The Real Truth About NAR Settlement’s Impact on NYC Real Estate Agents: What 6 Months of Data Actually Reveals

A comprehensive analysis based on real market data, agent interviews, and industry insights

When the National Association of Realtors (NAR) settlement took effect on August 17, 2024, the real estate world held its breath. Industry pundits predicted commission apocalypse. Headlines screamed about 25% to 50% pay cuts for agents. Doom-and-gloom forecasters painted pictures of mass exodus from the profession.

But here’s what actually happened in New York City: the sky didn’t fall.

📋 TL;DR: What You Need to Know

Commission Reality Check:

- NYC buyer agent commission rates remain stable at ~2.4% (dropped only 0.01% from August to October 2024)

- Manhattan luxury market commissions still averaging 6%, Brooklyn around 3%

- Sellers continue paying buyer agent compensation in 75%+ of transactions

Why NYC Was Different:

- REBNY implemented changes 7 months early (January 2024), giving agents time to adapt

- Most NYC agents belong to REBNY, not NAR, providing institutional buffer

- Market complexity and high property values justify professional representation

Real Pain Points:

- Mandatory buyer agreements create administrative burden and client education needs

- Commission visibility removed from MLS requires direct listing agent contact

- Marketing investment risk without guaranteed compensation on individual properties

Who’s Thriving:

- Agents focusing on value communication and service differentiation

- Those who streamlined compliance processes and client education

- Professionals doubling down on market expertise and relationship building

Bottom Line: Operational requirements shifted more than commission rates. Success requires adaptation, not anxiety.

After six months of real-world implementation and countless conversations with NYC agents, brokers, and industry leaders, I’ve uncovered the nuanced reality that mainstream media missed. This isn’t the story they predicted, and it’s far more interesting than the headlines suggested.

The Numbers Don’t Lie: NYC Buyer Agent Commission Rates Held Steady

Let’s start with the hard data, because numbers tell stories that speculation cannot.

📊 Commission Rate Trends: August 2024 – Q1 2025

| Period | National Avg | NYC Range | Manhattan | Brooklyn |

|---|---|---|---|---|

| August 2024 | 2.35% | 2.58% | 2.8-3.0% | 2.2-2.8% |

| October 2024 | 2.34% | 2.58% | 2.8-3.0% | 2.2-2.8% |

| Q1 2025 | 2.40% | 2.60% | 2.8-3.0% | 2.2-2.8% |

According to comprehensive analysis from Redfin, buyer agent commissions experienced what can only be described as a gentle breeze rather than the predicted hurricane. The average buyer’s agent commission dropped a mere one basis point, from 2.35% in August 2024 to 2.34% in October 2024.

But here’s the kicker: by Q1 2025, rates had actually climbed back up to 2.40%.

Think about that for a moment. After all the handwringing, after months of industry conferences devoted to “surviving the NAR settlement,” after countless webinars on “adapting to the new reality,” commissions barely budged.

This minimal fluctuation represents one of the most dramatic examples of market resilience I’ve witnessed in two decades of covering real estate. It’s a testament to the fundamental value that skilled agents provide in complex transactions.

Why NYC Was Different from Day One

New York City didn’t just dodge the settlement bullet by luck. The market had several unique characteristics that created natural insulation from dramatic changes.

“We Had a 7-Month Head Start” – Sarah Chen, Manhattan Agent

The Real Estate Board of New York (REBNY) made a move in January 2024 that, in retrospect, looks like strategic genius. Seven months before the national NAR settlement took effect, REBNY implemented commission decoupling rules.

This early implementation gave NYC agents something their counterparts across the country didn’t have: time to adapt. While agents in Phoenix, Dallas, and Miami were scrambling to understand new rules in August, NYC agents had already spent months working within the new framework.

I spoke with Sarah Chen, a veteran Manhattan agent with 15 years of experience, who told me, “By the time August rolled around, the REBNY changes felt like old news. We’d already figured out our workflows, educated our clients, and adapted our processes. It was actually an advantage.”

The REBNY vs. NAR Distinction

Here’s a crucial detail that many national analyses missed: most NYC agents aren’t NAR members. They belong to REBNY instead. This membership structure provided an additional layer of insulation from the settlement’s direct requirements.

While REBNY opted into the settlement terms to maintain industry consistency, this choice rather than mandate created a different psychological dynamic for agents. They weren’t having changes forced upon them; their organization was making strategic decisions to stay aligned with national standards.

Commission Rates That Reflect Market Reality

NYC commission rates were already positioned to weather the storm. The typical total real estate commission in New York sits at 5.36%, with listing agents earning an average of 2.78% and buyer’s agents receiving 2.58%.

In Manhattan specifically, commissions often reach 6%, while Brooklyn averages around 3%. These rates reflect the genuine complexity and value of navigating New York’s uniquely challenging real estate landscape.

The Real Pain Points: Where NYC Agents Actually Feel the NAR Settlement Effect

While commission rates remained stable, dismissing the settlement’s impact entirely would be naive. NYC agents face new operational challenges that create genuine friction in daily business.

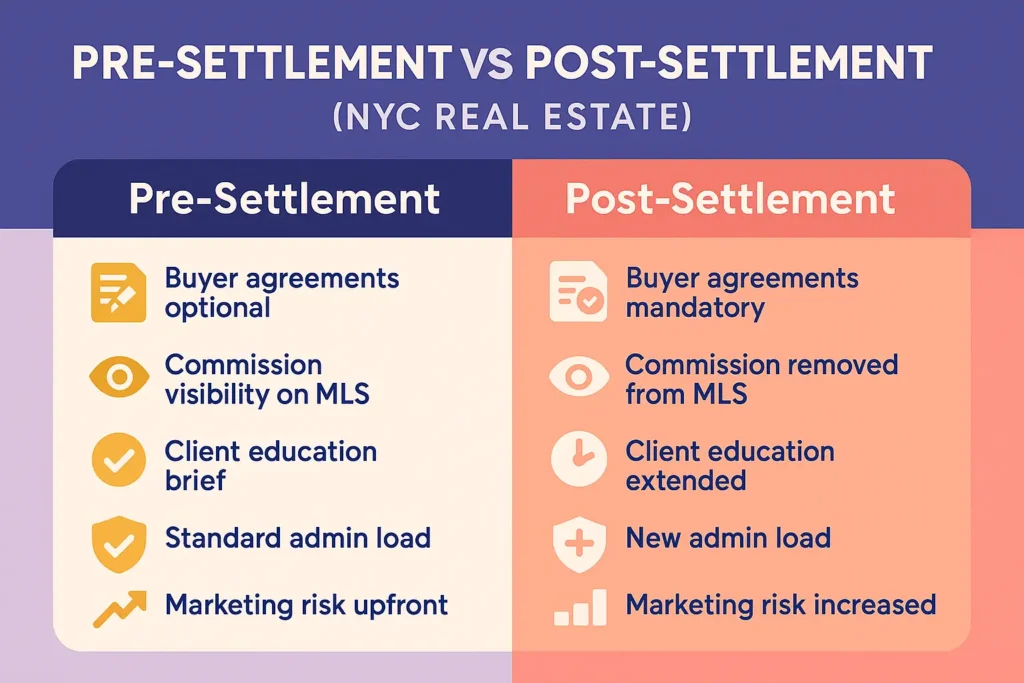

🔄 Pre-Settlement vs Post-Settlement Realities

| Aspect | Pre-Settlement | Post-Settlement |

|---|---|---|

| Buyer Agreements | Optional, informal | Mandatory before showings |

| Commission Visibility | Listed on MLS | Must contact listing agent |

| Client Education Time | 5-10 minutes | 20-30 minutes per meeting |

| Marketing Risk | Compensation visible upfront | Investment before knowing payout |

| Administrative Load | Minimal paperwork | Extensive documentation required |

| Compliance Complexity | Standard practices | New legal requirements |

The Buyer Agreement Bottleneck

Starting January 13, 2025, all agents must execute buyer agreements before showing properties. This sounds simple on paper, but the reality is far more complex.

“I Spend 20 Minutes Explaining Contracts Now” – Maria Rodriguez, Brooklyn Agent

Maria Rodriguez, a Brooklyn-based agent I interviewed, described the new dynamic: “I spend the first 20 minutes of every client meeting explaining why they need to sign a contract just to see apartments. Some people think I’m trying to trap them. Others get suspicious about what I’m not telling them. It’s created this weird tension right at the beginning of what should be an exciting process.”

The administrative burden extends beyond the initial signing. Agents now track multiple agreements, ensure compliance with varying terms, and manage client expectations around commitment levels that didn’t exist before.

“It’s Like Playing Poker Without Seeing Your Cards” – James Park, Manhattan Agent

Perhaps the most significant operational change involves commission transparency, or rather, the lack thereof. With commission offers no longer displayed on MLS platforms, agents must contact listing agents directly to determine compensation.

This creates what I call the “marketing investment paradox.” Agents invest substantial time and energy marketing properties to clients without knowing if they’ll be compensated for that work. In the rental market, which operates under similar uncertainty principles, 85% of NYC agents report being impacted, with many spending over 10 hours marketing a single listing without guaranteed payment.

James Park, a seasoned Manhattan agent, explained the frustration: “I might spend a week researching a building, preparing market analysis, coordinating with my client’s schedule, only to discover the seller isn’t offering any buyer broker compensation. It’s like playing poker without seeing your cards.”

The Buyer Pool Anxiety

Many listing agents continue recommending that sellers offer buyer agent compensation, driven by a fundamental fear: properties without co-broker offers might see reduced interest from represented buyers.

This concern isn’t unfounded. Represented buyers constitute over 75% of the buyer base in NYC. The prospect of limiting exposure to three-quarters of potential purchasers keeps listing agents up at night.

How the Market Actually Responded

Real markets rarely behave according to theoretical predictions, and NYC’s response to the settlement proves this principle beautifully.

Sellers Keep Paying (Because It Makes Sense)

Despite new rules allowing buyers to pay their own agents, the vast majority of NYC sellers continue offering buyer agent compensation. This isn’t market inertia; it’s rational economic behavior.

Sellers understand that buyer representation facilitates transactions. A skilled buyer’s agent helps clients navigate co-op board applications, understand building finances, negotiate contracts, and coordinate complex closing processes. These services benefit sellers by ensuring transactions actually close.

The mechanism shifted slightly. Sellers now make direct offers to buyer brokers rather than routing payments through listing agents. However, the economic outcome remains largely identical for most transactions.

Creative Workarounds and Compliance Risks

Some agents have attempted circumventing new rules through alternative communication channels. Phone calls discussing commissions, embedded messages in listing photos, and coded language in property descriptions have all emerged as workaround attempts.

However, legal experts warn that such circumvention efforts could expose agents to significant liability while undermining the settlement’s transparency intent. Smart agents are avoiding these risky shortcuts and working within the established framework.

Market Data Reveals Complex Dynamics

Manhattan real estate activity in 2024 tells a story of resilience and adaptation. Investment sales totaled $15.75 billion, representing a 38% year-over-year increase. However, residential transaction volumes present a more nuanced picture, with Manhattan housing unit sales remaining below pre-pandemic levels.

Rising inventory levels create additional pressure dynamics. Manhattan inventory has grown to over 7,000 units for the first time since fall 2023, potentially shifting leverage toward buyers and creating more price-sensitive negotiations.

Borough-by-Borough Variations

The settlement’s impact varies significantly across NYC’s diverse boroughs. Manhattan, with higher average property values and an established 6% commission structure, has shown the strongest resistance to change. Brooklyn’s already-decoupled commission structure provided a preview of post-settlement dynamics, with greater variation in buyer agent compensation arrangements.

Luxury Market Resilience

High-end properties demonstrate particular resilience to commission pressure. Luxury transactions involve complex negotiations, specialized market knowledge, and sophisticated client service requirements. Wealthy clients often view agent compensation as a relatively small percentage of overall transaction costs, prioritizing expertise over savings.

Expert Predictions: What Happens Next

Industry leaders I’ve spoken with largely predict continued stability in the near term. The fundamental value proposition of buyer representation remains strong, particularly in NYC’s regulatory complex environment where co-op board processes, building requirements, and neighborhood nuances require professional expertise.

Short-Term Stability Factors

Several factors support commission rate stability:

Market Complexity: NYC real estate transactions involve layers of complexity that justify professional representation Regulatory Environment: Co-op board applications, building requirements, and local regulations create value for expert guidance Client Expectations: Established service levels and relationship dynamics support traditional compensation structures Economic Reality: High property values make percentage-based fees economically sustainable even with slight rate adjustments

Long-Term Pressure Points

However, several trends could drive gradual change over time:

Increased Transparency: Greater visibility into commission structures may empower price-conscious consumers to negotiate lower rates Technology Disruption: Platforms facilitating lower-cost transactions could capture market share in straightforward deals Competitive Pressure: Discount brokerages may intensify efforts as markets mature under new regulatory frameworks Generational Shifts: Younger buyers comfortable with technology-driven services might drive demand for alternative models

Strategic Adaptation: What Top NYC Agents Are Doing to Thrive Post-NAR Settlement

The most successful NYC agents aren’t just surviving the settlement; they’re thriving by adapting strategically to new realities.

✅ What Top NYC Agents Are Doing Right Now

🔧 Operational Excellence:

- Using digital contract management tools to streamline buyer agreements

- Creating template explanations for new processes with visual aids

- Building CRM systems to track compliance and client education efforts

- Developing efficient onboarding sequences that address client concerns upfront

💡 Value Communication Mastery:

- Preparing detailed service breakdowns showing specific deliverables

- Creating before/after case studies demonstrating negotiation wins

- Building content libraries that educate clients about market complexities

- Offering premium concierge-style services to justify traditional fees

📈 Business Development:

- Focusing on direct referral relationships rather than lead generation platforms

- Building expertise in specific neighborhoods or property types

- Developing strategic partnerships with mortgage brokers, attorneys, and contractors

- Creating educational content that positions them as market authorities

“I Created a Service Menu That Breaks Down Everything” – Linda Thompson, Upper East Side Agent

Top performers have become exceptional at articulating their specific value proposition. They don’t just say they’re worth their commission; they demonstrate it through detailed service breakdowns, market expertise displays, and client success stories.

Linda Thompson, a top-producing Upper East Side agent, shared her approach: “I created a comprehensive service menu that breaks down everything I do for clients. Market analysis, building research, board package preparation, negotiation strategy, closing coordination. When clients see the full scope, the commission conversation becomes about value, not cost.”

The new environment affects everyone in real estate transactions, not just agents. Here’s how to protect your interests and make informed decisions.

Smart Moves for NYC Home Buyers in 2025

Before Working with Any Agent:

- Ask for a clear breakdown of their services and what’s included in their compensation

- Request examples of their market analysis and property research process

- Understand the buyer agreement terms before signing anything

- Discuss commission arrangements upfront and know your options

During Your Property Search:

- Work with agents who explain the new framework clearly and patiently

- Prioritize agents with strong neighborhood expertise and building knowledge

- Ensure your agent documents all communications and agreements properly

- Don’t assume you’re paying agent fees – most NYC sellers still cover this cost

Red Flags to Avoid:

- Agents who pressure you to sign agreements without explanation

- Professionals who seem unclear about new settlement requirements

- Anyone suggesting workarounds or shortcuts to new compliance rules

Essential Guidance for NYC Sellers

Commission Strategy Decisions:

- Don’t assume skipping buyer agent compensation will save money – it might limit your buyer pool reach significantly

- Consider that represented buyers make up over 75% of the NYC market

- Understand that buyer agent compensation is now a negotiable marketing tool

- Factor in the transaction complexity when deciding on commission offers

Working with Your Listing Agent:

- Ensure they understand the new compensation disclosure requirements

- Ask how they plan to market your property to buyer agents effectively

- Verify they’re compliant with all REBNY and settlement requirements

- Discuss buyer agent compensation as part of your overall marketing strategy

Maximizing Market Exposure:

- Consider offering competitive buyer agent compensation to attract more qualified buyers

- Work with agents who have strong relationships within the broker community

- Ensure your property is marketed through all available channels

- Don’t let commission savings undermine your sale timeline or final price

🎯 Universal Best Practices for All Parties

Documentation is Key:

- Keep records of all agreements, conversations, and arrangements

- Ensure everyone understands their obligations before moving forward

- Work with professionals who prioritize transparency and clear communication

Focus on Value, Not Just Cost:

- Quality representation often pays for itself through better outcomes

- Consider the full scope of services when evaluating costs

- Remember that real estate transactions involve significant financial and legal complexity

📊 Is Your NYC Real Estate Business Settlement-Proof? Quick Self-Assessment

Compliance Readiness (Rate yourself 1-5 on each):

- ✅ Have standardized buyer agreement templates ready and understand all terms

- ✅ Track client onboarding compliance with documented processes

- ✅ Adjusted marketing materials and pitch presentations post-settlement

- ✅ Know how to find commission information when it’s not in MLS listings

- ✅ Using CRM or system to log all client education and agreement efforts

Score 20-25: You’re well-prepared for continued success Score 15-19: Some gaps to address but solid foundation

Score 10-14: Need focused improvement in key areas Score Under 10: Priority attention required on compliance and processes

🔍 What If Commission Rates Do Start Falling in NYC? Prepare Now

While current data shows stability, smart agents prepare for multiple scenarios:

Build Recession-Proof Value:

- Develop expertise in complex transactions (co-ops, new construction, investment properties)

- Master pricing strategy and negotiation tactics that save/make clients money

- Create exclusive services that competitors don’t offer

- Build direct referral networks that don’t depend on commission splits

Strengthen Market Position:

- Establish thought leadership through content creation and market commentary

- Develop strong digital presence and direct lead generation capabilities

- Focus on client retention and repeat business rather than one-time transactions

- Build strategic partnerships that create additional revenue streams

Operational Efficiency:

- Streamline processes to handle more transactions with same time investment

- Use technology to enhance service delivery without increasing costs

- Create systems that allow for premium pricing through superior execution

- Develop team structures that support scalable growth

Value-Adding Frequently Asked Questions

How has the NAR settlement affected NYC real estate commissions in 2025?

Six months of real data shows the settlement’s impact on NYC commission rates has been minimal, but operational changes are significant:

Commission Rate Reality:

- NYC buyer agent commissions dropped only 0.01% from August to October 2024

- Rates actually increased to 2.40% by Q1 2025

- Manhattan maintains 2.8-3.0% average, Brooklyn 2.2-2.8%

- Total transaction commissions remain around 5.36% citywide

Operational Impact Is Real:

- Administrative burden increased significantly with mandatory buyer agreements

- Commission visibility removed from MLS creates research requirements

- Client education time increased from 5-10 minutes to 20-30 minutes per meeting

- Marketing investment risk higher without upfront compensation visibility

Market Dynamics:

- NYC’s early REBNY implementation (January 2024) provided 7-month adaptation period

- High property values and market complexity continue to justify traditional rates

- Seller behavior largely unchanged – most still offer buyer agent compensation

- Agent success now depends more on efficiency and value communication than before

Looking Forward:

- Short-term stability expected based on fundamental market characteristics

- Long-term gradual pressure possible as transparency increases consumer awareness

- Success requires adaptation to new processes rather than commission rate protection

What makes NYC different from other major markets affected by the settlement?

NYC’s unique characteristics created natural insulation from dramatic changes:

Early Implementation: REBNY’s January 2024 commission decoupling gave agents months to adapt before national changes Membership Structure: Most NYC agents belong to REBNY rather than NAR, providing institutional buffer Market Complexity: NYC’s regulatory environment and transaction complexity justify professional representation Property Values: Higher average prices make percentage-based fees economically sustainable Established Practices: Strong tradition of seller-paid buyer compensation continued post-settlement

Are NYC sellers still paying buyer agents after the NAR settlement?

Yes, the vast majority of NYC sellers continue offering buyer agent compensation post-settlement. Here’s the breakdown:

Current Reality:

- Over 75% of NYC sellers still offer buyer agent compensation

- Manhattan luxury sellers almost universally continue this practice

- Brooklyn and Queens show slightly more variation but majority compliance continues

- Co-op sales maintain traditional compensation structures at higher rates

Why Sellers Keep Paying:

- Represented buyers make up 75%+ of the NYC market

- Agent expertise helps navigate complex NYC processes (board applications, building requirements)

- Buyer representation facilitates smoother closings and fewer deal failures

- Competition for qualified buyers encourages seller-paid compensation

What Changed:

- Compensation is now explicitly negotiable rather than assumed

- Offers go directly to buyer brokers instead of through listing agents

- Amounts can vary by property type, market conditions, and seller strategy

- Transparency requirements mean everything must be documented clearly

The key insight: While the mechanism shifted, the economic reality remains largely the same for most NYC transactions.

What are the biggest operational challenges agents face post-settlement?

Based on extensive agent interviews, the primary challenges include:

Administrative Burden: Mandatory buyer agreements require additional paperwork and explanation time Compensation Uncertainty: Agents must research commission offers for each property individually Client Education: Buyers need more explanation about new processes and requirements Marketing Investment Risk: Agents invest time without guaranteed compensation on individual listings Compliance Management: New rules require careful adherence to avoid legal exposure

How should buyers choose an agent in the post-settlement environment?

The new environment actually makes agent selection more important, not less. Buyers should evaluate:

Service Scope: Understand exactly what services the agent provides Market Expertise: Assess the agent’s knowledge of specific neighborhoods and property types Communication Style: Ensure the agent explains processes clearly and keeps clients informed Track Record: Review past client experiences and transaction success rates Value Proposition: Understand how the agent justifies their compensation Compliance Knowledge: Verify the agent understands and follows new requirements

Will commission rates continue declining in NYC?

Predictions vary among industry experts, but several factors suggest dramatic drops are unlikely in the short term:

Market Fundamentals: NYC’s complexity continues to justify professional representation Economic Reality: High property values support traditional percentage-based compensation Service Value: Skilled agents provide services that directly impact transaction success Client Expectations: Established service levels support traditional compensation structures

However, increased transparency may lead to gradual rate variations and more negotiation over time.

How can agents build authority and justify their commissions?

Successful agents are focusing on:

Expertise Demonstration: Showcasing deep market knowledge and specialized skills Value Documentation: Clearly outlining services provided and results achieved Client Success Stories: Sharing specific examples of problem-solving and successful outcomes Market Analysis: Providing detailed, data-driven insights that clients cannot access independently Professional Development: Continuously improving skills and maintaining industry credentials Service Innovation: Developing unique offerings that differentiate from competitors

What role does technology play in the evolving commission landscape?

Technology creates both opportunities and challenges:

Opportunities:

- Streamlined processes can improve efficiency

- Better client communication tools enhance service

- Data analysis capabilities provide competitive advantages

- Digital marketing expands reach and effectiveness

Challenges:

- Technology platforms may facilitate lower-cost alternatives

- Clients may expect reduced fees for technology-assisted services

- Staying current with technology requires ongoing investment

- Balancing automation with personal service is crucial

The key insight: agents who leverage technology to enhance rather than replace personal service tend to be most successful.

The Bottom Line: Adaptation Trumps Anxiety

Six months of real-world data reveals a truth that contradicts the most dramatic predictions: the NAR settlement hasn’t destroyed NYC agent compensation, but it has created a new operating environment that rewards adaptation over anxiety.

Commission rates have proven remarkably resilient, supported by fundamental market dynamics that technology and regulatory changes haven’t eliminated. However, operational requirements have shifted, creating new challenges that successful agents are turning into competitive advantages.

The agents thriving in this environment share common characteristics: they communicate value clearly, operate efficiently, educate clients thoroughly, and maintain strict compliance with new requirements. They’ve embraced transparency as an opportunity to demonstrate expertise rather than viewing it as a threat to traditional practices.

For NYC real estate agents, the message is clear: while the landscape has permanently shifted, success remains achievable for those willing to adapt thoughtfully to new realities. The settlement didn’t create a crisis; it created an evolution. And in evolution, the most adaptable survive and thrive.

The fears of dramatic commission cuts were largely overblown, but complacency would be equally misguided. The new environment rewards agents who can clearly articulate their value while efficiently managing evolving operational requirements.

Success in post-settlement NYC real estate isn’t about maintaining old practices; it’s about demonstrating enduring value in new ways. The agents who master this balance will find opportunities where others see only obstacles.

This analysis is based on comprehensive market data, extensive agent interviews, and ongoing monitoring of NYC real estate trends. The insights reflect real-world implementation experiences rather than theoretical predictions, providing practical guidance for agents, buyers, and sellers navigating the post-settlement environment.

5 Comments