NYC Buyer Representation Agreement: Complete Guide for Real Estate Professionals

Last updated: August 22, 2025

What Changed in NYC Buyer Representation

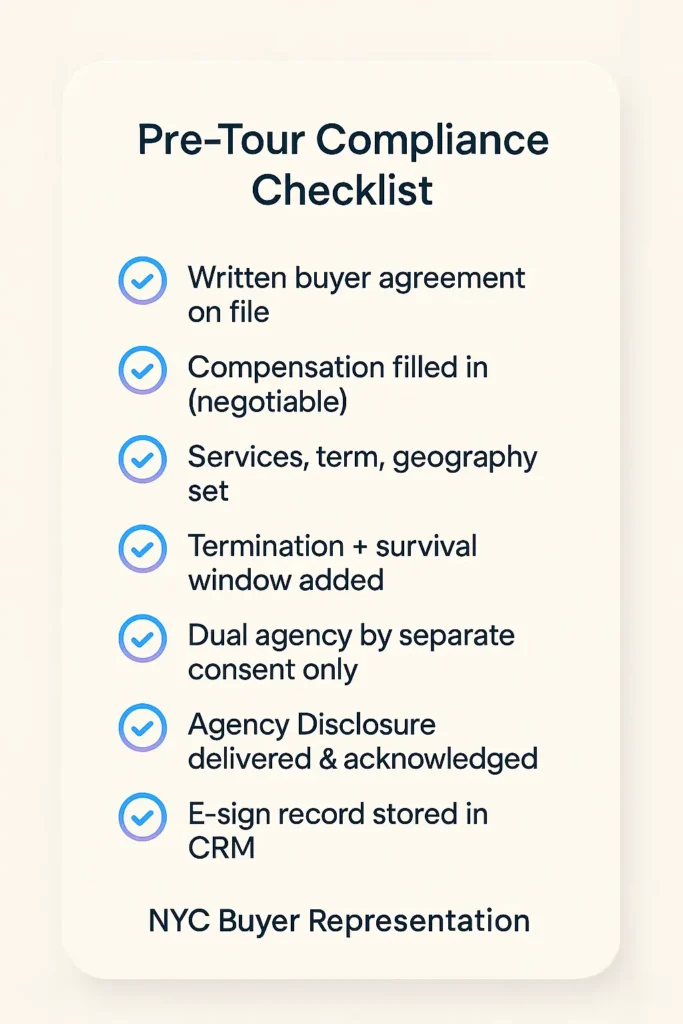

• Written buyer agreements are required before any tour, in person or virtual, for MLS and RLS participants. • Compensation must be agreed in writing up front. It is negotiable and not set by law. • Offers of compensation are no longer shown on MLS. RLS is removing compensation fields as part of its practice changes. • Clear services, duration, geographic scope, and termination terms are essential for compliance and client trust.

The August 2024 practice changes transformed New York City real estate transactions overnight. If you’re searching for a buyer representation agreement template NYC solution that protects your business while satisfying new requirements, you’re facing the same challenge as thousands of other real estate professionals across the five boroughs.

This shift, triggered by the National Association of Realtors’ $418 million settlement, requires MLS and RLS participants to have written buyer agreements before any property viewing. For brokers and agents, this means adapting your entire client onboarding process, renegotiating commission structures, and navigating complex requirements that can make or break your transactions.

You’ll discover how to implement compliant buyer representation agreements, avoid costly legal pitfalls, and turn these new requirements into a competitive advantage. We’ll cover practical templates, negotiation strategies, and proven systems that successful NYC brokers use to maintain profitability while protecting their clients.

NYC Buyer Representation Agreement: Definition

A written contract that a buyer signs with an agent or broker before touring any property, including live virtual tours. It sets the services, duration, geographic scope, and how the agent will be paid, and it must disclose that compensation is negotiable and not set by law.

Understanding the New NYC Buyer Representation Framework

What Changed on August 17, 2024

New York State law now mandates that buyers sign a representation agreement before viewing any properties, whether in person or virtually. This requirement stems from increased transparency demands following the NAR settlement, fundamentally changing how buyers and agents interact from first contact.

The law requires specific disclosures about compensation, services, and representation terms. Agents who show properties without signed agreements face potential legal liability and regulatory penalties.

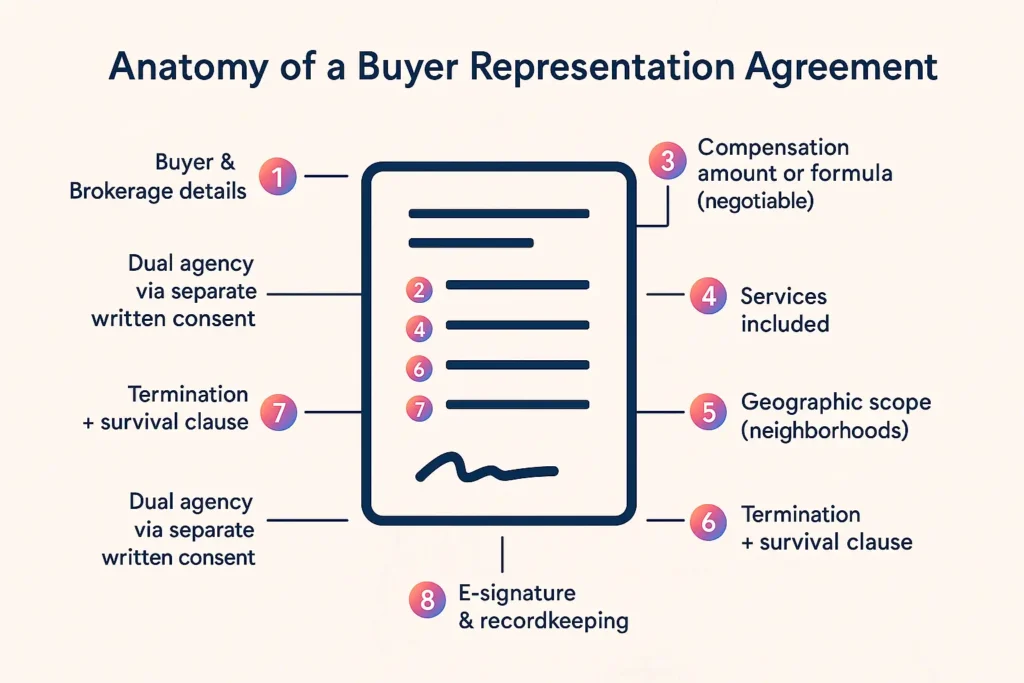

Legal Requirements Every Agreement Must Include

Current regulations mandate these elements in every buyer representation agreement:

- Specific compensation amount or rate (no open-ended fee structures)

- Clear statement that fees are negotiable and not set by law

- Prohibition against agents receiving compensation exceeding the agreed amount

- Duration of the agreement with specific start and end dates

- Detailed description of services provided by the agent

- Termination conditions that protect both parties

Impact on Different Property Types

Co-op Transactions: Board approval processes may extend agreement terms. Some buildings maintain preferred broker lists that affect compensation structures.

Condo Purchases: Transfer taxes and flip taxes influence commission negotiations. New developments often have different compensation models.

Investment Properties: Commercial aspects require specialized agreement language addressing due diligence periods and inspection contingencies.

Types of Buyer Representation Agreements

Exclusive Buyer Representation Agreements

An exclusive agreement creates a committed relationship where buyers work solely with one broker for a specified period, typically 3-6 months.

Key Features:

- Buyer commits to working exclusively with your brokerage

- You receive commission regardless of which agent shows the purchased property

- Higher service commitment expectations from buyers

- Greater agent investment in client success

Best For: Buyers seeking dedicated service and agents who want guaranteed compensation for their efforts.

Market Performance: According to REBNY data from early 2024, exclusive agreements result in 23% faster transaction closings and 15% higher client satisfaction ratings.

Non-Exclusive Buyer Representation Agreements

Non-exclusive agreements allow buyers to work with multiple agents simultaneously, with only the showing agent earning commission.

Key Features:

- Buyer can engage multiple brokers

- Only the agent who shows the purchased property receives compensation

- Lower service commitment expectations

- Requires more competitive positioning

Best For: Market-testing situations or buyers who prefer keeping options open.

Revenue Impact: Non-exclusive agreements typically generate 30-40% less revenue per client relationship due to reduced conversion rates.

Hybrid Agreement Models

Some brokerages have developed hybrid models that combine elements of both approaches:

Tiered Exclusive Agreements: Different service levels with corresponding fee structures Geographic Exclusive Agreements: Exclusive rights within specific neighborhoods or property types Time-Limited Exclusive Agreements: Short-term exclusive periods with renewal options

Commission Structures Across NYC Boroughs

Manhattan Commission Landscape

Traditional REBNY listings maintain 5-6% total commission structures, with buyer agents typically receiving 2.5-3%. However, newer listings show increasing variability.

Current Market Data (2024):

- 87% of Manhattan listings still offer buyer agent compensation

- Average buyer agent commission: 2.78% of sale price

- Luxury properties ($2M+): Often negotiate lower percentage rates

- New developments: May offer flat fees or reduced percentages

Brooklyn and Outer Borough Variations

Commission structures vary significantly outside Manhattan:

Brooklyn MLS:

- Total commissions often range 3-4%

- Buyer agents typically receive 1.5-2.5%

- Some listings offer no buyer agent compensation

Queens and Bronx:

- Generally 1.5-2% for buyer agents

- More negotiable fee structures

- Higher percentage of seller-paid commissions

Negotiation Strategies by Borough

Manhattan Strategy: Focus on service differentiation and market expertise to justify premium rates.

Brooklyn Strategy: Emphasize local neighborhood knowledge and property type specialization.

Queens/Bronx Strategy: Highlight transaction volume efficiency and competitive pricing.

Common Pain Points and Professional Solutions

Problem 1: Commission Payment Confusion

The Challenge: Buyers often assume sellers always pay agent commissions, leading to shock when they discover potential out-of-pocket costs.

Professional Solutions:

- Create clear compensation disclosure documents

- Develop seller concession negotiation strategies

- Establish relationships with lenders who finance buyer agent commissions

- Prepare alternative compensation structures (price adjustments, closing cost credits)

Implementation: Use a three-tier explanation system: basic overview, detailed breakdown, and written confirmation of understanding.

Problem 2: Complex Agreement Language

The Challenge: Standard agreements contain legal language that confuses buyers and creates liability concerns for agents.

Professional Solutions:

- Develop plain-language summary sheets for all agreement terms

- Create visual explanation tools (infographics, flowcharts)

- Establish attorney review processes for complex transactions

- Train staff on clear communication techniques

Best Practice: Schedule 15-minute agreement explanation sessions separate from property viewing appointments.

Problem 3: Unfavorable Termination Terms

The Challenge: Agreements with poor termination clauses create client relations problems and potential legal disputes.

Professional Solutions:

- Draft reasonable termination provisions (24-48 hour notice periods)

- Include performance standards that trigger termination rights

- Avoid automatic renewal clauses without explicit consent

- Create mutual termination procedures that protect both parties

Legal Protection: Include specific language about commission obligations for properties viewed before termination.

Problem 4: Dual Agency Complications

The Challenge: Automatic dual agency consent creates conflicts of interest and legal liability.

Professional Solutions:

- Require separate consent for each dual agency situation

- Develop reduced fee structures for dual agency transactions

- Create clear disclosure procedures for potential conflicts

- Establish referral networks to avoid dual agency when possible

Revenue Impact: Dual agency transactions should offer 20-25% fee reductions to address reduced service levels.

Problem 5: Geographic and Service Scope Issues

The Challenge: Overly broad geographic areas or vague service descriptions create unrealistic expectations.

Professional Solutions:

- Define specific geographic boundaries (neighborhood-level precision)

- Detail exact services provided at each price point

- Establish clear communication protocols and response times

- Create measurable performance standards

NYC-Specific Market Strategies

REBNY vs. Alternative MLS Systems

Different MLS systems require different approach strategies:

REBNY (Manhattan/parts of Brooklyn):

- Traditional commission structures remain strong

- Established buyer agency compensation

- Standardized agreement formats

- Higher average transaction values

Brooklyn MLS:

- More variable compensation structures

- Increased seller resistance to buyer agent fees

- Need for flexible agreement terms

- Growing flat-fee service models

OneKey MLS:

- Diverse compensation approaches

- Technology-integrated service models

- Performance-based fee structures

- Regional variation in buyer expectations

Building-Specific Considerations

Co-op Buildings:

- Board approval processes extend agreement terms

- Some buildings maintain preferred broker relationships

- Transfer requirements affect commission timing

- Maintenance and assessment disclosures impact negotiations

Condo Buildings:

- Developer relationships in new construction

- Sponsor unit considerations

- Transfer tax implications for commission structures

- Flip tax impacts on net proceeds calculations

Luxury Market Adaptations

High-Value Transactions ($2M+):

- Negotiate percentage reductions based on transaction size

- Offer enhanced service packages to justify premium rates

- Develop relationships with luxury service providers

- Create exclusive showing and negotiation processes

International Buyers:

- Address currency exchange considerations in agreements

- Develop relationships with international tax advisors

- Create extended communication protocols for time zone differences

- Establish specialized disclosure procedures for foreign ownership

Red Flags and Risk Management

Agreement Terms to Avoid

Automatic Renewal Clauses: Never include agreements that renew without explicit buyer consent.

Broad Geographic Areas: Avoid terms like “New York metropolitan area” that create unrealistic service expectations.

Vague Compensation Language: Eliminate phrases like “customary commission rates” that don’t specify exact amounts.

No Termination Provisions: Always include reasonable exit strategies for both parties.

Blanket Dual Agency Consent: Require case-by-case approval for potential conflict situations.

Agent Performance Warning Signs

Pressure Tactics: Agents who demand immediate signatures without explanation create legal liability.

Inflexible Terms: Refusal to modify standard agreement language suggests poor client service.

Compensation Confusion: Inability to clearly explain fee structures indicates insufficient training.

Limited References: Lack of verifiable track record in NYC market creates credibility concerns.

Poor Documentation: Reluctance to put performance commitments in writing suggests unreliability.

Legal Liability Protection

Documentation Requirements:

- Maintain copies of all signed agreements

- Record all property showings and client communications

- Document agreement modifications in writing

- Keep evidence of service delivery and performance

Insurance Considerations:

- Review errors and omissions coverage for agreement-related claims

- Ensure adequate liability protection for dual agency situations

- Consider additional coverage for high-value transactions

- Document compliance procedures for regulatory protection

Best Practices for Implementation

Client Onboarding Process

Step 1: Initial Consultation (30 minutes)

- Assess buyer qualifications and timeline

- Explain new legal requirements clearly

- Review different agreement options

- Address compensation questions upfront

Step 2: Agreement Selection (15 minutes)

- Compare exclusive vs. non-exclusive benefits

- Customize terms based on buyer needs

- Negotiate compensation and service levels

- Schedule follow-up for questions

Step 3: Documentation and Compliance

- Complete all required disclosures

- Provide plain-language summaries

- Establish communication protocols

- Set performance expectations and timelines

Performance Management Systems

Client Communication Standards:

- Response time commitments (typically 2-4 hours during business days)

- Regular market update schedules (weekly or bi-weekly)

- Property showing coordination procedures

- Negotiation and offer presentation processes

Service Delivery Metrics:

- Number of properties shown per week/month

- Average response time to client inquiries

- Market analysis update frequency

- Transaction timeline adherence

Technology Integration

CRM System Requirements:

- Agreement tracking and renewal notifications

- Commission calculation and tracking tools

- Client communication documentation

- Performance metric reporting

Digital Tools:

- Electronic signature platforms for agreement execution

- Mobile apps for property showing coordination

- Automated market report generation

- Client portal access for transaction updates

Financial Planning and Commission Management

Revenue Projection Models

Exclusive Agreement Revenue:

- Higher conversion rates (typically 15-25% better than non-exclusive)

- More predictable income streams

- Reduced marketing costs per transaction

- Better client lifetime value

Non-Exclusive Agreement Revenue:

- Lower conversion rates but higher volume potential

- Increased marketing expenses per client

- More competitive pricing pressure

- Reduced client relationship investment

Budget Planning for New Requirements

Additional Costs to Consider:

- Legal review expenses for agreement customization

- Technology upgrades for compliance tracking

- Staff training on new procedures

- Marketing materials explaining new requirements

Revenue Protection Strategies:

- Diversify between exclusive and non-exclusive clients

- Develop referral networks for overflow opportunities

- Create premium service tiers with higher fees

- Establish relationships with commission-financing lenders

Commission Negotiation Frameworks

Seller-Paid Commission Scenarios:

- Present compensation requests early in listing negotiations

- Develop relationships with listing agents for smoother arrangements

- Create win-win proposals that benefit all parties

- Document agreements clearly to avoid disputes

Buyer-Paid Commission Alternatives:

- Seller concessions to cover buyer agent fees

- Purchase price adjustments maintaining seller net proceeds

- Mortgage financing options where available

- Installment payment plans for qualified buyers

Future Market Evolution

Industry Trends and Predictions

Based on early implementation data from other markets that adopted similar requirements, NYC can expect:

Commission Rate Changes:

- Gradual reduction in average buyer agent commissions (projected 15-20% decrease over 18 months)

- Increased service differentiation based on value delivery

- More tiered pricing models offering different service levels

- Greater competition driving innovation in service delivery

Technology Integration:

- Enhanced digital agreement platforms

- AI-powered client matching systems

- Automated compliance monitoring tools

- Blockchain-based commission tracking and payment systems

Service Model Innovation:

- Flat-fee service options for specific transaction types

- Hybrid models combining traditional and discount approaches

- Specialized services for luxury and international buyers

- Technology-enhanced efficiency reducing service costs

Regulatory Developments

Expected Changes:

- Standardized agreement formats across MLS systems

- Enhanced disclosure requirements for dual agency situations

- Stricter enforcement of compensation disclosure rules

- Potential expansion to commercial real estate transactions

Compliance Preparation:

- Establish relationships with real estate attorneys

- Implement robust documentation systems

- Train staff on evolving requirements

- Monitor regulatory announcements for updates

Frequently Asked Questions

What happens if a buyer refuses to sign a representation agreement?

You cannot show properties to buyers who refuse to sign representation agreements. The law requires signed agreements before any property viewings, whether in person or virtual. Focus on education about the benefits of representation and address specific concerns about the agreement terms.

Can buyers negotiate commission rates in their representation agreements?

Yes, all commission rates are negotiable. The agreement must clearly state that fees are not set by law and can be adjusted based on services provided, transaction complexity, and market conditions. Many agents offer tiered service packages with corresponding fee structures.

How do dual agency situations work under the new requirements?

Dual agency requires separate, explicit consent for each transaction where your brokerage represents both buyer and seller. The initial buyer representation agreement can acknowledge the possibility but cannot provide blanket consent. Each situation requires new disclosures and often reduced commission rates.

What geographic areas should be specified in buyer representation agreements?

Be specific about geographic boundaries, typically at the neighborhood level. Avoid broad terms like “New York metropolitan area.” Consider the areas where you can effectively provide services and have market expertise. You can always expand the area with written amendments.

How long should buyer representation agreements last?

Most NYC agreements run 3-6 months, but you can negotiate shorter initial terms (30-60 days) to test the relationship. Avoid automatic renewal clauses and include reasonable termination provisions. Longer terms work better for exclusive arrangements with committed buyers.

What services must be included in buyer representation agreements?

Agreements should detail specific services like property searches, showing coordination, market analysis, offer preparation, negotiation assistance, and transaction coordination. Be clear about communication protocols, response times, and any services not included in your standard offering.

Can buyers work with multiple agents under non-exclusive agreements?

Yes, non-exclusive agreements allow buyers to work with multiple agents simultaneously. Only the agent who shows the property the buyer ultimately purchases receives compensation. This arrangement provides buyers more flexibility but often results in less dedicated service from agents.

What happens to commission if a transaction doesn’t close?

Agreement terms should specify commission obligations based on why transactions don’t close. Typically, no commission is owed if buyers withdraw for reasons covered by contingencies. However, if buyers breach contract without valid reasons, they may still owe commission depending on agreement language.

How do new construction purchases work with buyer representation agreements?

New construction often involves extended timelines that may exceed standard agreement terms. Consider longer agreement periods or renewal options for new developments. Some builders have preferred agent programs that affect commission structures, so review these arrangements carefully.

What documentation should agents maintain for compliance?

Keep copies of all signed agreements, written communications, property showing records, and any agreement modifications. Document service delivery and maintain evidence of compliance with agreement terms. This documentation protects you in disputes and regulatory reviews.

Can international buyers sign representation agreements electronically?

Yes, electronic signatures are generally valid for buyer representation agreements. Ensure your e-signature platform complies with New York State requirements and consider time zone differences when coordinating signatures with international buyers.

How do commission disputes get resolved under the new system?

Most agreements include dispute resolution procedures, often requiring mediation before litigation. Clear documentation of agreement terms, service delivery, and communication helps resolve disputes. Some brokerages include arbitration clauses for faster resolution processes.

Conclusion

The mandatory buyer representation agreement requirement represents the most significant change to NYC real estate transactions in decades. While initially disruptive, these requirements create opportunities for agents who adapt quickly and implement compliant systems effectively.

Success requires understanding the legal requirements, developing clear communication processes, and creating agreements that protect both agents and buyers. Agents who treat these changes as competitive advantages rather than obstacles will build stronger client relationships and more sustainable businesses.

The market continues evolving as buyers and agents adapt to new requirements. Stay informed about regulatory updates, monitor industry best practices, and be prepared to adjust your approaches as market conditions change.

Next Steps:

- Review your current agreement templates for compliance with new requirements

- Develop plain-language explanation materials for buyer education

- Train your team on proper implementation procedures

- Establish relationships with attorneys for complex transaction support

The agents and brokerages that master these new requirements first will establish competitive advantages that extend far beyond regulatory compliance. Start implementing these strategies today to position your business for long-term success in New York City’s evolving real estate market.

One Comment