FSBO in NYC: Typical Commission Savings vs Lost Exposure (Data-Backed Analysis)

Last updated: November 21, 2025

Executive Summary

Selling your home without a real estate agent in New York City could save you $15,000 to $45,000 in listing agent commissions. However, it’s important to consider the fsbo nyc commission savings. The data shows that FSBO homes nationally sell for $55,000 less on average than agent-assisted sales, with NYC FSBO success rates estimated at less than 1%.

For a typical $1 million NYC condo: save approximately $30,000 in listing commission, but potentially sell for $850,000 instead of $1,000,000—netting you $113,650 less than working with an agent. This guide examines why these outcomes occur and when FSBO might actually make sense.

What FSBO Really Means in NYC (and How It’s Different From Other Markets)

For Sale By Owner (FSBO) means selling your property without hiring a listing agent. In most U.S. markets, this involves listing on the local Multiple Listing Service (MLS) through flat-fee providers and handling negotiations yourself.

NYC operates differently. The city uses the REBNY Listing Service (RLS)—not a traditional MLS—creating unique challenges for FSBO sellers. National flat-fee services claiming “50-state coverage” often list NYC properties on irrelevant databases like the New York State MLS, where few Manhattan or Brooklyn buyers actually search.

New York City operates on a broker-centric ecosystem where 75-90% of buyers are represented by agents. Traditional FSBO listings that exclude brokers or fail to list on RLS receive exposure to only 10-25% of potential buyers. NAR data suggests that while over 90% of all sellers get MLS exposure, only about 1 in 10 FSBO sellers use an MLS website. In other words, most FSBO listings never reach the same distribution channels as agent-listed homes. Additionally, 90% of NYC transactions involve two agents, with nationally only 5-6% of sales being FSBO. In NYC, one analysis estimates less than 1% of home sales close without a listing agent.

Key Takeaway: FSBO in NYC isn’t just harder than in other markets—it’s structurally different. Without RLS access and broker cooperation, you’re marketing to a fraction of potential buyers.

Understanding fsbo nyc commission savings is essential for any seller considering this route, as it impacts your overall financial outcomes.

FFSBO vs Agent: A clear breakdown of real-world pricing, exposure, and negotiation differences — essential context before exploring why FSBO outcomes are dramatically different in NYC.

How Much Commission Can You Actually Save With FSBO in NYC?

NYC Commission Landscape 2025

Real estate commissions in New York typically average around 5.76% of the sale price, usually split as roughly 3.0% to the listing agent and 2.7% to the buyer’s agent, according to 2025 surveys of New York sellers and agents.

For FSBO sellers, the theoretical savings come from eliminating the listing agent’s commission—but here’s the critical reality: in practice, roughly three-quarters of sellers (including many FSBOs) still offer a buyer’s agent commission, so the real savings often only come from the listing side.

NYC Commission Cost Examples

Here’s what commission savings look like at different price points:

- $500,000 home: Full commission $28,800 (5.76%); listing agent portion saved $15,000; buyer agent commission typically still paid $13,500

- $1,000,000 home: Full commission $57,600; listing agent portion saved $30,000; buyer agent commission typically still paid $27,000

- $1,500,000 home: Full commission $86,400; listing agent portion saved $45,000; buyer agent commission typically still paid $40,500

Recent reports put Manhattan’s median sale price around $1.15 million, with Brooklyn at $858,000 and Queens at $581,000. In these high-price markets, small percentage mistakes quickly become six-figure differences in net proceeds.

The Hidden Truth About Buyer Agent Commissions

FSBO sellers who refuse to pay buyer agents effectively shut themselves off from the majority of the market. Buyer agents are reluctant to show FSBO properties for several reasons: reliability concerns (FSBO sellers are “notorious for being unrealistic, hard to deal with, prone to renegotiate the buyer agent commission”), paperwork uncertainty with no contractual commission agreement upfront, time efficiency (easier to focus on RLS listings with guaranteed commission), and professional barriers from 30,000+ NYC agents who actively discourage buyers from FSBO properties.

Key Takeaway: Your real commission savings in FSBO are typically 2.78%-3.07% (listing agent portion only), not the full 5.36%-5.76%. On a $1 million property, that’s $30,000 saved, not $57,600—and only if you don’t lose more than $30,000 on sale price.

The Exposure Trade-Off: Where Your FSBO Listing Appears (and Doesn’t)

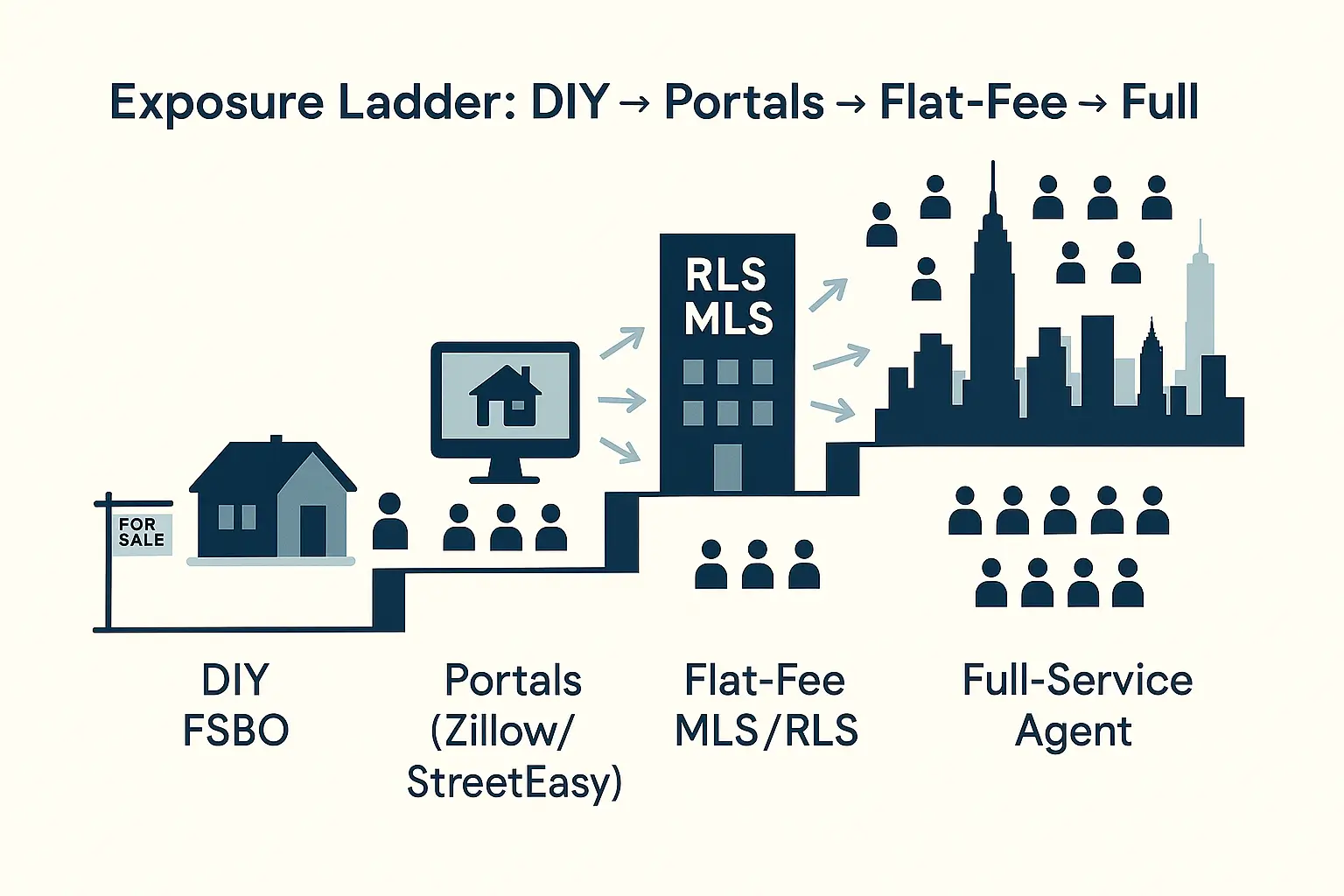

Understanding where your FSBO listing appears determines whether buyers will see your property. Here’s the exposure ladder:

- Level 1 – DIY Only: Yard sign + Craigslist reaches 5-10% of market ($50-$200 cost)

- Level 2 – Public Portals: Zillow, StreetEasy, Realtor.com reach 10-25% of market ($599+ for StreetEasy FSBO, $99-$400 for basic packages)

- Level 3 – Flat-Fee RLS/MLS: Reaches 60-75% of market ($99-$1,500 upfront + 2.5-3% buyer agent commission)

- Level 4 – Full-Service Agent: Reaches 75-90% of market (5.76% full commission)

Even when you offer commission, FSBO listings face resistance. Agents prioritize RLS listings where commission is contractually guaranteed and documentation is standardized.

Key Takeaway: The exposure gap isn’t just about where you list—it’s about broker cooperation that drives showings.

Why Do FSBO Homes Typically Sell for Less?

National FSBO Performance Data

According to NAR’s 2024 Profile of Home Buyers and Sellers, the typical FSBO home sold for $380,000, versus $435,000 for agent-assisted sales (about 15% less). In the latest 2025 data, that gap widened to $360,000 vs $425,000 (approximately 18% less).

Local and brokerage-level analyses in several markets show gaps as high as 25-30% in favor of agent-listed homes. A Coldwell Banker analysis of one Midwest market found FSBOs sold for approximately 29% less than agent-listed homes, a $75,000-$85,000 gap in that region.

NYC-Specific Reality

Manhattan FSBO transactions are “a rarity” according to industry sources. The complex co-op board approval process, high median prices ($1.15 million+), and broker-dominated culture make traditional FSBO particularly challenging.

Real-World Net Proceeds Comparison

Let’s model three scenarios for a $1 million NYC condo to see how commission savings compare to exposure loss:

| Scenario | Sale Price | Total Commission/Fees | Net Proceeds | Difference vs Agent |

|---|---|---|---|---|

| Agent – 5.76% | $1,000,000 | $57,600 | $942,400 | – |

| FSBO Portal-only | $850,000 | $21,250 | $828,750 | -$113,650 |

| Hybrid FSBO | $950,000 | $24,750 | $925,750 | -$16,650 |

Scenario A: Full-Service Agent

- List and achieved sale price: $1,000,000 (100% of market value)

- Commission paid: $57,600 (5.76%)

- Net proceeds: $942,400

Scenario B: Pure FSBO (No RLS, Portal-Only)

- List price: $1,000,000

- Achieved sale price: $850,000 (15% below market due to limited exposure)

- Buyer agent commission: $21,250 (2.5%)

- Net proceeds: $828,750

- Loss vs. agent: -$113,650

Scenario C: Hybrid FSBO (Flat-Fee RLS + Buyer Agent Commission)

- List price: $1,000,000

- Achieved sale price: $950,000 (5% below market, better exposure but still some resistance)

- Flat-fee MLS: $500

- Buyer agent commission: $23,750 (2.5%)

- Net proceeds: $925,750

- Loss vs. agent: -$16,650

What Drives Lower FSBO Sale Prices

91% of FSBO listings are priced too high, leading to extended market times and price reductions. Additional factors:

- Limited marketing: Without professional photography and staging, FSBO listings generate fewer competitive offers

- Negotiation disadvantage: 46% of FSBO sellers reject an offer that ends up being their highest

- Fewer showings: Limited RLS exposure means fewer competing buyers

Key Takeaway: Commission savings mean nothing if you net less money. Remember the table above—that’s the gap you’re really choosing between.

Hidden Costs: Time, Stress, and Legal Risk

Recent FSBO guides estimate 15-20 hours per week for FSBO sales. Tasks include market research, photography coordination, listing management, scheduling showings (evenings/weekends), responding to inquiries, qualifying buyers, negotiating offers, and managing inspections.

For a sale taking 3-4 months, you’re investing 180-320 hours. At a professional hourly rate of $75-150, that’s $13,500-$48,000 in opportunity cost.

Emotional Stress and Unexpected Costs

36% of home sellers experienced such stress they cried during the process. FSBO adds layers: difficulty staying objective during negotiations, personal attachment affecting pricing, dealing with difficult buyers directly, opening your home to unvetted strangers, and risk of scams.

One 2025 analysis found that 36% of FSBO sellers reported making legal mistakes, and sellers who skipped an agent were more than twice as likely to face unexpected costs (27% vs 13%), including professional photography ($200-$500), flat-fee MLS ($99-$1,000), attorney fees ($2,000-$5,000+), staging, and inspection repairs.

Legal Risks in NYC

New York requires both buyer and seller to use attorneys for contract preparation and closing. FSBO sellers face significant legal exposure: incomplete property disclosures leading to lawsuits, outdated contracts missing NY-specific requirements, earnest money mismanagement, undiscovered title issues, and fair housing violations.

For co-op sales, buyers must submit comprehensive board packages including financial statements, tax returns (1-3 years), bank statements, and reference letters. Board review takes 2-4 weeks with approval required before closing.

Key Takeaway: The commission you save gets consumed by unexpected costs, time investment, and emotional toll.

NYC vs Typical U.S. Market: Why FSBO Is Structurally Harder Here

| Factor | NYC | Typical U.S. City |

|---|---|---|

| Listing System | RLS (broker-centric) | MLS (more accessible) |

| Buyer Representation | 75-90% have agents | 60-70% have agents |

| Property Types | Co-ops, condos, complex boards | More owner-occupied single-family |

| Closing Process | Attorneys mandatory | Often no attorney required |

| Median Price | $1.15M+ (Manhattan) | $400-500K nationally |

| FSBO Success Rate | <1% | 5-6% |

This comparison shows why national FSBO advice often doesn’t apply to NYC sellers. The broker ecosystem, co-op complexity, and price points create fundamentally different selling dynamics.

When Does FSBO in NYC Actually Make Sense?

Despite all of these headwinds, there are specific situations where FSBO can make financial sense in NYC—but they’re the exception, not the rule.

1. Known Buyer Transactions: 38% of successful FSBO sales involve known buyers—family, friends, neighbors, or existing tenants. When you already have a buyer, the exposure problem disappears.

2. Agent-Assisted FSBO: List on REBNY RLS through flat-fee service ($99-$400), offer competitive buyer agent commission (2.5%-3%), hire transaction coordinator for paperwork, and use attorney for legal documents.

3. High-Demand Properties: Properties in desirable neighborhoods with low inventory can overcome exposure limitations through demand alone.

Success Requirements

To overcome the <1% NYC success rate:

- List on REBNY RLS (not just Zillow/Craigslist)

- Offer competitive buyer agent commission (2.5%-3%)

- Hire professional photographer ($200-500)

- Use qualified real estate attorney from the start

- Price based on recent comps, not emotional attachment

- Invest 15-20 hours/week in management

- Offer competitive buyer agent commission (2.5%-3%)

Key Takeaway: FSBO works in NYC for pre-arranged sales or when you invest in hybrid services. Pure FSBO almost never succeeds in New York City.

What Are the Best Alternatives to FSBO for Cutting Commission in NYC?

You don’t have to choose between full commission and pure FSBO:

- Flat-Fee MLS ($99-$400): RLS listing with basic syndication. You handle all marketing, showings, negotiations. Still pay buyer agent 2.5-3%.

- Discount Broker (1-2% Listing): Limited services, basic RLS listing. Total commission 3.5-5%.

- Transaction Coordinator ($500-$1,500): Paperwork management only. You handle marketing, pricing, negotiations.

- FSBO with Buyer Agent Only: Pay 2.5-3% to buyer agent on accepted offers. You handle seller-side marketing.

- 1.5% Listing Agent: Full services with negotiated reduced rate. Total 4-4.5% commission.

Key Takeaway: Hybrid approaches can reduce costs while maintaining critical RLS exposure.

FSBO Myths vs Reality

Myth: “If I go FSBO, I save 5-6%.”

Reality: In practice, roughly three-quarters of sellers (including many FSBOs) still offer buyer’s agent commission. Your real savings are usually only the listing side—around 3%—while risking a 10-18% lower sale price.

Myth: “MLS doesn’t matter; buyers just use Zillow.”

Reality: NAR data shows over 90% of all sellers get MLS exposure, but only about 1 in 10 FSBO sellers use an MLS website. In NYC specifically, 75-90% of buyers work with agents who pull from RLS/MLS first.

Myth: “I can handle the paperwork myself.”

Reality: One 2025 analysis found 36% of FSBO sellers made legal mistakes. In NYC’s attorney-driven market with co-op boards and complex disclosure requirements, the risks are even higher.

FAQ: FSBO in NYC – Your Questions Answered

How much commission can I really save with FSBO in NYC?

Theoretical savings are around 3.0% (listing agent portion), equating to $15,000-$45,000 on typical NYC properties. However, in practice, roughly three-quarters of sellers (including many FSBOs) still offer buyer’s agent commission (2.5%-3%). Nationally, FSBO homes sell for $55,000-$95,000 less than agent-assisted sales, often wiping out savings entirely.

What percentage of FSBO sales succeed in NYC?

NYC has an extremely low FSBO success rate estimated at less than 1% of all transactions. Nationally, only 5-6% of 2024 home sales were FSBO (a historic low), with just 11% completing sales without eventually hiring an agent.

Why do buyer agents avoid FSBO listings?

Agents cite lack of contractual commission guarantees, concerns about seller reliability, more efficient use of time on RLS listings, and professional incentives to protect traditional commission structures. Even when FSBO sellers offer commissions, listings not on RLS remain largely invisible.

Should I list my NYC FSBO on the MLS?

Yes, but specifically on the REBNY Listing Service (RLS). National flat-fee services often list on irrelevant New York databases with minimal broker membership. NAR data shows that while over 90% of all sellers get MLS exposure, only about 1 in 10 FSBO sellers use an MLS website. Proper RLS listing through NYC-specific flat-fee services ($99-$400) is essential to reach the 75-90% of buyers represented by agents.

What are the biggest mistakes FSBO sellers make?

Top five mistakes: overpricing (91% of FSBOs priced too high), poor listing syndication (97% not on MLS), writing “No Brokers” (excludes 75-90% of buyers), amateur photos and marketing, and not offering buyer agent commission.

Do I need an attorney for FSBO in New York?

Yes, it’s mandatory. New York is an attorney-closing state requiring both buyer and seller to use lawyers for contract preparation and closing. Attorney fees typically range $2,000-$5,000+ but are essential for legal protection and transaction management.

Can I negotiate buyer agent commission in FSBO?

Technically yes, but it’s counterproductive. Offering below-market buyer agent commission (less than 2.5%-3%) further reduces already-limited exposure. Since most FSBO sellers end up paying buyer commissions anyway, starting with competitive rates attracts more showings.

How do I price my FSBO correctly in NYC?

Pricing requires comprehensive comparative market analysis using recent sales (within 90 days) of similar properties in your neighborhood. Consider hiring an appraiser ($400-$600) or using flat-fee MLS services that include pricing guidance. 91% of FSBO listings are overpriced, leading to extended market time and price reductions.

Decision Checklist: Is FSBO Right for Your NYC Property?

✅ FSBO Might Work If:

- You already have a buyer (family, tenant, neighbor)

- Your property is in extremely high demand

- You have real estate experience

- You’re willing to invest 15-20 hours/week for 3-4 months

- You can afford flat-fee RLS and buyer agent commission

❌ FSBO Probably Won’t Work If:

- You’re trying to save the entire commission

- You only plan to list on Zillow/Craigslist without RLS

- Your property is a co-op with complex board approval

- You’re pricing based on what you need, not market data

- You lack time for evenings/weekend showings

Conclusion: The Math Doesn’t Add Up for Most NYC Sellers

For the vast majority of NYC sellers, FSBO is a costly gamble. The data is clear: FSBO homes sell for $55,000-$95,000 less nationally, NYC FSBO success rates sit below 1%, you miss 75-90% of NYC’s buyer pool without RLS listing, sellers face unexpected expenses with 15-20 hours weekly time commitment, and 36% make costly legal mistakes.

The bottom line for a $1M NYC property: FSBO theoretical savings of $30,000 versus typical outcome of selling for $850,000-$900,000 equals $100,000-$150,000 loss—$70,000-$120,000 worse than paying full commission.

The only viable FSBO scenarios are known-buyer transactions (38% of FSBO) or properly executed Agent-Assisted FSBO with RLS listing, buyer agent commission, and professional support.

Your Next Steps

- Run the numbers honestly: Calculate potential sale prices with 0%, 5%, 10%, and 15% discounts compared to commission costs

- Assess your situation: Do you have a buyer already? Is this a simple condo or complex co-op?

- Consider hybrid options: Flat-fee RLS with buyer agent commission may offer the best balance

- Get professional pricing: Hire an appraiser ($400-600) before listing to avoid overpricing

- Consult a real estate attorney: Get advice on disclosure requirements before you list

The commission you pay isn’t a cost—it’s an investment in exposure, expertise, and ultimately, your net proceeds. In NYC’s complex, broker-dominated market, going it alone rarely pays off.