Realtor.com Seller Leads: The Complete 2025 Performance Guide

Last updated: October 1, 2025

Introduction

Sarah Martinez spent $14,400 on lead generation in 2024. As a broker managing a team of six agents in Phoenix, she watched her Realtor.com subscription renew month after month while her team struggled to convert prospects into closings. Her experience isn’t unique. Across the United States, real estate professionals invest billions in online lead generation, yet many report conversion rates that barely justify their monthly spend.

If you’re considering investing in seller leads from real estate portals, you need accurate information about what works, what doesn’t, and what the numbers actually show. This guide examines lead generation programs, real conversion data from practicing agents, filtering capabilities, and the legitimate concerns raised in recent litigation. You’ll learn how to evaluate whether portal leads fit your business model, what red flags to watch for, and which alternatives might deliver better returns.

By the end of this article, you’ll have a framework for making informed decisions about lead purchases, specific tactics for maximizing conversion rates, and realistic expectations based on industry data rather than marketing claims.

Understanding Lead Generation Programs

Primary Service Tiers and Seller Lead Mechanics

Real estate portals offer multiple programs designed for different business sizes and budgets. Understanding these options helps you match services to your actual needs rather than overpaying for features you won’t use.

Connections Plus targets individual agents and small teams. According to the original platform materials, monthly costs range from $200 to over $1,800 depending on your market and ZIP code exclusivity. You receive shared buyer and seller prospects who have interacted with property listings. Seller leads in this tier are typically shared among multiple agents (usually 3-5 depending on market demand), meaning you’re competing for attention the moment you receive the contact. The program assumes you have basic CRM capabilities and can respond to inquiries within hours, though response time becomes critical when leads aren’t exclusive.

ReadyConnect Concierge (formerly Opcity) operates on a pay-at-closing model exclusively for brokerages. Instead of monthly subscriptions, you pay referral fees of 30-35% of gross commission when deals close. Seller leads in this program receive warm transfers via three-way calls, meaning a representative connects the homeowner with you directly. These contacts may be shared occasionally through round-robin distribution among participating agents, though the live-transfer format gives you immediate conversation opportunity. The National Association of Realtors reported that referral-based models can reduce upfront risk for brokerages with inconsistent cash flow.

Market VIP provides exclusive access to prospects in specific geographic areas for select brokerages. This premium tier requires significant upfront investment but promises higher-quality contacts with genuine exclusivity. Unlike Connections Plus, where seller leads route to multiple agents simultaneously, Market VIP grants you sole access within your contracted ZIP codes. Think of it as buying first-response rights in your territory. This program works best for brokerages with inside sales agents (ISAs) who can respond within 60 seconds consistently.

How Seller Leads Are Actually Generated

Understanding exactly how platforms capture seller information helps you anticipate lead quality and intent levels. Seller leads differ fundamentally from buyer inquiries in both entry points and qualification signals.

Primary Seller Entry Points:

Home valuation tools represent the largest source of seller contacts. When homeowners enter their address to see “what’s my home worth,” they trigger seller lead routing. These prospects range from curious neighbors checking market values to serious sellers planning listing timelines. The platform cannot distinguish intent at capture, which explains quality variance.

“List My Home” or “Talk to a Listing Agent” buttons appear on property pages and market reports. These clicks indicate higher intent than passive valuation requests. Homeowners actively seeking agent contact typically convert at 2-3x the rate of valuation-only inquiries based on industry patterns.

CMA (Comparative Market Analysis) requests signal near-term listing consideration. When homeowners request formal market analyses, they’re usually comparing agents or preparing for listing conversations. These represent the highest-intent seller leads available through portal channels.

Seller timeline questionnaires capture critical qualification data. Forms asking “when are you planning to sell” or “have you already listed” help route leads appropriately, though homeowners don’t always answer accurately.

Property-specific inquiries from owners occur when someone views listings in their own neighborhood, then requests agent contact. Behavioral tracking identifies these patterns and flags potential sellers researching competition.

How This Differs from Buyer Lead Generation:

Buyer leads typically originate from saved searches, property tours requests, and direct listing inquiries. The intent signals are clearer because buyers actively click “contact agent” on specific properties. Seller lead capture relies more heavily on forced form submissions (requiring contact information to see valuation estimates), which creates the quality concerns agents report.

The 2024 class-action lawsuit against Realtor.com specifically alleges that 40-50% of distributed contacts either lack genuine purchase intent or cannot be verified as real people. While this litigation remains ongoing, it highlights concerns many agents have privately expressed for years, particularly around forced-submission seller capture methods.

Filtering and Targeting Capabilities for Seller Leads

Geographic and Demographic Options

Modern lead platforms offer sophisticated filtering that theoretically helps you focus on your ideal client profile. However, seller lead filters differ significantly from buyer targeting and deserve specific attention.

Core Seller Filters Available:

ZIP Code and Neighborhood Boundaries: Target specific geographic areas where you have expertise and market knowledge. Premium tiers often require ZIP code minimums (typically 3-5 ZIPs) to maintain service.

Price Range Specifications: Set minimum and maximum property values matching your experience level. Luxury specialists can filter for $1M+ homes, while volume agents may target $200K-500K properties.

Property Type Selections: Choose from single-family homes, condos, co-ops, multi-family properties, townhomes, or land. Each property type requires different expertise and converts at different rates.

Timeline to List: Critical for seller leads. Options typically include immediate (0-30 days), short-term (1-3 months), medium-term (3-6 months), and exploring (6+ months). Immediate timeline leads convert at significantly higher rates but cost more in competitive markets.

Equity Position Indicators: Some platforms flag estimated equity levels, helping you avoid underwater homeowners unlikely to list. High-equity properties (50%+ equity) typically indicate more serious selling consideration.

Pre-Qualification Signals: Includes whether the prospect has contacted multiple agents, previously listed the property, or actively researched market conditions through repeated visits.

Distress Signals: Flags indicating potential foreclosure, tax delinquency, or divorce situations. These require specialized expertise but can convert quickly with proper handling.

“Already Listed” Flags: Filters that exclude homeowners currently working with agents. This prevents wasted contact attempts, though accuracy varies based on data freshness.

First-Time Seller vs. Experienced Seller: Some programs distinguish between first-time sellers who need more education versus experienced sellers ready for quick transactions.

Shared vs. Exclusive Distribution Rules

Understanding exactly how your seller leads are distributed determines realistic conversion expectations and influences your response strategy.

Connections Plus Distribution:

Seller leads are shared among 3-5 agents in your market depending on subscription density. All agents receive the contact simultaneously, creating immediate competition. ZIP code exclusivity options exist but require premium pricing (often 2-3x base subscription costs). Even with ZIP exclusivity, leads may route to multiple agents if you don’t cover all property types or price ranges in that area. Response speed becomes critical since prospects typically engage with whoever contacts them first and provides immediate value.

ReadyConnect Concierge Distribution:

Uses round-robin and priority logic for seller lead routing. Live transfers connect prospects with available agents in real-time, reducing simultaneous distribution. However, if you’re unavailable when a seller lead comes through, it routes to the next agent in the queue. Priority ranking considers your response history, conversion track record, and availability windows. Agents with better performance metrics receive more frequent transfer opportunities. Some seller leads are shared if multiple brokerages serve the same territory, though the warm-transfer format gives you conversational advantage.

Market VIP Distribution:

Provides true ZIP code exclusivity for participating brokerages. Seller leads in your contracted territories route only to your team, eliminating external competition. Internal distribution among your agents depends on your brokerage’s routing rules and ISA structure. This exclusivity justifies the higher monthly investment but requires consistent performance to maintain contracts. Platforms may revoke exclusivity if response times exceed service level agreements or conversion rates fall significantly below benchmarks.

Intent-Based Behavioral Signals

Advanced targeting incorporates how users interact with seller tools and listing pages. The system tracks specific behaviors that correlate with genuine listing intent:

Time Spent on Valuation Tools: Homeowners who spend 5+ minutes exploring valuation results show higher intent than those who check once and leave.

Repeat Valuation Requests: Multiple valuation checks over days or weeks indicate serious consideration rather than casual curiosity.

CMA Request Behavior: Downloading or requesting comparative market analyses signals near-term listing evaluation.

Neighborhood Competition Research: Homeowners viewing multiple listings in their own area are researching competition and pricing.

Mortgage Payoff Calculator Usage: Indicates equity assessment and net proceeds calculation.

Agent Profile Views: Homeowners who view agent bios and reviews after requesting valuations show higher engagement.

However, intent signals aren’t perfect. Research from the National Association of Realtors indicates that online browsing behavior doesn’t always predict actual listing readiness. Many homeowners research property values years before they’re ready to transact, particularly in appreciating markets where curiosity drives frequent checking.

Real Conversion Data and Performance Metrics

Industry-Wide Benchmarks

Let’s establish realistic expectations using verified data. According to the National Association of Realtors, real estate lead conversion rates across all sources typically range from 0.5% to 1.2%. Portal leads often perform at the higher end because users are actively searching for properties rather than passively seeing advertisements.

When agents self-report conversion rates of 3-5%, they often use selective calculation methods. They might count only “qualified” leads in their denominator while including all closings in their numerator. This makes comparisons difficult and inflates apparent success rates.

Seller Lead Close Rates by Program and Intent

Understanding realistic conversion expectations for seller-specific leads helps you budget accurately and set achievable goals. Close rates vary significantly by program structure, intent level, and market conditions.

ReadyConnect Concierge (Pay-at-Closing) Seller Leads:

Planning close rate: 1-8% depending on speed-to-lead and price band. The warm-transfer format provides immediate conversation opportunity but doesn’t guarantee listing agreements. Agent performance threads and review roundups suggest the following ranges:

- Agents responding within 60 seconds: 5-8% close rate

- Agents responding within 5 minutes: 3-5% close rate

- Agents responding after 10+ minutes: 1-3% close rate

Price band influences outcomes significantly. Luxury properties ($1M+) convert at lower percentages but deliver higher commissions per closing. Volume-market properties ($200K-500K) convert more frequently but require more transactions to achieve similar income.

The 30-35% referral fee on gross commission means you need strong conversion performance to justify participation. At 3% close rate, you’ll pay referral fees on roughly one of every 33 seller leads received. Calculate whether your average listing commission minus the referral fee still provides adequate profit.

Connections Plus (Subscription/Shared) Seller Leads:

Planning close rate: 1-4% for seller leads specifically. The shared distribution model creates immediate competition, making response speed and value delivery critical. Synthesis from multiple agent reports suggests:

- ZIP exclusivity with <60 second response: 3-4% close rate

- Shared leads with <60 second response: 2-3% close rate

- Shared leads with 5+ minute response: 1-2% close rate

- Any leads with >15 minute response: <1% close rate

Monthly subscription costs of $200-1,800 require careful calculation. At $800/month and $40 per lead, you receive approximately 20 seller leads monthly. At 2% conversion, that’s 0.4 listings per month, or roughly 5 listings annually. Ensure your average listing commission justifies this investment after accounting for other business expenses.

Market VIP (Brokerage Exclusive) Seller Leads:

Planning close rate: 3-8% where brokerages handle speed-to-lead with dedicated ISAs. Public performance data remains limited for this premium tier, so treat these ranges as planning estimates rather than guarantees. The higher close rates reflect genuine ZIP exclusivity and professional lead handling:

- Brokerage with ISA responding <60 seconds: 6-8% close rate

- Brokerage with agent response <3 minutes: 4-6% close rate

- Brokerage with inconsistent response: 3-4% close rate

Monthly fees typically exceed $5,000 for competitive markets, making this option viable only for established brokerages with volume capacity. The exclusivity reduces competition but doesn’t eliminate the need for excellent service and fast response.

Close Rates by Lead Intent Buckets

Seller lead quality varies dramatically based on initial engagement type, making intent segmentation critical for realistic forecasting:

Valuation Curiosity (60-70% of Seller Lead Volume):

These prospects click “what’s my home worth” without immediate listing plans. Planning close rate: 0.5-2%. Most are researching equity positions, satisfying curiosity about market appreciation, or conducting long-term planning. However, quality follow-up can nurture these contacts into listings months later. Don’t dismiss valuation-only leads entirely; they’re top-of-funnel prospects requiring patient nurturing systems.

Near-Term Listing Consideration (20-30% of Volume):

Homeowners indicating 3-6 month timelines or requesting CMAs. Planning close rate: 3-6%. These prospects are evaluating agents, comparing market conditions, and making preliminary decisions. Your competition includes other agents receiving the same lead plus prospects’ sphere-of-influence referrals. Differentiation through local expertise, marketing plans, and responsiveness determines conversion success.

Ready-to-List Now (10-20% of Volume):

Prospects clicking “list my home” or “talk to a listing agent” with immediate timelines. Planning close rate: 8-15%. These high-intent sellers have made the decision to list and are selecting representation. Response speed matters most here since they’re often contacting multiple agents simultaneously. The agent who provides immediate value and clear next steps typically wins the listing.

Close Rates by Market Competitiveness

Geographic factors significantly influence seller lead conversion, with hot markets and long-tail ZIPs performing differently:

Hot ZIP Codes (High Inventory Turnover, High Agent Density):

Major metropolitan areas like Manhattan, San Francisco, Miami, and competitive suburban markets see close rates at the lower end of ranges. More agents compete for the same leads, and homeowners receive multiple contacts simultaneously. Your differentiation and speed-to-lead become critical. Planning close rate: Use the lower end of program-specific ranges (1-3% for Connections Plus, 3-5% for ReadyConnect, 4-6% for Market VIP).

Long-Tail Markets (Moderate Inventory, Moderate Competition):

Secondary markets and suburban areas with fewer competing agents often deliver better conversion rates. Homeowners receive fewer simultaneous contacts, giving you more opportunity to build rapport. Planning close rate: Use the middle of program-specific ranges (2-3% for Connections Plus, 4-6% for ReadyConnect, 5-7% for Market VIP).

Rural and Small-Town Markets:

Portal leads often underperform in these areas because relationships and reputation drive business more than online lead generation. Homeowners typically know local agents personally or receive referrals from their network before searching online. Planning close rate: Lower than suburban markets despite reduced competition.

Portal-Specific Performance

Agent experiences vary significantly beyond these planning ranges. According to the original research, successful agents report achieving 2x return on investment when they implement quick response systems and consistent follow-up protocols. Others document minimal conversion success despite following recommended practices.

The platform’s effectiveness depends heavily on three factors: market conditions, agent responsiveness, and lead nurturing capabilities. A responsive agent in a hot market with strong sales skills will outperform an average agent in a slow market every time, regardless of lead source.

Cost Analysis and Unit Economics

Understanding true cost per acquisition helps you plan budgets and evaluate ROI realistically. Portal leads from platforms like Realtor.com typically cost $30-50 per contact according to industry reporting. Compare this to:

- Facebook advertising: $5-10 per lead

- Google AdWords: $15-20 per lead

- Direct mail campaigns: $2-5 per contact

ReadyConnect (PAC) Unit Economics:

No upfront cost per lead, but 30-35% referral fee on gross commission at closing. Example calculation:

- Average listing commission: $10,000

- Referral fee (33%): $3,300

- Net commission to you: $6,700

- Planning close rate: 4% (1 closing per 25 leads)

- Effective cost per lead: $132 ($3,300 ÷ 25 leads)

This model makes sense when you have inconsistent cash flow but can handle commission splits. Your actual cost per lead increases with lower close rates and decreases with higher conversion.

Connections Plus Unit Economics:

Monthly subscription creates fixed costs regardless of conversion. Example calculation:

- Monthly subscription: $800

- Average leads received: 20 seller leads

- Cost per lead: $40

- Planning close rate: 2.5% (1 closing per 40 leads)

- Total cost for one listing: $1,600 (40 leads × $40)

- Average listing commission: $10,000

- Net after lead costs: $8,400

This model works when you can maintain consistent conversion rates and your average commission justifies the monthly commitment. Cash flow becomes critical since you pay monthly regardless of closings.

Market VIP Unit Economics:

Higher monthly minimums require volume capacity. Example calculation:

- Monthly subscription: $5,000

- Average leads received: 50 seller leads (more volume due to exclusivity)

- Cost per lead: $100

- Planning close rate: 5% (1 closing per 20 leads)

- Total cost for one listing: $2,000 (20 leads × $100)

- Average listing commission: $10,000

- Net after lead costs: $8,000

This makes sense only for brokerages closing multiple listings monthly from the lead flow. Solo agents rarely achieve sufficient volume to justify Market VIP investment.

Impact of Speed-to-Lead SLA on Seller Conversion:

Response time dramatically affects close rates, particularly for seller leads where competition is intense:

- <60 seconds response: Baseline conversion rate

- 5 minutes response: 30-40% reduction in close rate

- 10 minutes response: 50-60% reduction in close rate

- 30+ minutes response: 70-80% reduction in close rate

These estimates combine agent-reported experiences with general sales research on lead response timing. One study by LeadSimple found that the odds of qualifying a lead decrease by 10x if you wait longer than 5 minutes to respond. For seller leads specifically, agents in industry forums consistently report that first responder advantage determines who gets the listing appointment in competitive scenarios.

The higher cost reflects the supposed higher intent level of property portal users. However, higher intent only matters if conversion rates justify the premium pricing. A $50 lead that converts at 1% costs you $5,000 per closing in lead costs alone. A $10 Facebook lead that converts at 0.5% costs you $2,000 per closing.

Legitimate Concerns and Pain Points

Lead Quality Issues

The most significant concern facing agents involves contact authenticity and qualification. The 2024 class-action lawsuit alleges systematic problems with lead quality, including:

Invalid Contact Information: Agents frequently report disconnected phone numbers immediately after receiving a lead. Email addresses bounce. Names appear generic or suspicious. One broker documented that 23 of 50 leads received in January 2024 had invalid phone numbers within 24 hours of contact attempts.

Misleading Intent Signals: When platforms require form submissions to view property details, they create frustration among users who never intended to speak with agents. This practice generates complaints about unwanted solicitation and wastes agent time on prospects with zero purchase interest.

Non-Exclusive Distribution: Despite promises of exclusivity, multiple agents report receiving identical contacts simultaneously. This undermines the value proposition and creates bidding wars for prospect attention. You can’t build meaningful relationships when three competitors received the same information at the same time.

Contract and Support Challenges

Contract Inflexibility represents a major obstacle. Agents lock into 6-12 month agreements that are difficult to cancel even when lead quality fails to meet expectations. Cancellation windows are typically narrow (often 30 days before renewal), and early termination may require paying remaining contract months or significant penalties. According to agent testimonials referenced in the original research, when requesting refunds for poor-quality contacts, platforms typically offer credits for additional leads or suggest upgrading to higher-tier subscriptions rather than providing monetary refunds.

ZIP Code Minimums in contracts often require purchasing multiple territories to access service, even if you only want one specific area. This forces higher monthly spending than agents initially budget for and may include ZIPs where you have limited expertise or brand recognition.

Lead Replacement Policies vary by program and rarely satisfy agents fully. When you receive fake contacts or invalid information, platforms may credit your account with replacement leads. However, replacement processes require extensive documentation (screenshots, call logs, timestamps), and many agents report that credits arrive slowly or get disputed. Some programs cap monthly replacements regardless of actual quality issues, leaving you paying for unusable contacts.

Double-Sell Handling creates frustration when the same homeowner appears on multiple platforms simultaneously. If a prospect submits information on Realtor.com, Zillow, and Homes.com within hours, multiple agents receive what they believe are exclusive leads. No standard protocol exists for handling these duplicates, and platforms rarely refund for contacts available through competing services. Agent threads on Reddit consistently mention this issue as a major pain point reducing effective lead value.

Unresponsive Support Systems compound these issues. Agents report slow email response times, limited phone support availability, and dismissive attitudes toward quality complaints. The dispute resolution process often requires extensive documentation while providing minimal recourse for legitimate grievances.

Financial Considerations

High Upfront Investment requirements strain budgets, particularly for newer professionals with limited capital reserves. The monthly subscription model demands consistent payments regardless of lead quality or conversion success.

Hidden Fee Structures and automatic price increases during contract renewals catch agents off-guard. Some report annual cost escalations despite declining contact quality. These practices erode trust and make budget planning difficult.

Value Propositions and Success Factors

Platform Advantages

Despite concerns, portal leads offer legitimate benefits for certain business models:

High-Intent Audience: Users searching for properties on real estate portals demonstrate higher purchase intent than cold prospects. They’re actively researching, comparing options, and often ready to engage with professionals. This natural filtering can improve conversion potential compared to cold outreach.

CRM Integration: Many platforms provide contact management tools, automated follow-up sequences, and performance analytics. These features help agents optimize their nurturing processes and track which prospects warrant continued attention.

Market Coverage: With significant search traffic and national brand recognition, major portals provide access to large prospect pools across diverse markets. This reach can be particularly valuable for agents in competitive metropolitan areas where standing out requires multiple marketing channels.

What Successful Agents Do Differently

Agents achieving positive returns typically demonstrate specific behaviors:

Lightning-Fast Response Times: Research consistently shows that contacting leads within 5 minutes dramatically improves conversion rates. One study by LeadSimple found that the odds of qualifying a lead decrease by 10x if you wait longer than 5 minutes to respond. Successful agents treat lead response like emergency calls.

Systematic Follow-Up Protocols: Converting leads requires multiple touchpoints. According to research by the National Association of Realtors, the typical home buyer or seller needs 8-12 contacts before making a decision. Top performers use CRM systems to ensure consistent follow-up over weeks or months.

Strong Conversion Skills: Agents with sales coaching backgrounds or formal training convert leads at higher rates. They know how to qualify prospects quickly, identify genuine pain points, and present solutions that resonate. Natural sales ability matters more than lead volume.

Frequently Asked Questions

How much do online seller leads actually cost?

Based on industry reporting, Connections Plus pricing ranges from $200-1,800 monthly depending on market exclusivity and ZIP code competition. Cost per lead typically falls between $30-50, though exclusive leads can reach $400-500 each. Additional fees may include setup costs and contract commitment penalties for early cancellation. Calculate your break-even point before committing: if you need to close one transaction per month to justify costs, ensure your conversion rate and average commission support that math.

What’s the real conversion rate for portal leads?

Actual conversion rates range from 1-2% based on agent reports documented in industry analysis. This falls significantly below platform claims of 3-5x industry average performance (note: Realtor.com cites “3-5x industry average” without specifying methodology or timeframe in their marketing materials, making independent verification difficult).

Success depends heavily on response speed, follow-up consistency, and agent sales skills. The National Association of Realtors reports that top-performing agents can achieve 5-10% conversion on high-quality leads, but this requires exceptional systems and skills that most agents don’t possess.

For seller leads specifically, expect these ranges:

- ReadyConnect (PAC): 1-8% depending on speed and price band

- Connections Plus: 1-4% for seller leads

- Market VIP: 3-8% with professional ISA handling

Remember these rates represent closings divided by total seller leads received, not just “qualified” leads.

How can I identify and avoid fake leads?

Red flags include immediate disconnected numbers, bounced email addresses, generic or suspicious names, and unrealistic property inquiries. Verify lead information quickly after receipt. Document quality issues with screenshots and call logs. Submit disputes through official channels while maintaining detailed records. Create a “dead lead” category in your CRM and track the percentage of unusable contacts each month. If fake leads exceed 20% of your total, escalate concerns to platform support and consider alternative sources.

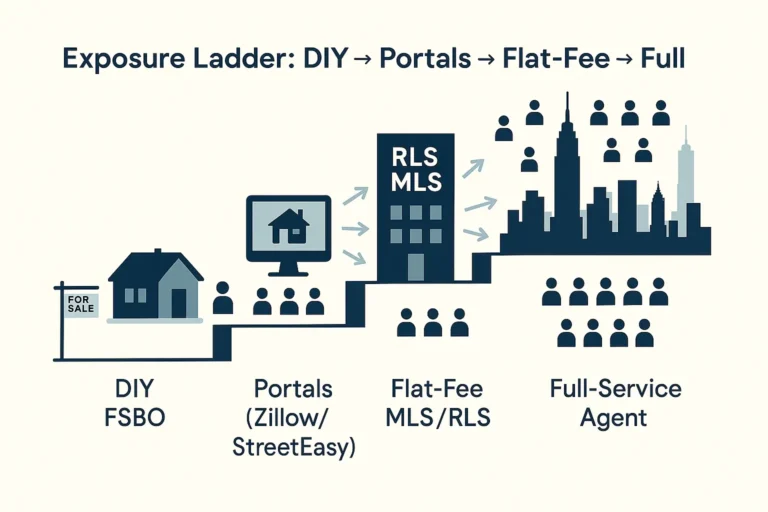

What alternatives exist to portal seller leads?

Zillow Premier Agent typically receives better agent reviews despite higher costs, according to multiple agent surveys.

Pay-at-closing options like HomeLight, Rocket Homes, and OpCity reduce upfront risk by charging fees only when deals close.

Self-generated leads through Facebook advertising, Google AdWords, or direct mail campaigns often provide better cost-effectiveness for experienced marketers who can manage campaigns independently. Many successful agents build referral networks through past clients, which costs nothing but time and relationship management.

Should new agents invest in purchased leads?

New agents should exercise extreme caution given the high upfront costs, long-term contracts, and mixed success rates. Building referral networks, geographic farming, and sphere of influence marketing typically provide better return on investment for agents with limited experience and capital. According to the National Association of Realtors, 41% of sellers found their agent through referrals from friends and family, making relationship-building a more sustainable strategy than purchased leads for agents starting their careers.

How do I maximize return on investment if I choose to purchase leads?

Implement these specific tactics:

Immediate response protocols: Contact leads within 5 minutes of receipt, even if just to schedule a longer conversation later.

Systematic CRM usage: Enter every lead into your CRM immediately with scheduled follow-up tasks.

Automated drip campaigns: Create email sequences that provide value (market updates, buying guides, neighborhood information) rather than just soliciting business.

Personalized follow-up: Reference specific properties the prospect viewed or specific needs they mentioned in their inquiry.

Value-added content: Share relevant blog posts, market reports, or video walkthroughs that address their likely questions.

Performance tracking: Calculate conversion rate and cost per closing by lead source monthly, not quarterly or annually.

What should I look for in lead generation contracts?

Review these elements carefully before signing:

Contract length: Negotiate for 3-month trials rather than 12-month commitments for your first engagement.

Cancellation terms: Understand exactly what penalties apply if you cancel early and whether refunds are available for unused portions.

Lead quality guarantees: Ask what recourse you have if lead quality doesn’t meet specified standards.

Price escalation clauses: Determine whether costs can increase during your contract term and by how much.

Exclusivity definitions: Clarify whether “exclusive” means one agent receives the lead or multiple agents receive it with time delays.

How many leads do I need to close one transaction?

Using industry-standard conversion rates for seller leads specifically, expect these planning ranges:

ReadyConnect Concierge (PAC): 12-100 seller leads per closing, depending on your response speed and price band. At 4% average close rate, you’ll need approximately 25 seller leads. With 30-35% referral fees, ensure your average listing commission justifies this investment.

Connections Plus: 25-100 seller leads per closing. At 2% average close rate, you’ll need 50 seller leads. At $30-50 per lead, that’s $1,500-2,500 in lead costs per closing.

Market VIP: 12-35 seller leads per closing. At 5% average close rate, you’ll need 20 seller leads. Higher per-lead costs but better conversion offsets the difference.

Add your time investment for follow-up (estimated 2-5 hours per lead minimum across all tiers), and you’re investing significant resources. Compare this to your average listing commission to determine whether the economics work for your business.

Price Band Matters: Luxury listings ($1M+) convert at lower percentages but higher absolute commissions. A $2M listing at 2.5% commission ($50,000) justifies more lead investment than a $300K listing at 2.5% commission ($7,500). Calculate your numbers based on your actual market segment.

Geographic Performance Variance: Agents in hot ZIP codes report needing 60-80 seller leads per closing due to intense competition. Agents in long-tail markets may close one listing per 25-35 seller leads with the same effort level.

What metrics should I track to evaluate lead performance?

Track these specific metrics monthly:

Contact rate: Percentage of leads you successfully reach by phone or email

Qualification rate: Percentage of contacted leads who meet your buyer/seller criteria

Appointment rate: Percentage of qualified leads who agree to meet with you

Conversion rate: Percentage of appointments that result in signed agreements

Cost per closing: Total lead costs divided by number of closings

Time to close: Average days from lead receipt to closing

Lead source comparison: Track all metrics separately for each lead source to identify your best-performing channels

Are there specific markets where portal leads perform better?

According to industry analysis and agent-reported experiences, portal leads tend to perform better in:

High-inventory markets where buyers have many options and benefit from agent guidance

Markets with complex transactions like New York City co-ops or San Francisco condos where expertise matters

Luxury segments where sellers expect professional representation and sophisticated marketing

Competitive markets where sellers recognize they need strong marketing to stand out

For seller leads specifically:

- High-appreciation markets generate more valuation curiosity, increasing top-of-funnel volume

- Markets with older homeowner demographics where sellers may have less digital sophistication and appreciate agent guidance

- Price bands $300K-$800K tend to convert best; very affordable (<$200K) and ultra-luxury (>$2M) segments show lower portal conversion

Portal leads typically underperform in:

Low-inventory markets where properties sell quickly through minimal marketing and word-of-mouth Small towns where relationships and reputation matter more than online presence

Markets with very experienced buyers/sellers who prefer to work independently or have established agent relationships Rural areas where geographic farming and community involvement drive business more than online leads

Property Type Variance:

- Single-family homes: Standard conversion rates

- Condos in metro areas: 20-30% higher conversion due to complexity

- Co-ops (NYC, Chicago): 30-40% higher conversion due to board approval complexity

- Multi-family/investment properties: 15-25% lower conversion; investors more price-sensitive

- Luxury estates ($2M+): 40-50% lower conversion; longer sales cycles, more referral-driven

How long should I test a lead source before making a decision?

Give any lead source at least 90 days before evaluating performance. Real estate transactions take time, and many prospects need weeks or months of nurturing before they’re ready to transact. Track your metrics from day one, but don’t make final judgments until you’ve seen complete conversion cycles. Some leads that seem cold in month one convert in month four. Calculate your return on investment based on closings that result from leads received during your test period, even if those closings occur months later.

What questions should I ask a platform representative before purchasing?

Ask these specific questions and request written answers:

- What is your average contact rate (successful phone/email contact within 48 hours)?

- What percentage of leads result in appointments with your average user?

- How do you define and measure lead quality?

- What recourse do I have if lead quality doesn’t meet my expectations?

- Can you provide contact information for three agents in my market who have used your service for 12+ months?

- What percentage of users renew their contracts after the initial term?

- How do you generate leads, and are prospects notified their information will be shared with agents?

- Are leads exclusive or shared, and if shared, with how many agents?

Practical Implementation Framework

The Seller Lead Quality Ladder

Understanding where each lead falls on the quality spectrum helps you allocate time and resources appropriately. This ladder combines vendor claims with agent-reported experience to set planning ranges rather than absolute guarantees.

Tier 1: Ready-to-List (Highest Quality)

Signal Characteristics:

- Clicked “List my home” or “Talk to a listing agent now”

- Requested formal CMA within past 7 days

- Indicated 0-30 day listing timeline

- Viewed 5+ comparable listings in their neighborhood

- Engaged with mortgage payoff calculators

Planning Close Rate: 8-15% with <60 second response Expected Response: Prospect answers phone, engages in listing conversation Time Investment: 2-3 hours for initial consultation and follow-up Recommended SLA: Contact within 60 seconds; any delay significantly reduces conversion

Tier 2: Near-Term Consideration (Medium-High Quality)

Signal Characteristics:

- Requested home valuation with 1-3 month timeline indicated

- Asked for CMA but timeline is 30-90 days

- Viewed agent profiles after valuation request

- Repeat visits to valuation tool over 2-4 weeks

- Engaged with market trend reports or neighborhood data

Planning Close Rate: 3-6% with <5 minute response Expected Response: Prospect may not answer immediately but will engage within 24 hours

Time Investment: 4-6 hours over 2-8 weeks for nurturing and consultation

Recommended SLA: Contact within 5 minutes; follow up daily for first week

Tier 3: Valuation Curiosity (Medium Quality)

Signal Characteristics:

- Single home valuation request without timeline

- Generic “what’s my home worth” inquiry

- No agent profile views or additional engagement

- First-time visitor to platform

- No indication of motivation or urgency

Planning Close Rate: 1-3% with <5 minute response

Expected Response: Low initial engagement; requires long-term nurturing

Time Investment: 8-12 hours over 3-6 months with systematic follow-up

Recommended SLA: Contact within 5-10 minutes; weekly follow-up for first month, then monthly

Tier 4: Research/Exploration (Lower Quality)

Signal Characteristics:

- Forced form submission to view property details

- Indicated 6+ month timeline or “just exploring”

- Out-of-area inquiry (not homeowner in target ZIP)

- Refinance research rather than sale consideration

- Student or first-time visitor researching market generally

Planning Close Rate: 0.5-1% even with fast response Expected Response: Minimal engagement; may not want agent contact Time Investment: 2-3 hours over 6-12 months with quarterly touches Recommended SLA: Contact within 24 hours; monthly follow-up if they engage

Tier 5: Unqualified/Invalid (No Quality)

Signal Characteristics:

- Disconnected phone number immediately

- Bounced email address

- Generic names (Test User, John Smith with fake details)

- Duplicate submission from same person within hours

- Already listed property or not homeowner

Planning Close Rate: 0%

Expected Response: No contact possible or hostile response

Time Investment: 5-10 minutes for verification and documentation Recommended Action: Document for dispute; submit replacement request

Program-Specific Quality Distribution

ReadyConnect Concierge: Expect 15-20% Tier 1, 30-40% Tier 2, 25-35% Tier 3, 10-15% Tier 4, 5-10% Tier 5. The warm-transfer format filters out some low-quality prospects before reaching you.

Connections Plus: Expect 10-15% Tier 1, 20-30% Tier 2, 40-50% Tier 3, 15-20% Tier 4, 10-15% Tier 5. Shared distribution and less screening means wider quality variance.

Market VIP: Expect 20-25% Tier 1, 35-45% Tier 2, 20-30% Tier 3, 5-10% Tier 4, 5-10% Tier 5. Exclusivity and higher minimum investment correlates with better average quality, though not guaranteed.

Seller Lead Filters Map: How to Configure Your Account

Most agents don’t realize they can request specific filter configurations from their account representative. While not all options are publicly documented, here’s what you should ask for when setting up or optimizing your lead flow:

Intent Signal Filters (Request These Specifically):

✓ “What’s my home worth?” inquiries (expect 60-70% of volume; lowest intent)

✓ “Talk to a listing agent” clicks (expect 15-20% of volume; higher intent)

✓ “List my home soon” submissions (expect 5-10% of volume; highest intent)

✓ CMA/Comparative Market Analysis requests (expect 10-15% of volume; high intent)

✓ Seller timeline indicators: immediate (0-30 days), short-term (1-3 months), medium-term (3-6 months), exploring (6+ months)

Ask your rep: “Can you prioritize CMA requests and ‘list my home’ clicks over generic valuations?” Some programs allow weighted distribution toward higher-intent signals.

Disqualifier Filters (Essential to Activate):

✓ Not verified homeowner (requires platform data match)

✓ Already listed property (checks MLS for active listings)

✓ Out-of-area inquiries (geographic mismatch between property and contact address)

✓ Underwater/low equity properties (estimated mortgage > 95% of value)

✓ Recent refinance activity (suggests no sale intent)

✓ Landlord/investor research (specify whether you want rental property owners)

Ask your rep: “Please enable all disqualifier filters to reduce unqualified contacts. I’ll accept lower volume for higher quality.”

Routing Rule Filters (Configure to Match Your Business):

✓ ZIP Code Specifications: List your 3-10 target ZIPs in priority order; indicate which you want exclusively vs. shared

✓ Price Floor/Ceiling: Set minimum property value to match your expertise (luxury agents might set $750K minimum; volume agents might prefer $150K-400K range)

✓ Property Type Preferences: Single-family, condo, co-op, multi-family, townhome, land (specify all that apply or narrow to your specialty)

✓ Days-to-List Timeline: Accept only 0-90 day timelines if you need immediate transactions; include 6+ months if you have strong nurturing systems

✓ Live-Transfer Availability Windows: For ReadyConnect, specify your call availability hours to prevent leads routing to competitors when you’re unavailable

Ask your rep: “What’s the minimum lead volume I’ll receive with these filters? Can we adjust monthly if volume is too low?”

Advanced Filters (Not Always Available, But Worth Requesting):

- High-equity indicators (50%+ equity preferred)

- Repeat valuation checkers (homeowners who’ve checked value 3+ times)

- Competitive research behavior (viewed multiple listings in own neighborhood)

- Agent profile viewers (engaged beyond basic valuation)

- Mortgage calculator users (indicates serious financial planning)

- First-time seller vs. experienced seller preferences

Important Filter Limitations:

Platforms don’t publicly document all available filters, and options vary by program tier. Market VIP subscribers typically access more granular filtering than Connections Plus users. Your account representative may not volunteer these options unless you ask specifically. Filter accuracy depends on data quality; an “already listed” filter only works if MLS data updates promptly.

Monthly Filter Review Protocol:

Evaluate filter performance monthly and adjust based on:

- Lead volume received vs. expected

- Quality distribution across tiers

- Response rate and engagement levels

- Actual close rate vs. planning estimates

- Cost per closing vs. budget expectations

Request filter adjustment calls with your rep quarterly, bringing specific data on which filter combinations deliver your best results.

30-Day Lead Conversion System

If you decide to purchase portal leads, implement this system from day one:

Week 1: Foundation Setup

Create response templates for common scenarios (initial contact, follow-up, value proposition, objection handling). Configure your CRM with automated task reminders for follow-up intervals (1 hour, 1 day, 3 days, 1 week, 2 weeks, 1 month). Set up email sequences that provide valuable content rather than sales pitches. Record a video introduction that showcases your personality and expertise for quick text message sharing.

Week 2-4: Active Engagement

Contact every lead within 5 minutes of receipt using phone as your primary method. If you can’t reach them by phone, send a text message within 10 minutes and email within 15 minutes. Leave voicemails that reference the specific property they viewed and offer one piece of valuable information (recent sale in the neighborhood, market trend affecting their timeline). Schedule appointments with qualified prospects immediately, even if the meeting is weeks away.

Ongoing: Systematic Nurturing

Track every interaction in your CRM with detailed notes. Send value-added content weekly: market updates, new listings matching their criteria, neighborhood information, buying/selling guides. Ask for referrals even from prospects who don’t transact immediately. Request feedback on why they chose another agent or decided not to proceed.

Alternative Lead Generation Strategies

Competitive Positioning: Seller-Specific Lead Vendors

Before committing to Realtor.com seller leads, compare against other seller-centric sources that may deliver better value or alignment with your business model:

HomeLight Seller Leads:

Pay-at-closing referral model similar to ReadyConnect but with different geographic coverage and agent selection criteria. Referral fees typically range 25-30% of gross commission (slightly lower than Realtor.com’s 30-35%). HomeLight emphasizes agent performance metrics and client satisfaction ratings in their matching algorithm. Best for agents with strong track records who can compete on reputation rather than speed alone. Less volume than major portals but potentially higher intent levels since homeowners actively choose the referral service.

UpNest:

Competitive bidding platform where sellers request proposals from multiple agents. No upfront costs, but you compete directly on commission rates and service offerings. Typical referral fees: 20-25% when you win the listing. This model favors agents willing to negotiate commission rates and provide detailed marketing proposals. Volume tends to be lower than subscription portals, but sellers using UpNest have typically moved beyond casual research into serious agent evaluation.

Clever Real Estate:

Flat-fee and discount brokerage model connecting sellers with agents offering reduced commission structures. Referral fees around 25-30% of gross commission. Best suited for agents comfortable with lower commission rates in exchange for lead flow. Geographic coverage is expanding but remains limited compared to national portals. Sellers using Clever are price-sensitive, making this source less attractive for agents focused on full-service, premium-commission business models.

OJO (Movoto):

AI-powered platform that pre-qualifies leads through conversational messaging before routing to agents. Pay-at-closing model with referral fees in the 25-35% range. The pre-qualification process theoretically improves lead quality by filtering out tire-kickers before agent contact. However, the AI screening may also alienate some prospects who prefer immediate human interaction. Best for agents who value quality over volume and can handle lower lead flow with higher conversion expectations.

ReferralExchange and OpCity (Realtor.com’s referral network):

These services connect relocating clients with agents in destination markets. Seller leads come primarily from agents referring their departing clients to you for purchasing in your area, though some sellers enter through relocation requests. Referral fees typically 20-30% depending on the relationship structure. Volume is lower but intent levels are high since relocation creates genuine transaction necessity.

Side-by-Side Comparison: Seller Lead Sources

| Source | Fee Structure | Exclusivity | Median Price Point | Time-to-List | Best For |

|---|---|---|---|---|---|

| Source Realtor.com ReadyConnect | Fee Structure 30-35% at closing | Exclusivity Shared (occasional) | Median Price Point $250K-500K | Typical Time-to-List 30-90 days | Best For Brokerages with ISA teams |

| Source Realtor.com Connections Plus | Fee Structure $200-1,800/month | Exclusivity Shared (3-5 agents) | Median Price Point $200K-600K | Typical Time-to-List 30-120 days | Best For Individual agents with fast response |

| Source Realtor.com Market VIP | Fee Structure $5,000+/month | Exclusivity Exclusive by ZIP | Median Price Point $300K-700K | Typical Time-to-List 30-90 days | Best For Established brokerages, volume capacity |

| Source HomeLight Seller | Fee Structure 25-30% at closing | Exclusivity Matched to 3 agents | Median Price Point $300K-600K | Typical Time-to-List 30-60 days | Best For Top-rated agents with proven track records |

| Source UpNest | Fee Structure 20-25% at closing | Exclusivity Competitive bidding | Median Price Point $250K-500K | Typical Time-to-List 30-90 days | Best For Agents comfortable with negotiated commissions |

| Source Clever Real Estate | Fee Structure 25-30% at closing | Exclusivity Matched to agent | Median Price Point $200K-450K | Typical Time-to-List 30-60 days | Best For Discount and flat-fee service models |

| Source OJO | Fee Structure 25-35% at closing | Exclusivity 1-2 agents | Median Price Point $250K-500K | Typical Time-to-List 30-90 days | Best For Agents preferring quality over volume |

| Source OpCity/ReferralExchange | Fee Structure 20-30% at closing | Exclusivity Exclusive referral | Median Price Point $300K-700K | Typical Time-to-List 30-120 days | Best For Relocation specialists |

← Scroll horizontally to view all columns →

Note: Median price points and time-to-list ranges are planning estimates based on general agent reporting and vary significantly by market. Always verify current fee structures and program terms directly with vendors, as these change frequently.

Building a Referral Engine

Instead of purchasing leads, consider investing equivalent time and money into building a referral system:

Past Client Reactivation: Contact every past client quarterly with valuable market updates. According to the National Association of Realtors, 83% of buyers would use their agent again, but only 12% of sellers actually do. The gap isn’t satisfaction; it’s staying in touch.

Strategic Partnership Development: Build relationships with mortgage brokers, estate attorneys, home inspectors, and contractors who interact with potential clients daily. Offer to be their trusted agent referral in exchange for reciprocal referrals.

Geographic Farming: Choose a specific neighborhood and become the recognized expert through direct mail, door knocking, local sponsorships, and community involvement. Studies suggest that 1,000 homes farmed consistently for 12 months can generate 20-40 transactions annually.

Self-Directed Digital Marketing

For agents comfortable with technology:

Facebook Lead Ads: Create targeted campaigns featuring your listings, market updates, or buyer guides. Cost per lead typically runs $5-10 with proper targeting. Conversion rates may be lower than portal leads, but the cost advantage can make up the difference.

Google Local Service Ads: These pay-per-lead ads appear at the top of Google searches and include Google’s verification badge, building immediate trust. Costs vary by market but often deliver qualified prospects at competitive rates.

Content Marketing: Build a blog or YouTube channel answering common buyer and seller questions in your market. This requires significant time investment but creates long-term value and positions you as the local expert.

Future Trends and Predictions

Increasing Transparency Requirements

The 2024 litigation against Realtor.com may accelerate industry-wide changes in lead generation practices. Expect increased pressure for:

Clear disclosure of how leads are generated and whether prospects consented to contact Standardized quality metrics that allow meaningful comparison between providers Shorter contract terms as competition increases and agents demand more flexibility Performance guarantees that tie pricing to actual conversion rates rather than just lead volume

Technology Integration

Artificial intelligence tools will increasingly screen and qualify leads before human contact. Smart CRM systems will predict which prospects are most likely to convert based on behavior patterns, helping agents prioritize their time. Video messaging and virtual tours will become standard for initial prospect engagement, reducing the time required to build rapport.

Shift Toward Performance-Based Pricing

More platforms will adopt pay-at-closing models to reduce agent risk. This aligns platform incentives with agent success and naturally filters out low-quality leads. Expect subscription-based models to decline while performance-based partnerships increase over the next 24 months.

Conclusion: Making an Informed Decision

Portal seller leads aren’t inherently good or bad. They’re tools that work exceptionally well for certain agents in specific situations and fail miserably for others. Your success depends on matching the tool to your skills, budget, and business model.

Before purchasing any leads, calculate your break-even numbers. Know exactly how many leads you need to contact one qualified prospect, how many qualified prospects you need to schedule one appointment, and how many appointments you need to close one transaction. Factor in your average commission and subtract lead costs to determine your actual profit per closing.

Implement the documentation system described above from day one. Track your performance weekly. After 90 days, you’ll have real data showing whether portal leads work for your specific situation. If conversion rates justify the cost, continue. If they don’t, redirect that investment toward referral building, geographic farming, or self-directed marketing that gives you more control over costs and quality.

Remember that purchased leads should supplement, not replace, organic lead generation through referrals and sphere of influence marketing. The most successful agents use portal leads to fill gaps in their pipeline while continuously building long-term referral sources that don’t require monthly payments.

Next Steps:

- Calculate your break-even numbers before contacting any lead provider

- Request trial periods or short initial contracts (3 months maximum)

- Implement the 30-day conversion system and documentation tracking

- Evaluate results after 90 days using objective data rather than feelings

- Adjust your strategy based on what your numbers tell you

The real estate lead generation landscape continues evolving. Success requires staying informed, tracking performance objectively, and adapting quickly when strategies stop working. Use this guide as your framework for making decisions based on data rather than marketing promises.