to first contact attempt

Contact Rate: Percentage of leads you successfully reach by phone

Appointment Rate: Leads converted to in-person or virtual meetings

Listing Rate: Buyer leads who also list properties with you

Referral Generation: New leads generated from purchased lead conversions

Lifetime Value: Total commission earned from each converted lead source

These metrics help identify improvement opportunities and justify marketing investments to business partners or lenders.

What questions should I ask before signing up?

Critical questions for sales representatives:

- How many competing agents currently operate in my target ZIP codes?

- What’s the average lead volume for my specific market over the past 12 months?

- Can you provide references from successful agents in similar markets?

- What’s your policy for lead quality disputes and refunds?

- How quickly can I modify my service level or cancel if needed?

- What additional tools or training do you recommend for new subscribers?

Document all responses and compare multiple platforms before making final decisions.

Is it worth paying extra for exclusive leads?

Exclusive access eliminates competition but comes with significantly higher costs and limited availability. Consider exclusive programs when:

- You have established conversion systems proving profitability at higher price points

- Your market shows extreme competition making shared leads unproductive

- You’re building a team and need predictable lead flow for multiple agents

- Your average transaction values justify premium lead costs

Start with shared programs to develop conversion skills and prove ROI before investing in exclusive access.

How long should I test a platform before making long-term commitments?

Plan for a minimum 90-day evaluation period to account for:

- Learning curve in developing effective follow-up systems

- Seasonal variations in lead quality and volume

- Time needed to build rapport with prospects who convert slowly

- Technical integration challenges with your existing systems

Track detailed metrics from day one and set specific performance benchmarks for continuation decisions. Many platforms offer shorter trial periods, but meaningful results require longer evaluation timeframes.

Conclusion: Making the Strategic Decision

Realtor.com leads represent a viable path to consistent business growth, but success requires strategic thinking beyond simply buying access to prospects. The agents who thrive with these programs treat lead generation as one component of a comprehensive business system rather than a magic solution to income challenges.

Your decision should center on three critical factors: your ability to respond immediately to inquiries, your commitment to persistent follow-up processes, and your budget for both lead costs and supporting technology. Without these elements in place, even the highest-quality leads will fail to generate positive returns.

The most successful approach involves starting small, measuring everything, and scaling gradually based on proven results. Begin with a modest budget on shared leads while building the systems and skills necessary for higher conversion rates. Once you’ve demonstrated consistent profitability, consider investing in exclusive access or expanding to additional markets.

Remember that sustainable success comes from diversified lead sources rather than dependence on any single platform. Use purchased leads to accelerate growth while simultaneously developing referral networks, content marketing strategies, and community relationships that will support your business long-term.

The real estate industry continues evolving toward more sophisticated, technology-driven approaches to client acquisition and service delivery. Agents who embrace these changes while maintaining focus on relationship building and expert service delivery will thrive regardless of which specific lead generation platforms they choose.

Ready to optimize your lead generation strategy? Start by auditing your current conversion processes, technology infrastructure, and budget allocation. The foundation you build today determines whether purchased leads become a profitable growth engine or an expensive learning experience.

18 Comments