California Housing Demand Stalls Despite Rate Stability: What’s Really Blocking the Market in 2025

Last updated: December 23, 2025

You’d think falling mortgage rates would revive California’s housing market. They didn’t. Even as rates dropped from 6.6% to the low 6% range through 2025, buyer demand continued its downward slide. Pending home sales fell 5.8% year-over-year in December 2025—the steepest drop in nearly a year. Meanwhile, overall home sales remain 20% below historical averages and 40% below pandemic peaks.

This article explains why California housing demand hasn’t recovered despite stabilizing rates. You’ll learn what’s actually preventing buyers from entering the market, how the state’s affordability crisis differs from rate sensitivity, and what conditions would need to change for demand to return. Whether you’re a broker guiding frustrated clients or an agent trying to understand why qualified buyers keep backing out, this analysis gives you the full picture backed by current market data.

California Housing Demand 2025 – At a Glance

- Mortgage rates: ~6.0% (down from 6.6%)

- Pending sales: –5.8% YoY (December 2025)

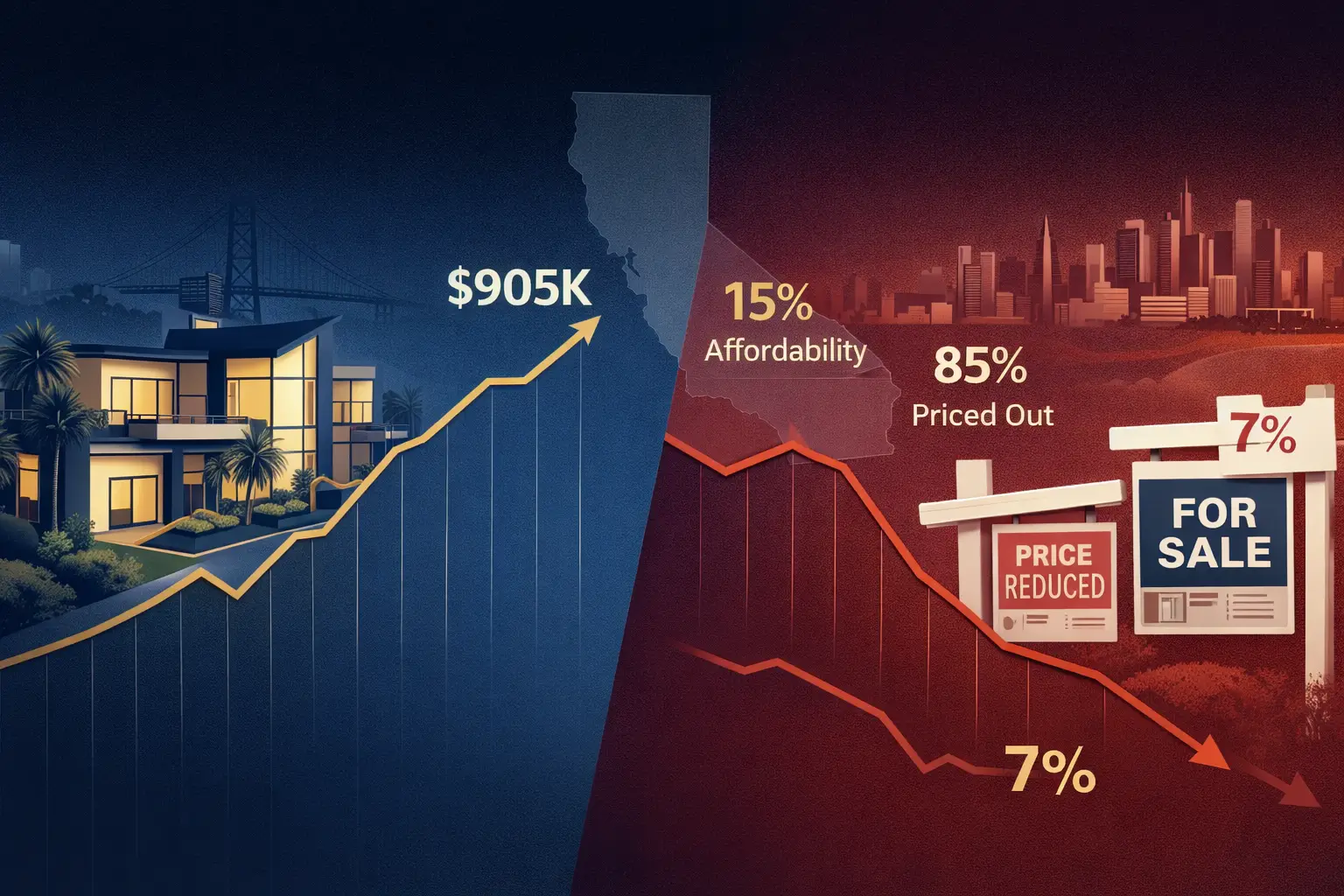

- Median home price: ~$905,680

- Median household income: ~$80,000

- % households that can afford median home: 15%

- Estimated housing shortage: ~3 million units

- Days on market: 52 days (up 6 days YoY)

The California Housing Demand Blockage Framework

California housing demand is constrained by four interlocking forces that rate changes alone cannot resolve:

1. Structural Affordability Gap: Prices require 2.7x median household income, pricing out 85% of buyers

2. Capital Barriers: Down payment requirements ($90,000-$225,000) exceed typical savings, insurance costs escalate

3. Supply Immobility: Lock-in effect (79% of owners hold sub-5% mortgages) and Prop 13 prevent inventory turnover

4. Confidence Collapse: Economic uncertainty, job market concerns, and climate risk suppress purchase intent

Each of these forces operates independently but reinforces the others, creating a market where traditional solutions (lower rates, buyer’s market conditions) fail to stimulate demand. The following sections examine each constraint in detail.

Why Rate Stability Hasn’t Restored California Housing Demand

The California Association of Realtors projected in early 2025 that declining mortgage rates would “unlock pent-up demand.” Market reality proved otherwise. As rates fell, buyer activity contracted further.

The explanation is straightforward. Affordability depends on three variables: home prices, household income, and interest rates. Only one improved in 2025. Home prices remained elevated around $905,680 statewide, and incomes stayed flat near $80,000 median. A 1% rate decline provides minimal relief when the fundamental problem is a 2.7x multiplier between what homes cost and what buyers earn.

Consider the math on a typical California home purchase. Even at improved 5.9% rates with 20% down, buyers need approximately $218,000 in annual household income (assumes 20% down payment, 30-year fixed mortgage, 28% front-end debt-to-income ratio). California’s median household income sits at $80,000. That $138,000 gap explains why only 15% of state households could afford a median-priced home in Q2 2025, compared to 34% nationwide.

California housing demand remains suppressed because rate changes can’t solve income-price misalignment. The state built insufficient housing for over two decades, creating an estimated 3 million unit shortage. Prices increased 150% since 2012 while incomes grew only 30%.

The Structural Affordability Crisis Crushing California Housing Demand

California housing demand collapsed because most residents are mathematically priced out. In Q2 2025, just 15% of state households could afford a median-priced home, down from 17% in Q1 2025 and 34% statewide in 2012, according to California Association of Realtors data.

Regional disparities make California housing demand even more uneven:

- San Francisco Bay Area: Median home price $1,300,000 requires $334,400 income (3.5x median household income)

- Orange County: Median price $1,100,000 requires $373,200 income (4.4x median household income)

- Los Angeles Metro: Median price $830,000 requires $213,600 income (2.7x median household income)

- Inland Empire: Median price $609,160 requires $156,800 income (2.1x median household income)

First-time buyers face particularly impossible barriers. A widely shared Reddit post from a Bay Area household earning $360,000 combined annual income illustrates the paradox: they earn too much to qualify for assistance programs (typically capped at 80-120% of Area Median Income) yet lack the $180,000-$225,000 down payment required for median homes.

Even qualified mortgage borrowers hit insurmountable down payment barriers. Analysis shows 52% of prospective mortgage buyers plan to put down less than 20%, with median targets of 10-19%. However, a 10% down payment on a $900,000 Southern California median home requires $90,000 in cash. Prospective buyers report a median of $94,000 in total liquid assets across checking, savings, retirement, and investment accounts.

Down payment assistance programs remain inadequate for California housing demand recovery. California’s MyHome program offers only 3.5% of purchase price. Los Angeles’s LIPA provides up to $161,000 in deferred-payment loans, substantial but insufficient for most markets.

The Lock-In Effect: Why Supply Can’t Adjust to Meet California Housing Demand

While affordability crushes California housing demand, the lock-in effect simultaneously prevents inventory increases that might naturally correct the market. This creates a paradoxical stalemate where homes are scarce AND nobody is buying them.

Approximately 79% of California homeowners hold mortgages at interest rates below 5%, many secured at 2-4% during the 2020-2021 pandemic boom. A homeowner with a $1 million mortgage at 2.8% pays approximately $4,100 monthly. That same home at current 7% rates costs $6,650 monthly—a 62% payment increase of $2,550 per month.

Combined with rising property taxes under California’s Proposition 13 (capped at 2% annual increases for existing owners but reset upon sale), selling becomes financially irrational unless forced by major life events.

The lock-in effect manifests as artificially constrained inventory even as buyer activity collapses. New listings declined 3.1% year-over-year in December 2025—the largest decline in over two years. Total homes for sale increased only 4.2%, the smallest increase since January 2024.

Why Investor Demand Isn’t Filling the Gap in California Housing

Many observers expected institutional investors or cash buyers to absorb inventory as traditional buyer demand collapsed. This hasn’t materialized. Several factors suppress investor appetite for California housing demand participation:

Compressed cap rates: High purchase prices relative to achievable rents reduce return on investment. California rental yields average 3-4% in prime markets, below financing costs and opportunity costs for most institutional capital.

Rent growth deceleration: Rents moderated through 2024-2025 as affordability constraints hit renters. Without rent appreciation offsetting acquisition costs, cash flow analysis turns negative.

Insurance cost escalation: Property insurance premiums increased 30-50% in wildfire-prone areas, with some insurers exiting the state entirely.

Short-term rental restrictions: California metros including Los Angeles, San Francisco, and San Diego implemented strict STR regulations, eliminating premium rental strategies.

Exit liquidity concerns: Climate risk and insurance availability create uncertainty about future buyer pools when investors eventually sell.

The result: investor demand cannot rescue California housing demand from its structural constraints. Cash buyers represented only 26% of transactions in Q4 2025, down from 29% year-prior.

Economic Uncertainty and Climate Risk Dampen California Housing Demand

Beyond structural affordability, psychological factors and macroeconomic concerns caused prospective buyers to retreat despite rate stabilization. According to recent market surveys, 59% of prospective buyers have been searching for 6 months or longer—signaling paralysis, not purchasing intent.

Google searches for homes increased 10% year-over-year by December 2025, yet purchase intent remains historically low. Prospective buyers cited multiple macroeconomic concerns: labor market weakness, industry layoffs in tech sector, tariff uncertainty, and inflation concerns affecting household discretionary spending.

In August 2025, Redfin senior economist Asad Khan noted: “Homebuyers are spooked by high home prices, high mortgage rates and economic uncertainty, and now sellers are spooked because buyers are spooked.”

Climate change and insurance affordability have emerged as major California housing demand factors. According to Zillow’s 2025 consumer housing trends report, 53% of California prospective buyers rate climate risks “very or extremely impactful” on purchase decisions—the highest of any state.

Climate risks documented by prospective buyers include wildfires (44% in Western states, particularly California), floods (41% nationally), extreme temperatures (34%), and drought (25%). Nearly 35% of sellers who moved from California cited insurance policy issues, and 41% cited natural disaster risk—double the rate of sellers from Texas (21%).

Regional Disparities in California Housing Demand

California’s housing crisis varies dramatically by region. San Jose experienced the steepest pending sales decline at negative 35.1% year-over-year, followed by Oakland at negative 17.6%. Meanwhile, San Francisco maintains stronger conditions with median prices near $1.8 million and year-over-year appreciation of 12.6%, driven by AI-wealth-generated demand.

The Inland Empire (San Bernardino and Riverside counties) represents the most affordable region, requiring $156,800 annual income (2.1x median), attracting buyers from coastal areas. Bay Area peripheral counties (Solano, Sonoma) emerge as “mix shift” beneficiaries as buyers unable to afford SF, Marin, or Santa Clara redirect to more affordable adjacent counties.

Frequently Asked Questions: California Housing Demand in 2025-2026

Why hasn’t California housing demand recovered if mortgage rates stabilized?

Short answer: Because affordability, not rates, is the binding constraint.

Mortgage rates are only one variable in the affordability equation. California homes would still require $218,000 annual income even at 5.9% rates with 20% down. Only 15% of households meet this threshold. The affordability crisis fundamentally stems from the gap between prices (up 150% since 2012) and incomes (up approximately 30% since 2012), not rates.

Is it smarter to rent than buy in California in 2025?

Short answer: For most households, yes—renting offers superior flexibility and lower monthly costs.

Monthly rent for a typical California apartment averages $2,800-$3,200, while mortgage payments (including taxes and insurance) on median-priced homes exceed $5,500-$6,500. For buyers without substantial down payments or strong equity accumulation expectations, renting provides financial flexibility during economic uncertainty.

Will California’s housing market crash like 2008?

Short answer: No, but expect prolonged stagnation through 2027.

Three factors prevent a 2008-style crash. First, foreclosure rates remain historically low because homeowners with equity are not underwater. Second, the lock-in effect means existing homeowners will not panic-sell. Third, job and income fundamentals remain above pre-2008 recession levels.

Can first-time buyers realistically purchase California homes in 2025-2026?

Short answer: Only with incomes exceeding $200,000 or multi-generational resources.

Single first-time buyers earning median California income ($80,000) have been effectively priced out for the past 5 years and will remain excluded through 2026. Viable paths include down payment assistance programs (CalHFA MyHome, LIPA) for moderate-income earners ($95,000-$150,000) or multi-generational household purchases pooling resources.

Are cash buyers distorting California housing demand?

Short answer: No—cash buyers declined to 26% of transactions in Q4 2025.

Contrary to popular perception, cash buyers aren’t driving California housing demand dynamics. They represented only 26% of transactions in Q4 2025, down from 29% year-prior. Even well-capitalized buyers exercise caution due to compressed cap rates, insurance costs, and climate risk.

Which California markets remain viable for buyers?

Short answer: Inland Empire and peripheral Bay Area counties offer best affordability.

The Inland Empire (San Bernardino, Riverside) is most affordable, requiring $156,800 income (2.1x median). Coastal regions (LA, Orange, San Diego) are least affordable, requiring $213,000-$373,000 annual income. Bay Area peripheral counties (Solano, Sonoma) emerge as alternatives.

How does Proposition 13 affect California housing demand?

Short answer: It prevents inventory turnover and locks existing owners in place.

Proposition 13 locks in property tax assessment at purchase price with 2% annual increases until sale. This creates perverse incentives: existing homeowners remain anchored to homes, reducing inventory turnover. Property tax rates for new buyers are 2-3x those for neighbors who bought decades ago.

What would restore California housing demand substantially?

Short answer: Price declines of 25-30% or massive housing construction—neither is likely near-term.

The real solution requires either massive home price declines (20-30% or more), significant income growth, or substantial new housing construction (1.5 million or more units built over 5-7 years). California faces an estimated 3 million unit housing shortage.

Who This Analysis Is For

This analysis serves:

- Brokers advising hesitant buyers and sellers navigating affordability constraints

- Agents operating in affordability-constrained metros who need data-backed client conversations

- Investors evaluating California risk-adjusted returns and market entry timing

- Journalists and analysts covering housing policy and regional market dynamics

Conclusion: What California Housing Demand Recovery Requires

California housing demand won’t recover from rate stability alone. The lock-in effect prevents supply adjustment while affordability constraints prevent demand response. Interest rates have become almost irrelevant—a buyer earning $80,000 cannot afford a $900,000 home at 5% any more than at 7%.

Rate stabilization removed volatility but unmasked the real problem: a structural 2.7x income-to-price multiplier that makes California homeownership a luxury good for 85% of residents. California housing demand will not recover until prices fall 25-30%, incomes roughly double, or housing supply expands to reduce price pressure. None are likely near-term.

For brokers and agents, the strategic takeaway is clear: educate clients on realistic affordability thresholds, focus on buyers with incomes exceeding $200,000 or access to multi-generational resources, and target geographically to areas like the Inland Empire where California housing demand remains viable. The top-end luxury market and tech-driven enclaves will continue transacting, while the broad middle market faces years of suppressed activity until structural solutions emerge.

California doesn’t have a housing cycle problem. It has a housing arithmetic problem—and arithmetic doesn’t respond to optimism.