Co-op Board Rules on Broker Commissions: Hidden Pitfalls in 2025

Last updated: November 10, 2025

TL;DR: What Changed and Why It Matters

Co-op commission rules changed dramatically after the August 2024 NAR settlement, but most co-op boards haven’t updated their policies. This creates dangerous traps around post-closing liquidity requirements, board approval timing, broker conflicts of interest, seller concessions, and deal structure. Buyers now sign mandatory representation agreements before touring apartments, sellers face pressure to negotiate commission, and boards still enforce outdated financial requirements. Result? Higher rejection rates, failed deals, and costly surprises. Understanding the nyc co op commission rules 2025 is crucial for navigating this landscape.

The co-op market in 2025 looks nothing like it did 18 months ago. Since the National Association of Realtors (NAR) settlement took effect on August 17, 2024, confusion around who pays what commission has created unprecedented friction in co-op transactions. Buyers sign representation agreements before seeing apartments. Sellers wrestle with whether to offer buyer-agent compensation. And co-op boards continue enforcing financial requirements that assume the old commission structure still exists, highlighting the importance of knowing the nyc co op commission rules 2025.

The nyc co op commission rules 2025 will further shape the market, and staying informed is essential for both buyers and sellers.

This guide reveals the hidden pitfalls at the intersection of co-op board rules on broker commissions in 2025, giving you strategic insights to avoid costly mistakes and understand the nyc co op commission rules 2025.

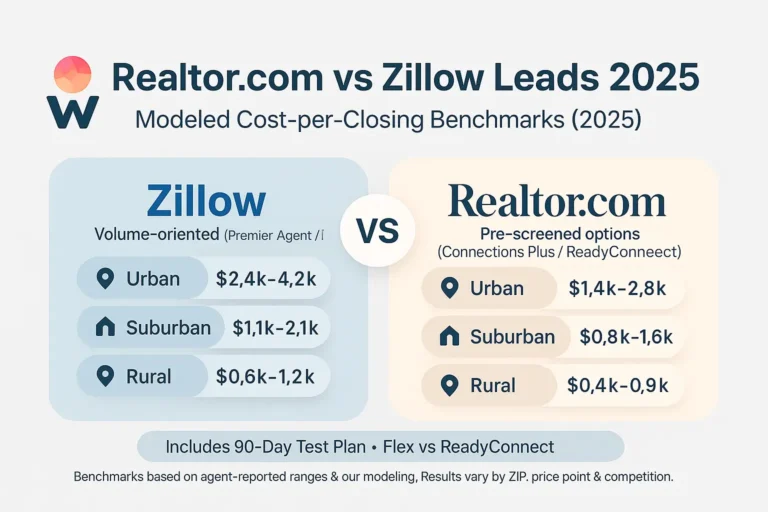

Who Pays What in 2025? Side-by-Side Comparison

| Item | Pre-NAR Settlement | Post-NAR Settlement (2024-2025) |

|---|---|---|

| Buyer agent commission | Usually paid by seller (2.5-3%) | Seller optional; buyer often pays |

| Buyer-agent agreement | Not required | Mandatory before showings |

| RLS/MLS commission display | Required and visible | Prohibited (removed Aug 1, 2025) |

| Co-op board liquidity rules | Accounted for seller-paid commission | Still outdated (high rejection risk) |

Understanding the New Commission Reality After the NAR Settlement

The NAR settlement restructured real estate commissions, hitting co-op transactions particularly hard. Two critical changes took effect on August 17, 2024, according to REBNY:

No MLS-Listed Compensation: Multiple Listing Services, including REBNY’s Residential Listing Service, can no longer display buyer-agent commission offers. As of August 1, 2025, REBNY removed compensation fields from the RLS entirely.

Mandatory Written Buyer Agreements: Buyers must sign written representation agreements before touring properties. These agreements state the agent’s compensation structure, but they’re signed before anyone knows if the seller will pay the buyer’s agent.

In New York City, where co-ops represent approximately 75% of Manhattan’s housing stock, these changes created a perfect storm of uncertainty.

How Much Commission Do NYC Co-op Buyers Pay in 2025?

Buyer-agent commissions typically range from 2% to 3% when buyers pay directly. On a $500,000 co-op, that’s $10,000 to $15,000. Many sellers still offer to pay buyer-agent compensation, but buyers don’t know the seller’s position until after making an offer.

Hidden Pitfall #1: The Co-op Board Approval Timing Trap

Co-op board approval processes stretch from 30 days to six months. Average approval time in Manhattan is 60-90 days. This creates dangerous mismatches with the new commission structure.

The Problem: Buyers sign commission agreements at the beginning. If the board delays or rejects the application after months, disputes arise over commission responsibility.

Real Case Example: Sarah made an offer on a $450,000 Upper West Side co-op in March 2025, signing a buyer-broker agreement committing to pay her agent 2.5% ($11,250) if the seller didn’t cover it. The seller agreed to pay initially. After three months, the seller backed out. Sarah found another co-op quickly, but this seller wouldn’t pay buyer-agent commission. Sarah suddenly needed $11,250 she hadn’t budgeted for, dropping her post-closing liquidity below the board’s threshold. She was rejected despite strong income and credit.

Expert Tip: Build a “commission escrow buffer” of 3% of your target purchase price in a separate savings account. If you don’t need it for commission, it strengthens your board package.

Hidden Pitfall #2: Broker-Board Member Conflicts of Interest

When a co-op board member works as a broker selling apartments in their building, conflicts emerge. New York’s Business Corporation Law requires boards to review contracts with “interested directors” annually, but legal experts note the statute doesn’t clearly reach broker commission transactions, according to Habitat Magazine analysis in 2024.

Real Case Example: Michael purchased a $600,000 Brooklyn co-op. One board member was also a broker who represented three recent sales in the building. Michael was rejected without interview despite exceeding all financial requirements. He later discovered the broker-board member had a client interested in the same unit at a higher price.

Best Practice: Broker-board members should recuse themselves from voting on transactions they’ve brokered and disclose conflicts to all parties.

Hidden Pitfall #3: The Flip Tax and Commission Double-Whammy

Co-op sellers face a brutal squeeze. The combination of flip taxes and broker commissions can consume 8-12% of sale proceeds. In Manhattan, flip taxes average around 2% of the sale price.

Real Case Example: Jennifer listed her $750,000 Murray Hill co-op in January 2025. To reduce costs, she offered only 1.5% buyer-agent commission. Her listing received minimal showings for three months. When she increased to 2.5%, she received multiple offers within two weeks but ultimately accepted $725,000. Combined with her 2% flip tax ($14,500) and total 5.5% commission ($39,875), closing costs exceeded $54,000.

Expert Tip: Calculate your net proceeds before listing. Take your target price, subtract flip tax, subtract full commission (assume 5-6%), and subtract other closing costs ($3,000-$5,000). If the number doesn’t work, adjust expectations upfront.

Hidden Pitfall #4: Post-Closing Liquidity Requirements Haven’t Adjusted

Co-op boards require buyers to demonstrate 1-2 years of “post-closing liquidity”—cash reserves after closing sufficient to cover 12-24 months of mortgage and maintenance. These requirements haven’t adjusted for buyers potentially paying their own agent’s commission.

Is Buyer-Agent Commission Counted in Post-Closing Liquidity?

Most co-op boards haven’t updated policies. When a buyer pays their agent, it reduces liquid assets by 2-3% of the purchase price. Boards then reject buyers for “insufficient liquidity” even though they would have qualified under seller-paid scenarios. Data suggests insufficient liquidity accounts for 35-45% of co-op rejections.

Real Case Example: David and Lisa offered on an $800,000 co-op requiring $72,000 post-closing liquidity. They had $95,000 after down payment. The seller wouldn’t pay buyer-agent commission, so they paid $24,000 (3%). This dropped liquidity to $71,000—$1,000 below the threshold. The board rejected them.

What Buyers Should Do: Assume you’ll pay commission when calculating liquidity. Build a 10-15% buffer beyond stated requirements.

Hidden Pitfall #5: Can Co-op Boards Reject Based on Concessions?

Yes, indirectly. While boards cannot explicitly reject based on commission structure, they absolutely reject based on seller concessions that inflate purchase price or suggest buyer financial weakness.

Real Case Example: Tom offered $550,000 for a co-op with a $520,000 asking price, requesting $30,000 in seller concessions. The board rejected the application, stating the sale price was “not reflective of market value” and the concession structure “raised questions about buyer qualifications.”

Better Approach: Negotiate seller-paid commission as a term of the purchase agreement separate from the purchase price.

Expert Tip: Ask the listing agent if the building has concession policies before making an offer. Some co-ops cap concessions at 2-3% or prohibit them entirely.

Hidden Pitfall #6: Unrepresented Buyers and the Commission Rebate Myth

A dangerous misconception persists that buying a co-op without a buyer’s agent results in reduced purchase price. According to real estate attorneys writing in 2024-2025, listing brokers simply pocket the entire commission when dealing with unrepresented buyers rather than passing savings.

Without a broker, buyers must compile board application packages independently. Attorney Jeff Reich noted in 2024 guidance that incomplete applications are the most common cause for board rejection. Historically, 20-35% of NYC co-op transactions fall through, with incomplete applications being a leading cause.

Hidden Pitfall #7: Discriminatory Rejection Disguised as Commission Disputes

A concerning pattern in 2025 involves boards potentially using commission-related issues as cover for discriminatory rejection. With commission structures now negotiable and complex, boards can claim concerns about transaction financial structure while potentially masking discriminatory intent.

New legislation has been proposed in New York requiring co-op boards to provide written reasons for rejection within 90 days. As of November 2025, this remains pending.

What Buyers Need to Know About Co-op Board Rules on Broker Commissions

Buyer Checklist for 2025 Co-op Purchases

✓ Budget assuming you pay buyer-agent commission (add 2-3%)

✓ Add 10-15% buffer beyond board’s liquidity requirements

✓ Confirm board liquidity calculation method before offering

✓ Have attorney review buyer-broker agreement for flexibility

✓ Avoid large seller concessions that inflate purchase price

✓ Ask listing agent about building’s concession policies

✓ Verify board meeting schedule to estimate approval timeline

✓ Document all commission negotiations in writing

Negotiate Flexible Commission Agreements: Work with your agent to create agreements that account for co-op-specific risks, including provisions reducing commission if the board rejects your application.

Choose Co-op-Experienced Agents: Work with agents who specialize in co-ops and have relationships with boards in your target buildings.

What Sellers Need to Know About Co-op Commission Rules

Seller Checklist for 2025 Co-op Sales

✓ Decide upfront if you will pay buyer-agent compensation

✓ Calculate flip tax + commission before pricing (typically 6-9% total)

✓ Avoid inflating sale price to cover concessions

✓ Disclose commission structure to buyer’s agent immediately

✓ Consider board meeting schedule when timing listing

✓ Factor average 60-90 day board approval into closing timeline

Offer Competitive Buyer-Agent Compensation: Offering market-rate buyer-agent commission (2-3%) ensures maximum exposure to potential buyers.

Factor Flip Tax Into Pricing Strategy: Price your co-op accounting for total costs. Don’t try to recover these costs through inflated pricing, as boards often reject overpriced sales.

What Real Estate Professionals Need to Know

Legal Exposure for Agents Under New Co-op Commission Rules

Real estate professionals face increased liability exposure under the new commission structure:

Risk #1: Misrepresenting Commission Responsibility – Agents who fail to clearly explain that buyers may need to pay commission face potential lawsuits if boards reject buyers due to insufficient liquidity. Always provide written disclosure of all possible commission scenarios.

Risk #2: E&O Liability Under New Rules – Errors and omissions claims have increased related to commission disputes. Document every conversation about commission responsibility. Use REBNY’s standardized forms, but understand they don’t address co-op-specific scenarios.

Risk #3: Inadequate Disclosure – Agents must disclose variable rate commission structures to all parties. Failure to disclose can result in disciplinary action and commission disputes.

2025 Predictions: How Co-op Board Rules on Broker Commissions Will Evolve

Based on current trends, expect these changes over the next 12-24 months:

Board Policy Updates: More co-op boards will formally incorporate buyer-agent commissions into liquidity calculations, creating two-tier approval thresholds.

Increased Rejections: Expect a 15-25% increase in board rejections tied to concession structure and buyer-paid commission scenarios.

Legislation Requiring Rejection Explanations: New York’s proposed legislation requiring written rejection reasons within 90 days likely passes in 2025-2026.

Flat-Fee Buyer Representation: More agents will offer flat-fee structures (e.g., $15,000 flat rather than 2.5%) to provide buyers with certainty when calculating liquidity.

Frequently Asked Questions

Can a co-op seller refuse to pay the buyer’s agent commission in 2025?

Yes. Following the NAR settlement that took effect August 17, 2024, sellers are no longer required to offer compensation to buyer agents. If the seller doesn’t offer compensation, the buyer is typically responsible for paying their agent per their buyer-broker agreement.

What happens if a co-op board rejects my application after I’ve paid fees—do I still owe my buyer’s agent?

This depends on your buyer-broker agreement. Most stipulate commission is only owed upon successful closing. However, some may require payment for services rendered regardless of outcome. Have an attorney review your agreement before signing.

Can a co-op board reject a sale based on the commission structure?

Co-op boards can reject sales if they believe the price is too low and would harm property values. However, they cannot condition approval on commission rates—that’s between buyers, sellers, and agents.

Is it legal for a co-op board member to also be a broker selling apartments in their building?

Yes, it’s legal, but it creates conflicts of interest. Board members who broker transactions should disclose this interest and recuse themselves from voting on any transaction they’re involved in.

How long does co-op board approval typically take in 2025?

Well-organized co-ops with monthly board meetings may approve qualified buyers in 30-45 days. Buildings with less frequent meetings can take 3-6 months. Average approval time in Manhattan is 60-90 days.

Can I negotiate my buyer’s agent commission rate?

Absolutely. The NAR settlement emphasizes all commissions are negotiable. You can negotiate for a flat fee, hourly rate, percentage-based commission, or hybrid structure. However, negotiate before signing the buyer-broker agreement.

What is a flip tax and who pays it?

A flip tax is a transfer fee charged by co-ops when apartments are sold, typically paid by the seller. In Manhattan, amounts commonly range from 1-3% of the sale price, with an average around 2%.

Will buying a co-op without a buyer’s agent save me money?

Generally no. The seller’s commission obligation is contractually set when they list the property. If you don’t have representation, the listing broker usually keeps the entire commission rather than reducing the price.

What are the most common reasons co-op boards reject applications?

Primary reasons include insufficient post-closing liquidity (35-45% of rejections), inadequate income relative to housing costs, poor credit history, incomplete application packages, concerning interview performance, and purchase price too low for board’s valuation standards.

Can I ask the seller to pay my buyer’s agent commission as part of the purchase offer?

Yes. You can request the seller provide closing cost concessions equal to your agent’s commission. However, structure carefully—inflating the purchase price can create appraisal problems and raise board red flags. Better approach: negotiate seller-paid commission as a term separate from purchase price.

Conclusion: Your 10-Minute Commission Planning Exercise

The intersection of co-op board rules on broker commissions and post-NAR settlement changes has created unprecedented complexity in 2025. With proper planning, you can navigate successfully.

Take 10 minutes right now:

For Buyers:

- Calculate your target purchase price × 3% (potential buyer-agent commission)

- Add that to required down payment and closing costs

- Subtract total from your liquid assets

- Is the remaining amount at least 1-2 years of estimated carrying costs? If no, increase savings or lower target price

For Sellers:

- Take your target sale price

- Subtract flip tax (1-3%)

- Subtract total commission (assume 5-6%)

- Subtract other closing costs ($3,000-$5,000)

- Is the net acceptable? If no, adjust expectations

Three Critical Questions to Ask Your Attorney or Agent:

- “How does this building calculate post-closing liquidity, and does it account for buyer-paid commission?”

- “What’s this building’s policy on seller concessions?”

- “Can you show me recent successful board packages from this building?”

Success requires exceptional preparation, clear communication, and specialized expertise. Work with experienced co-op attorneys and brokers who understand how board policies intersect with the new commission rules. The hidden pitfalls surrounding co-op board rules on broker commissions in 2025 are real and consequential, but with proper preparation and expert guidance, they’re navigable.

One Comment