New York Real Estate Commission Guide 2025 for Buyers and Sellers

Last Updated: August 9, 2025

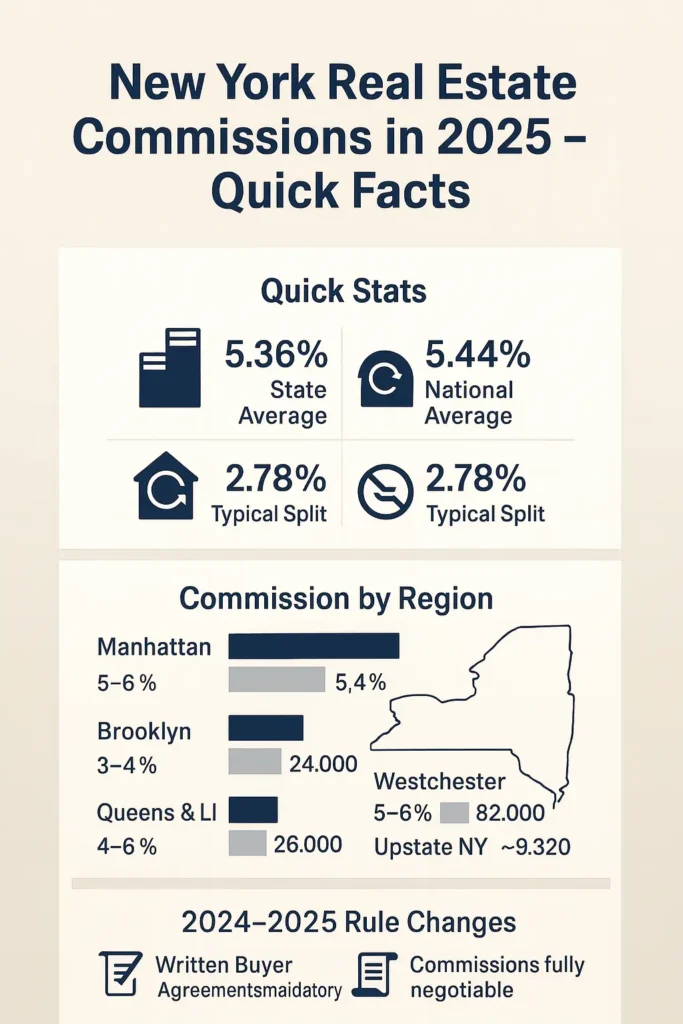

What Is the Standard Real Estate Commission in New York in 2025?

The standard real estate commission in New York in 2025 typically ranges from 4.5% to 6% of the sale price, depending on the region and property type.

In 2025, most New York home sales involve a total real estate commission between roughly 4.5% and 6% of the sale price.

These percentages vary widely because New York has some of the most diverse real estate markets in the country—from Manhattan co-ops to Brooklyn walk-ups to Long Island suburbs.

Here’s how it usually breaks down across the state:

- Manhattan & much of NYC: 5–6% is still the norm due to co-op complexity and premium marketing

- Brooklyn: Highly competitive, often 3–4% total

- Queens, Long Island & Westchester: Typically 4–6%, depending on service level and property type

- Upstate New York: Often in the mid-4% range

All real estate commissions in New York are entirely negotiable and not set by law, and the 2024–2025 NAR/REBNY rule changes have pushed buyers and sellers to negotiate fee structures even more transparently than before.

Update Log:

- August 2025: Added new REBNY requirements and market data

- January 2025: Updated for REBNY compliance changes

TLDR: What You Need to Know

• Commission rates vary dramatically across New York State, from 3% in Brooklyn to 6% in Manhattan

• The 2024 NAR settlement changed how commissions are negotiated and paid, requiring written buyer agreements

• You can negotiate all commission rates, but market dynamics affect your leverage

Ready to save thousands on your next transaction? Keep reading for specific strategies and negotiation scripts.

What Changed in 2024-2025

August 17, 2024: NAR settlement takes effect nationwide

- Mandatory written buyer agreements before property viewings

- MLS systems can no longer display buyer agent compensation offers

- Enhanced disclosure requirements for all commission negotiations

January 13, 2025: REBNY adds New York City requirements

- Written buyer broker agreements mandatory for all RLS transactions

- Agents must state commissions are “not set by law and are fully negotiable”

Sources: NAR Settlement Details | REBNY Compliance Updates

Commission Rates at a Glance

| Region | Typical Total Commission | Example Price | Approx Total Commission | Notes |

|---|---|---|---|---|

| Manhattan | 5-6% | $1,271,498 | $63,575-$76,290 | White-glove service, co-op complexity |

| Brooklyn | 3-4% | $800,000 | $24,000-$32,000 | Most competitive borough for rates |

| Queens & Long Island | 4-6% | $650,000 | $26,000-$39,000 | Full service at moderate pricing |

| Westchester | 5-6% | $850,000 | $42,500-$51,000 | Traditional structures persist |

| Upstate | ~4.66% | $200,000 | ~$9,320 | Most affordable option |

Note: All prices and commissions are illustrative examples based on current market medians.

Here’s What New Yorkers Actually Pay in 2025

New York State averages 5.36% of a home’s sale price in total real estate commissions, slightly below the national average of 5.44% (Source: NAR Commission Study 2025). However, this statewide average masks dramatic regional variations that could save or cost you thousands.

The typical split allocates 2.78% to the listing agent and 2.58% to the buyer’s agent (Source: FastExpert NY Market Report 2025). But in practice, these percentages vary significantly based on your specific location and market conditions.

Who Pays Real Estate Commission in New York?

In a typical New York sale, the seller pays the full real estate commission, which covers both the listing agent and the buyer’s agent. After the 2024–2025 NAR/REBNY changes, buyers and sellers can also agree to structures where the buyer pays some or all of their own agent’s fee, but the traditional seller-paid model is still the most common. In most New York transactions, the seller pays both the listing agent’s fee and the buyer agent’s fee, unless the buyer has agreed to pay their own agent directly under a written agreement.

Quick Summary:

- Seller usually pays the full commission (both agents)

- Buyer may pay their agent directly under a written agreement

- Seller credits can offset buyer-paid fees

- New development often pays set buyer-agent fees

The Five Real-World Payment Scenarios

Understanding who pays what is crucial for planning your transaction costs:

Scenario 1: Traditional Seller-Paid Structure

What happens: Seller pays both listing and buyer agent commissions as part of their marketing strategy

Who benefits: Attracts maximum buyer interest; familiar process for all parties

Cost consideration: Seller absorbs full commission cost but may achieve faster sale

Scenario 2: Seller Concession at Closing

What happens: Seller pays listing agent directly but offers buyer agent commission as a closing credit Who benefits: Provides flexibility in how buyer agent compensation is structured

Cost consideration: Same total cost to seller but different cash flow timing

Scenario 3: Buyer Payment with Seller Credit

What happens: Buyer pays their agent but negotiates seller credit to offset the cost.

Who benefits: Seller can market “no buyer agent fees” while buyer controls agent selection

Cost consideration: Net cost often similar but changes negotiation dynamics

Scenario 4: New Development Builder Fee

What happens: Builder or sponsor unit offers set buyer agent compensation as part of marketing package

Who benefits: Simplified process for new construction purchases

Cost consideration: Fee is typically built into unit pricing

Scenario 5: Direct Buyer Payment

What happens: No buyer compensation offered; buyer pays agent directly out of pocket or through financing

Who benefits: Sellers save money; buyers have complete control over agent selection

Cost consideration: Buyer needs additional cash or financing capacity

Regional Breakdown: Where Your Money Goes

NYC Real Estate Commission vs Rest of New York State

Overall, NY real estate commission rates vary widely because the state includes luxury markets, co-op-heavy neighborhoods, competitive boroughs, and suburban regions with different pricing dynamics.

NYC commission levels are usually higher than the rest of New York State because of co-ops, luxury marketing and higher prices. Manhattan and much of NYC still see 5–6% total commission, while suburbs and upstate markets often close deals closer to 4.5–5%.

Manhattan: Premium Market Reality

Manhattan maintains the highest commission rates in New York State at 5-6% total (Source: Manhattan Real Estate Market Report Q2 2025).

Typical Structure: 3% listing agent, 3% buyer’s agent On a $1,000,000 property: $50,000-$60,000 total commission cost

Why the premium: Co-op board package preparation, luxury marketing, extensive attorney coordination

What This Means for You: The higher cost often translates to white-glove service including professional staging consultation, extensive marketing reach, and experienced board approval guidance.

Brooklyn: The Competitive Alternative

Brooklyn offers the most competitive commission landscape at 3-4% total, thanks to different MLS rules that don’t require listing brokers to offer buyer broker compensation (Source: Brooklyn MLS Annual Report 2025).

Typical Structure: 2% listing agent, 1.5% buyer’s agent On a $1,000,000 property: $30,000-$40,000 total commission cost

The advantage: Significant savings without necessarily sacrificing service quality

What This Means for You: More negotiating power and cost savings, but you may need to be more involved in coordinating transaction details.

Queens and Long Island: Balanced Approach

These markets maintain moderate commission structures at 4-6% total, balancing comprehensive service with competitive pricing (Source: MLSLI Market Statistics 2025).

Typical Structure: 2.5% listing agent, 2.5% buyer’s agent On a $1,000,000 property: $40,000-$60,000 total commission cost

Service level: Full representation with regional market expertise

What This Means for You: Good middle ground between Manhattan’s premium pricing and Brooklyn’s discount rates while maintaining full-service representation.

Westchester: Traditional Territory

Westchester County has been slower to adopt commission changes, maintaining traditional 5-6% structures (Source: Westchester County Board of Realtors 2025).

Typical Structure: 2.75% listing agent, 2.75% buyer’s agent On a $1,000,000 property: $50,000-$60,000 total commission cost

Value proposition: Established networks and comprehensive service packages

What This Means for You: Traditional full-service representation with established processes, but less room for commission negotiation.

Upstate New York: Budget-Friendly Option

Upstate markets offer the state’s most affordable commission structures at approximately 4.66% total (Source: NYS Association of Realtors Regional Report 2025).

Typical Structure: 2.33% listing agent, 2.33% buyer’s agent On a $1,000,000 property: $46,600 total commission cost

Service expectations: Full representation at rates reflecting lower property values

What This Means for You: Comprehensive service at the state’s most affordable rates, ideal for value-conscious buyers and sellers.

Negotiation Scripts That Work

For Sellers

To Listing Agent: “We’ll offer 2.5% for the listing side. If market feedback suggests a buyer side offer improves activity, we’ll add up to 2.5% for 30 days and review weekly based on showing volume.”

Commission Cap Strategy: “We’re comfortable with X% up to $800,000. Above that threshold, let’s switch to a flat fee of $20,000 to cap our maximum exposure.”

For Buyers

Flat Fee Negotiation: “For homes above $900,000, I’d prefer a flat fee of $7,500. If the seller offers more, you keep the offered amount up to our cap and credit any excess to my closing costs, if allowed by the lender.”

Percentage Cap: “I’m comfortable with 2.5% up to $500,000. Above that, let’s cap the total fee at $12,500 regardless of final price.”

Financing and Concessions: Making It Work

Buyer-paid agent fees can often be managed through seller concessions or lender credits when loan programs allow:

| Loan Type | Concession Limits | Agent Fee Policy | Notes |

|---|---|---|---|

| Conventional | Up to 3-6% depending on down payment | Often allowed with restrictions | Confirm current limits with lender |

| FHA | Up to 6% of sale price | Allowed within guidelines | Must stay within total concession limits |

| VA | No limit on seller concessions | Generally allowed | Verify with VA-approved lender |

| Jumbo | Varies by lender | Policies vary widely | Negotiate terms upfront |

Important: Confirm current concession limits and seasoning requirements with your specific lender before finalizing any buyer agent fee arrangements.

Co-op Commission Considerations

NYC Co-Op Commission Split (3% / 2%) Explained

In many NYC co-op transactions, a 3% / 2% commission split is considered standard:

- 3% typically goes to the listing agent

- 2% goes to the buyer’s agent

This split isn’t mandated by law, but it has become common because co-op deals require significantly more work—board package preparation, financial review, interview coordination, and stricter building requirements.

Why the 3% / 2% structure exists:

- Listing agents often handle heavier administrative and compliance work

- Co-op boards require detailed documentation and agent oversight

- Some buildings have compensation rules that must be disclosed upfront

- Timelines are longer, increasing the workload on both sides

What buyers and sellers should expect:

- The total co-op commission often still falls within the typical NYC range of 5–6%

- Splits can be negotiated, but many co-op brokers prefer to keep the traditional 3% / 2% model

- If a building restricts buyer-agent compensation, those rules must be disclosed early in the process

- Buyers should confirm whether the seller or buyer is covering the buyer-agent fee under the new written agreement requirements

This section answers user intent directly and positions your guide as the most complete and accurate source for NYC co-op commission rules.

How it works: Co-op sales often require board approval, affecting commission timing and structure. Some buildings have restrictions on broker compensation that must be disclosed upfront.

What to expect: Extended timelines for board packages may justify higher commission rates. Agents familiar with specific building requirements provide additional value.

New Development and Sponsor Sales

How it works: Sponsor units and new developments often advertise set buyer agent compensation as part of their marketing strategy, typically 2-3% depending on price point.

What to expect: These fees are usually built into unit pricing. Negotiate directly with sponsors if no buyer agent compensation is offered.

Essential Checklists

Seller Pre-Listing Commission Checklist

- Decide whether to offer buyer agent compensation

- Set commission ceiling and review triggers

- Request detailed line-item marketing plan

- Add listing agreement clause about buyer compensation display and adjustment

- Confirm commission payment timing and conditions

- Understand your termination options

Buyer Pre-Tour Commission Checklist

- Define specific services you need

- Agree on fee structure (percentage, flat fee, or hybrid)

- Set commission cap for higher-priced properties

- Include commission shortfall clause if seller offer is insufficient

- Establish clear termination terms and notice requirements

- Define exact geographic area and property types covered

FAQ: High-Intent Questions Answered

Commission Structure and Negotiation

Q: How do I cap a percentage-based fee so it doesn’t balloon on higher prices?

A: Include a commission cap clause in your buyer agreement, such as “2.5% up to $800,000, then flat $20,000 above that threshold.” This protects you from excessive fees on expensive properties while maintaining percentage-based motivation for your agent.

Q: Can I switch from percentage to flat fee at a specific price threshold?

A: Yes, this hybrid approach is increasingly common. Example: “2.5% for homes up to $600,000, then $15,000 flat fee for anything above.” Include this structure in your written agreement before starting your search.

Q: What happens if the seller offer is lower than my buyer agreement?

A: You pay the difference. If your agreement specifies 3% but the seller offers only 2%, you owe the additional 1%. Always include a “seller contribution clause” that credits you for any amount the seller pays toward your agent’s fee.

Payment and Financing

Q: Can I roll buyer agent commissions into my mortgage?

A: Some lenders allow this within normal commission ranges, but policies vary. FHA loans generally permit it within concession limits, while conventional loans depend on your down payment percentage. Confirm with your lender before committing to direct payment arrangements.

Q: Are there tax implications for paying buyer agent commissions directly?

A: Yes, tax treatment may differ from seller-paid commissions. Buyer-paid fees might be treated as part of your cost basis rather than a deductible expense. Consult a tax professional for guidance specific to your situation and property type.

Market Strategy

Q: Should I offer buyer agent compensation when selling my home?

A: In most markets, yes. Properties offering buyer agent compensation typically receive 15-30% more showings (Source: NAR Buyer Agent Study 2025). However, in strong seller’s markets with low inventory, you may have more flexibility to reduce or eliminate this expense.

Q: How do commissions work in co-ops with board approval requirements?

A: Co-op transactions often justify higher commission rates due to board package preparation, interview coordination, and extended timelines. Many co-ops have specific broker requirements or restrictions that experienced agents navigate more effectively.

Service and Value

Q: What’s the real difference between a 6% and 3% commission in terms of service? A: Higher commissions often include enhanced marketing, professional photography, staging consultation, and more intensive buyer outreach. However, service level varies more by individual agent than commission rate. Focus on the specific marketing plan and services offered rather than just the percentage.

Q: How do I know if I’m getting good value from my agent’s commission? A: Evaluate based on: response time (within 2 hours), market knowledge (comparable sales analysis), marketing quality (professional photos, multiple platforms), and negotiation results. A good agent should provide a detailed marketing timeline and regular communication updates.

Commission Calculator: Compare Your Options

For a $800,000 Purchase:

- 3% total commission: $24,000

- 5% total commission: $40,000

- Flat fee option: $15,000

- Your potential savings: $9,000-$25,000

Want to calculate savings for your specific situation? Use our interactive commission calculator at [your website link].

Looking Ahead: 2025-2027 Market Predictions

Short-Term Outlook (2025-2026)

Commission structures will remain volatile as market participants adapt to new regulations. Expect continued seller pressure to offer buyer agent compensation in competitive markets, while buyers become more comfortable with direct payment arrangements.

Long-Term Trends (2027+)

New York may gradually align with international markets where buyers typically pay their own agents directly. This evolution could lead to reduced total commission costs through increased competition among buyer agents and service unbundling where buyers pay only for services they actually use.

Understanding commission structures is just the first step. The key to success in today’s market is having a clear strategy that aligns with your specific situation and goals.

Need personalized guidance? Schedule a 15-minute discovery call to discuss your local market dynamics and develop a commission strategy that saves you money while achieving your real estate goals.

This guide is updated regularly to reflect changing market conditions and regulations. For the most current information about New York real estate commissions, bookmark this page and check for updates monthly.

Disclaimer: This article provides general information about real estate commissions and is not intended as legal or tax advice. Consult with qualified professionals for guidance specific to your situation.

8 Comments