The Complete NYC Real Estate Agent’s First-Year Budgeting Guide: From Zero to Six Deals in 12 Months

Let’s talk money. The cost to become a real estate agent in NYC can top $20 000 before you earn a cent. I’ve coached dozens of rookies through that cash-crunch year—here’s the budget that kept them in business and on track for six closings.

TL;DR: Quick Start Budget Overview

💸 Estimated Year 1 Expenses: $15,000–$30,000

🧾 Minimum Capital Required: $20,000–$35,000 (to stay afloat for 6+ months)

🏡 Goal: 6 deals in 12 months = $40K–$70K net income

🎯 Must-dos: Track ROI monthly, reinvest profits, start with buyers, never stop prospecting

⏰ Break-even timeline: Deal #3 (typically months 6-9)

💡 Success secret: 50% of profits reinvested into highest-performing lead sources

Starting your real estate career in New York City is both thrilling and terrifying. The potential rewards are enormous, but so are the upfront costs and competition. After working with hundreds of new agents ove

r the past decade, I’ve seen too many talented individuals fail not because they lacked skill or ambition, but because they entered the market without a proper financial plan.

This comprehensive guide will show you exactly how to budget for your first year as a NYC real estate agent, protect your financial foundation, and position yourself for sustainable success. Whether you’re career-switching or fresh out of school, these insights will help you navigate the financial realities of real estate while building a thriving business.

The Reality Check: What Success Actually Costs in NYC

Let’s be honest about what you’re getting into. New York City’s real estate market rewards the prepared and punishes the naive. The average first-year agent earns between $90,000 and $110,000 in gross commissions, but that’s before expenses, taxes, and your broker’s split.

Your net income will likely be closer to $60,000 to $75,000 after all deductions. This means you need to be strategic about every dollar you spend, especially in those crucial first six months when expenses are high but closings are rare.

The good news? With proper budgeting and focused effort, most dedicated agents can close their first six deals within 12 months. The key is understanding exactly where your money needs to go and when.

Phase 1: Getting Licensed and Market-Ready ($825 – $1,440)

Before you can even show your first property, you’ll need to invest in your education and licensing. This isn’t optional, and trying to cut corners here will only hurt you later.

Educational Foundation

Pre-licensing Education (77 hours required): $245 – $600

Choose your education provider carefully. While online courses are cheaper, in-person programs often provide better networking opportunities and more thorough exam preparation. Consider schools like Real Estate Express for online learning or local institutions like Corofy Real Estate School for classroom instruction.

State Exam Preparation: $15 per attempt

Budget for at least two attempts, even if you’re confident. The New York State exam has a 70% pass rate, meaning 30% of test-takers need a second try. Each retake costs $15, so factor this into your planning.

Essential Compliance Requirements: $115 – $130

The background check, fingerprinting, and licensing application are non-negotiable costs. Budget $60-$75 for the Department of State background check and fingerprinting, plus $55 for your initial licensing application.

Professional Protection

Errors & Omissions Insurance: $150 – $300 annually

Most brokerages require E&O insurance, and even if yours doesn’t, you need it. Real estate transactions involve massive financial stakes, and one mistake could devastate your personal finances. Shop around for competitive rates, but don’t sacrifice coverage for savings.

Professional Association Memberships: $300 – $400

NAR (National Association of Realtors) and local board memberships aren’t just resume builders. They provide access to exclusive training, MLS systems, and networking events that can generate referrals. The investment pays dividends through education and connections.

🚨 Budgeting Non-Negotiables

Before we dive deeper into specific costs, here are the three absolute essentials that separate successful agents from those who struggle:

- Have at least 6 months of living expenses saved. Real estate income is unpredictable, especially in your first year.

- Invest consistently in lead generation. Even $500/month in marketing beats sporadic $2,000 spending sprees.

- Track cost per lead and cost per closed deal every month. What gets measured gets optimized.

Phase 2: Establishing Your Business Foundation ($600 – $5,400 annually)

Once licensed, you’ll need the infrastructure to operate professionally and serve clients effectively.

Monthly Cash Burn Chart: Your Operating Expenses

Here’s what you can expect to spend each month once you’re actively working:

| Category | Monthly Budget | Notes |

|---|---|---|

| Desk Fees | $150 | Can vary by brokerage |

| CRM + Tools | $80 | HubSpot or Follow Up Boss |

| Marketing (Ads + Print) | $500–$1,000 | Google, Social, Zillow |

| Networking + Referrals | $100 | Local events, partner coffees |

| MLS Access | $50 | OneKey participation |

| Misc. Admin | $50 | Print, signage, subscriptions |

| Total | $930–$1,430 | Expect no revenue for 3–4 months |

This burn rate means you’ll need $3,000-$5,000 in operating capital before seeing your first commission check.

Brokerage Partnership

Desk Fees: $50 – $200 monthly

Your brokerage choice dramatically impacts your bottom line. Traditional brokerages offer more support but take larger commission splits (often 60/40 or 70/30 in their favor). Discount brokerages offer 90/10 or 100% splits but provide minimal support.

For new agents, I recommend starting with a supportive brokerage even if the split is less favorable. The training, mentorship, and lead sharing often justify the higher costs in your first year.

MLS Access and Participation: $16.67 – $200 monthly

OneKey MLS access is essential for serving NYC clients. The participation fee varies by brokerage arrangement, but budget at least $200 annually for basic access. This investment gives you professional credibility and the tools to help clients effectively.

Technology Infrastructure

Customer Relationship Management (CRM): $50 – $200 monthly

A robust CRM system is non-negotiable in today’s market. Platforms like HubSpot, Follow Up Boss, or Chime offer different feature sets at various price points. Your CRM should handle lead capture, automated follow-up, transaction management, and client communication.

Professional Website and Branding: $300 – $1,000 one-time

Your website is often a client’s first impression of your professionalism. While you can start with basic templates, invest in professional headshots and quality copywriting. A well-designed website builds trust and converts more visitors into leads.

Transaction Management Tools: Included in CRM or $30-50 monthly

DocuSign, Dotloop, and similar platforms streamline contract management and closing coordination. Many CRMs include these features, but standalone tools may offer better functionality for complex transactions.

Phase 3: Marketing and Lead Generation ($5,000 – $12,000 annually)

This is where most new agents either succeed or struggle. Effective marketing drives lead generation, but ineffective spending can drain your budget without results.

Digital Marketing Strategies

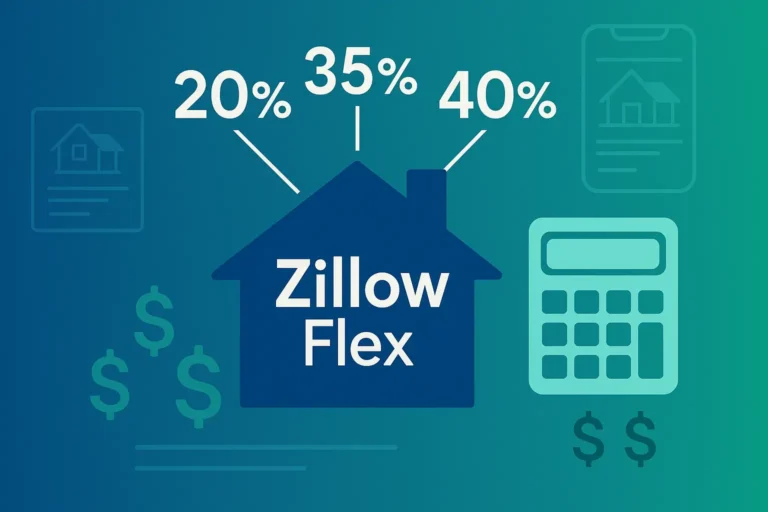

Zillow Premier Agent: $300 – $1,000 monthly

Zillow leads can be expensive ($20-$60 per lead, with metro area costs reaching $200-$350), but they’re often high-intent prospects actively searching for homes. Start small, track conversion rates religiously, and scale successful campaigns.

Success tip: Focus on less competitive zip codes initially. You’ll pay lower costs per lead and face less competition from established agents.

Social Media Advertising: $200 – $800 monthly

Facebook and Instagram ads offer precise targeting capabilities. Facebook typically delivers leads at $8-12 each, while Instagram ranges from $15-40. Create compelling content showcasing your market knowledge, recent sales, and client testimonials.

The key is consistency. Social media marketing builds relationships over time, not immediate sales. Budget for at least 6 months of consistent advertising before expecting significant results.

Google Ads: $300 – $1,000 monthly

Search advertising captures prospects at the moment they’re looking for help. While cost-per-click ranges from $3-5, qualified leads often cost $94-156 each. Start with highly specific keywords and geographic targeting to maximize your budget efficiency.

Traditional Marketing Approaches

Open Houses and Print Materials: $100 – $300 monthly

Open houses remain effective for meeting potential clients and building your sphere of influence. Budget for professional flyers, directional signage, and small promotional items. Quality materials reflect your professionalism and attention to detail.

Networking and Referral Building: $100 – $300 monthly

Join local business groups, Chamber of Commerce chapters, and industry associations. Budget for membership fees, event tickets, and occasional meals with potential referral partners. These relationships often generate the highest-quality leads at the lowest cost.

Your Journey to Profitability: The 6-Deal Progression

Let’s examine the realistic financial progression most successful new agents experience:

🎯 Level 1: First Deal (Month 4-6)

The Learning Experience

- Gross Commission: $10,000 (typical 3% on $333,000 sale)

- Your Share (70% split): $7,000

- Cumulative Income: $7,000

- Cumulative Expenses: ~$5,000

- Net Position: +$2,000 ✅

💬 “My first deal was a studio in Astoria. I was terrified I’d mess something up, but my broker walked me through every step. That $7,000 check felt like winning the lottery.” – Maria S., Queens-based agent

🎯 Level 2: Building Momentum (Month 6-8)

- Your Share: $7,000

- Cumulative Income: $14,000

- Cumulative Expenses: ~$10,000

- Net Position: +$4,000 ✅

Second deals often come from referrals or sphere-of-influence connections. Your confidence grows, and processes become smoother.

🎯 Level 3: The Turning Point (Month 8-10)

- Your Share: $7,000

- Cumulative Income: $21,000

- Cumulative Expenses: ~$15,000

- Net Position: +$6,000 🚀

By deal three, you’re truly profitable and can reinvest in higher-level marketing strategies.

🎯 Levels 4-6: Scaling Success (Month 10-12)

- Each Additional Deal: $7,000

- Total by Deal 6: $42,000 gross, ~$12,000 net profit

- Monthly income potential: $3,500-$7,000 💰

💬 “I started with just $12,000 in savings. My first listing was a rental in Flatbush that paid $2,400. It wasn’t glamorous, but it built my confidence and led to two buyer referrals.” – Jordan T., Brooklyn-based agent

At this point, you’re generating positive cash flow and can afford to increase marketing spend, hire assistance, or upgrade your technology stack.

Proven Strategies for Maximizing Your Budget ROI

Expense Tracking and Optimization

Implement Zero-Based Budgeting

Every dollar should have a specific purpose and expected return. Use tools like QuickBooks Self-Employed or FreshBooks to categorize expenses and track ROI by marketing channel.

Calculate Cost Per Closed Deal Monthly

Track how much each marketing channel costs per closed transaction, not just per lead. A channel generating cheap leads that don’t convert is worse than expensive leads that become clients.

The 50% Reinvestment Rule

After closing your second deal, reinvest 50% of your net commission into your highest-performing marketing channel. This accelerates your path to deals 3-6 while maintaining financial stability.

Advanced Cost-Reduction Techniques

Negotiate Everything

Your broker split, MLS fees, and vendor contracts are often negotiable. Established agents may have more leverage, but new agents can negotiate based on volume commitments or exclusive partnerships.

Leverage Free Marketing Opportunities

Build an email newsletter for your sphere of influence, create valuable content for social media, and develop strategic partnerships with local businesses. These activities cost time but not money.

Focus on Referral Development

Referral leads cost nothing and convert at 20-30% rates compared to 2-5% for cold leads. Provide exceptional service to every client, maintain regular communication, and systematically ask for referrals.

Advanced Financial Planning Strategies

Emergency Fund Management

Maintain 3-6 months of living expenses in readily accessible savings. Real estate income is irregular, especially in your first year. Your emergency fund prevents you from making desperate decisions during slow periods.

Tax Planning and Deductions

Work with a CPA familiar with real estate agent taxes. Many expenses are deductible including:

- Home office space

- Vehicle expenses for client meetings

- Marketing and advertising costs

- Professional development and education

- Professional association dues

Income Diversification

While building your sales business, consider complementary income streams:

- Property management for investor clients

- Real estate photography services

- Hosting homebuyer education seminars

- Affiliate partnerships with mortgage brokers and contractors

Red Flags and Common Budgeting Mistakes

Overspending on Technology

New agents often buy every new app or software platform, thinking technology alone will generate success. Start with basics and add tools only when you’ve identified specific needs.

Underfunding Marketing

Conversely, many agents try to bootstrap their marketing efforts and wonder why they struggle to generate leads. Effective marketing requires consistent investment over time.

Ignoring Seasonal Cash Flow

NYC real estate has seasonal patterns. Summer is typically busy, while winter can be slow. Plan your budget to account for these fluctuations.

Failing to Track ROI

Spending money on marketing without measuring results is like driving blindfolded. Every marketing dollar should be tracked, measured, and optimized.

Building Long-Term Financial Success

Year Two and Beyond

By your second year, your budget priorities shift from survival to growth. You’ll likely want to:

- Hire a transaction coordinator ($300-500 per deal)

- Invest in professional photography and staging

- Increase marketing spend in proven channels

- Consider team building or partnerships

Creating Multiple Revenue Streams

Successful agents often develop:

- Rental property portfolios

- Real estate investing partnerships

- Coaching or training programs

- Real estate-related business ventures

Professional Development Investment

Allocate 5-10% of your gross income to continuing education, conferences, and skill development. The real estate industry evolves rapidly, and ongoing learning is essential for long-term success.

FAQ: Your Most Pressing Budget Questions Answered

Starting Capital and Funding

Q: How much money do you need to start in NYC real estate?

The honest answer: You need $20,000-$35,000 to start comfortably in NYC real estate. This covers licensing costs ($825-$1,440), 6 months of living expenses, initial marketing budget, and operating capital for your first 3-4 months when you’re spending but not earning.

However, you can start with as little as $15,000 if you’re extremely strategic:

- Choose a 100% commission brokerage

- Focus on free marketing initially (social media, networking, sphere of influence)

- Keep your day job for the first 6 months

- Live very lean and reinvest every commission dollar

Q: Can you survive your first year part-time?

Yes, but it’s challenging and will slow your progress significantly. Part-time agents typically take 18-24 months to reach the same milestones that full-time agents achieve in 12 months.

Success factors for part-time agents:

- Work evenings and weekends consistently

- Focus on buyer clients (more flexible schedules)

- Leverage technology for efficient lead follow-up

- Partner with full-time agents for listing opportunities

- Plan to transition to full-time by month 6-9

Q: When do most new agents become profitable?

Most successful NYC agents reach profitability (positive cash flow) after closing their third deal, typically between months 6-9. However, true financial stability usually comes after 6-8 deals in the first 12-18 months.

Timeline breakdown:

- Month 1-3: Heavy expenses, no income (licensing, setup, marketing)

- Month 4-6: First deal closes, slight profitability

- Month 6-9: Deals 2-3 close, solid profitability

- Month 9-12: Deals 4-6 close, sustainable income

Q: Should I keep my day job while starting my real estate career?

A: For most people, yes. Real estate income is unpredictable in the first 6-12 months. Keep your job until you’ve closed at least 3-4 deals and have predictable lead flow. Plan to transition gradually rather than quitting cold turkey.

Q: Can I get financing or business loans to fund my real estate career?

A: Traditional business loans are difficult for new agents without proven income. Consider:

- Personal loans or lines of credit

- Credit cards for initial expenses (use carefully)

- Family loans or partnerships

- Part-time work in real estate-adjacent fields

Expense Management and ROI

Q: How do I know if my marketing spend is working?

A: Track three key metrics:

- Cost per lead (total spend ÷ leads generated)

- Lead conversion rate (closed deals ÷ total leads)

- Cost per closed deal (total spend ÷ closed transactions)

Adjust or eliminate channels that consistently underperform industry benchmarks.

Q: When should I increase my marketing budget?

A: After closing your second deal, when you have cash flow and data showing which channels work best. Increase spend on proven channels by 25-50% while maintaining others at baseline levels.

Q: What expenses are tax-deductible for real estate agents?

A: Most business expenses are deductible, including:

- Marketing and advertising costs

- MLS and association fees

- Professional development and education

- Home office expenses (if you work from home)

- Vehicle expenses for business use

- Professional clothing and dry cleaning

- Client entertainment and meals (50%)

Consult with a qualified tax professional for specific guidance.

Technology and Tools

Q: Do I really need an expensive CRM system as a new agent?

A: A CRM is essential, but it doesn’t need to be expensive. Start with basic platforms like HubSpot (free version) or MailChimp for email marketing. Upgrade as your client base grows and you identify specific needs.

Q: What’s the most important technology investment for new agents?

A: A reliable smartphone with a good camera, professional email address, and basic CRM system. These tools enable you to communicate professionally, capture leads, and follow up consistently.

Q: Should I build my own website or hire a professional?

A: Start with a professional template from platforms like WordPress or Squarespace ($200-500), then upgrade to custom design once you’re profitable. Your initial website needs to be professional but doesn’t need to be perfect.

Lead Generation and Client Development

Q: What’s the best lead generation method for brand-new agents?

A: Your sphere of influence (friends, family, former colleagues) combined with consistent social media presence. These approaches cost little money but require significant time and consistency.

Q: How many leads do I need to close one deal?

A: Industry averages suggest 10-20 leads per closed deal, but this varies by lead source:

- Referrals: 2-4 leads per deal

- Social media: 15-25 leads per deal

- Zillow/online leads: 20-40 leads per deal

- Cold calling: 50-100 leads per deal

Q: Should I focus on buyers or sellers as a new agent?

A: Start with buyers. They’re more available, provide faster feedback, and help you learn the market. Once you’ve closed 3-4 buyer deals, begin pursuing listing opportunities for higher commissions and better market positioning.

Market-Specific Challenges

Q: How does NYC’s competitive market affect new agent success?

A: NYC is extremely competitive, but there’s enough business for successful agents. Focus on niche markets or neighborhoods rather than competing citywide. Develop expertise in specific property types or buyer demographics.

Q: What neighborhoods should new NYC agents target?

A: Consider areas with high transaction volume but less established agent presence:

- Emerging neighborhoods in Brooklyn and Queens

- Co-op heavy areas where agent relationships matter

- First-time buyer markets with lower price points

Q: How important are industry connections in NYC real estate?

A: Extremely important. Attend local real estate board meetings, join agent Facebook groups, and participate in industry events. Many NYC deals happen through agent-to-agent relationships and referrals.

Timeline and Expectations

Q: How long before I can expect my first commission check?

A: Plan for 4-6 months from getting licensed to your first closing. This includes time to complete education, find clients, show properties, negotiate contracts, and complete the closing process.

Q: What’s a realistic income goal for my first year?

A: Conservative estimate: $40,000-60,000 net income

- Optimistic but achievable: $60,000-80,000 net income

- Exceptional (top 20%): $80,000+ net income

Remember, success depends on your effort, market knowledge, and ability to build relationships.

Q: When should I consider hiring help or joining a team?

A: Consider support when you’re consistently closing 1+ deals monthly and spending more time on administrative tasks than income-generating activities. This typically happens after 8-12 deals or 18-24 months in business.

Financial Planning and Growth

Q: How much should I save for taxes?

A: Set aside 25-30% of your gross commission income for federal, state, and local taxes plus self-employment tax. Work with a tax professional to optimize deductions and quarterly payment strategies.

Q: When can I afford to upgrade my marketing and tools?

A: After closing 3-4 deals and establishing positive cash flow. Reinvest profits strategically rather than upgrading everything at once. Prioritize investments that directly impact lead generation or client service.

Q: Should I specialize in a particular type of real estate?

A: Eventually, yes. Specialization allows you to charge higher commissions and build expertise. Popular NYC specializations include:

- Luxury condos

- Co-op sales

- Investment properties

- New construction

- Specific neighborhoods or demographics

Start as a generalist, then specialize based on your interests and market opportunities.

Your Path to NYC Real Estate Success Starts Now

Success as a New York City real estate agent isn’t about luck or natural talent. It’s about preparation, persistence, and smart financial management. The agents who thrive understand that every dollar spent must contribute to their long-term success.

Use this guide as your financial roadmap, but remember that budgets are living documents. Review and adjust your spending monthly based on results and changing market conditions. Track everything, measure ruthlessly, and reinvest profits into activities that generate the highest returns.

Most importantly, don’t let financial concerns paralyze you. Yes, starting a real estate career requires investment and involves risk. But with proper planning and dedicated effort, you can build a thriving business that provides financial freedom and professional satisfaction for decades to come.

The New York City real estate market rewards those who are prepared, professional, and persistent. Your first six deals are just the beginning of what can be an incredibly rewarding career. Start with a solid financial foundation, and everything else becomes possible.

Remember: in real estate, you’re not just selling properties. You’re building a business, developing relationships, and creating value for clients during one of the most important transactions of their lives. That’s worth investing in properly from day one.

Ready to take the next step? Review your current financial situation, create your 12-month budget using these guidelines, and commit to tracking every expense and result. Your future self will thank you for the discipline and planning you demonstrate today.

3 Comments