Zillow Flex Referral Fees 2025: Complete Guide for Real Estate Professionals

Last updated: August 31, 2025

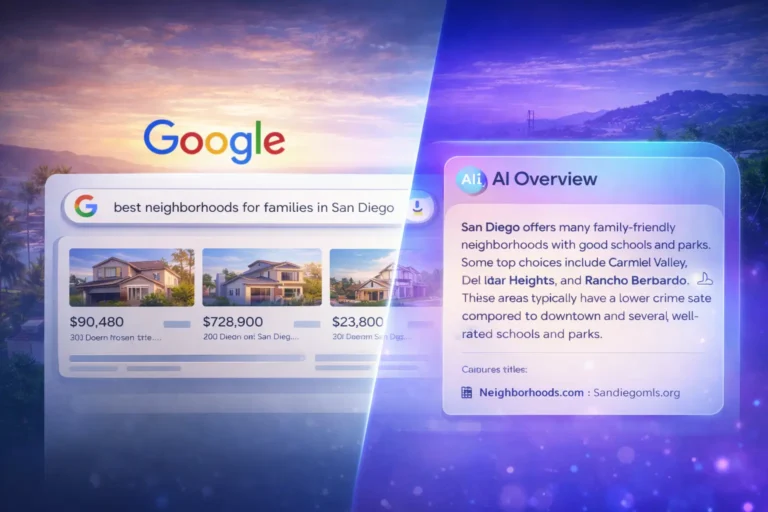

Picture this: You close a $400,000 home sale and earn a $12,000 commission. Then you write a $4,800 check to Zillow. Sound shocking? This scenario reflects the current reality of Zillow Flex referral fee structures that have transformed how real estate professionals approach lead generation in 2025.

Zillow’s performance-based lead program now charges up to 40% commission splits across all major markets, representing a dramatic shift from traditional lead generation models. This comprehensive guide breaks down everything real estate brokers, agents, and team leaders need to know about navigating Zillow’s evolving fee structure, calculating true ROI, and building sustainable lead generation strategies.

Whether you’re evaluating Zillow Flex for the first time or reassessing your current investment, you’ll discover actionable frameworks for maximizing conversion rates, alternative lead sources that deliver better value, and proven systems successful teams use to thrive despite rising platform costs.

Understanding Zillow Flex: The Performance-Based Model

Zillow Flex operates on a fundamentally different principle than traditional lead generation platforms. Instead of monthly subscription fees, agents pay nothing upfront but share a substantial portion of their commission only when transactions close successfully.

The program targets experienced agents through an invitation-only system. Zillow evaluates potential partners based on transaction history, customer satisfaction scores, and demonstrated ability to convert leads into closed deals. This selective approach creates higher barriers to entry compared to Premier Agent, which remains open to qualified agents willing to pay monthly fees.

Core Program Features:

- Zero upfront investment required

- Exclusive lead access without competition from other Flex agents

- Performance-based pricing tied directly to successful closings

- Strict performance monitoring and accountability standards

- Higher lead quality compared to shared Premier Agent prospects

The trade-off becomes clear when examining commission impact. While agents avoid monthly platform fees, they sacrifice significant earnings on every successful transaction. This model appeals most to agents confident in their conversion abilities and those seeking to minimize upfront marketing expenses.

2025 Zillow Flex Referral Fee Structure

Official Fee Structure and Live Rate Card

⚠️ LIVE FEE VERIFICATION REQUIRED Zillow Flex fees change by market and price tier. Seller connections = 40% everywhere. Buyer fees vary. Always check the live rate card (15-day change window).

Zillow’s success fees vary by market and sale price, currently ranging from 15-40% of gross commission income. The company maintains an official live rate card that serves as the authoritative source for current pricing, with all fees subject to change with 15-day notice.

Official Fee Rules:

- Seller Connections: Flat 40% fee in ALL markets (per Zillow’s pricing page)

- Buyer Connections: Variable fees by market and price tier (15-40% range)

- Fee Changes: 15-day advance notice for all adjustments

- Rate Card: Live pricing available on Zillow’s official pricing page

How to Read Zillow’s Rate Card

Instead of static fee tables that may become outdated, use Zillow’s live rate card to find current pricing for your specific market. The rate card shows price tiers and corresponding fee percentages for buyer connections in your area.

Historical Context (40% Buyer-Side Test Markets): Zillow initially tested 40% buyer-side fees in six markets starting late 2023: Denver, New Haven, Cape Coral, Reno, Oklahoma City, and Greenville. These test markets provided data for broader fee structure changes implemented throughout 2024-2025.

Always verify current fees at Zillow’s live rate card before making business decisions (15-day change window).

ZHL Integration and Performance Standards

Zillow increasingly ties Flex eligibility to Zillow Home Loans (ZHL) engagement targets and comprehensive performance metrics. Agents must meet specific benchmarks across multiple categories to maintain program access.

Required Performance Metrics:

- ZHL pre-approval target rates (varies by market)

- Lead answer rate minimums (typically 80%+)

- Engaged transfer rate standards

- Payment compliance (“pay on time” requirements)

- Customer satisfaction score maintenance

Fee Evolution Timeline

The current structure represents significant increases from historical rates. Zillow initially tested 40% fees in six markets during September 2023, including Denver, Cape Coral, and Oklahoma City. The company expanded this pricing model throughout 2024, reaching full implementation across major markets by 2025.

Phoenix and Atlanta now operate as Flex-exclusive markets, meaning Premier Agent options are no longer available. Industry analysts predict additional markets will transition to Flex-only models as Zillow prioritizes performance-based revenue streams over subscription models.

Financial Impact Analysis and Take-Home Calculations

Worked Profitability Examples Across Major Markets

Understanding true earnings requires calculating take-home income after all fees, splits, and taxes. These examples use common brokerage structures across different markets and price points.

$300,000 Phoenix Sale (Buyer Connection – 35% Flex Fee):

- Gross Commission (3%): $9,000

- Zillow Flex Fee (35%): $3,150

- Post-Flex Commission: $5,850

- Brokerage Split (70/30): $4,095 to agent

- Estimated Taxes (30%): $1,229

- Agent Take-Home: $2,866

- Effective Rate: 0.96% of sale price

$600,000 Dallas Sale (Buyer Connection – 35% Flex Fee):

- Gross Commission (3%): $18,000

- Zillow Flex Fee (35%): $6,300

- Post-Flex Commission: $11,700

- Brokerage Split (80/20): $9,360 to agent

- Estimated Taxes (30%): $2,808

- Agent Take-Home: $6,552

- Effective Rate: 1.09% of sale price

$600,000 Dallas Sale (SELLER Connection – 40% Flex Fee):

- Gross Commission (3%): $18,000

- Zillow Flex Fee (40%): $7,200

- Post-Flex Commission: $10,800

- Brokerage Split (80/20): $8,640 to agent

- Estimated Taxes (30%): $2,592

- Agent Take-Home: $6,048

- Effective Rate: 1.01% of sale price

$900,000 Los Angeles Sale (Buyer Connection – 40% Flex Fee):

- Gross Commission (3%): $27,000

- Zillow Flex Fee (40%): $10,800

- Post-Flex Commission: $16,200

- Brokerage Split (90/10): $14,580 to agent

- Estimated Taxes (35%): $5,103

- Agent Take-Home: $9,477

- Effective Rate: 1.05% of sale price

Sensitivity Analysis: Fee Band and Conversion Impact

Small changes in fee structure or conversion rates create significant income variations. This analysis shows how your earnings change when fees increase or conversion rates decline.

Scenario: Fee Increase from 35% to 40% on $600,000 Sale:

- Net income reduction: $504 (-7.7% decrease in take-home pay)

- Required additional transactions to offset: 1 extra closing every 13 transactions

Scenario: Commission Rate Drop from 3% to 2%:

- Same $600,000 sale at 35% Flex fee

- Gross Commission (2%): $12,000

- Agent Take-Home: $4,368 (33% reduction from 3% scenario)

Break-Even Analysis Calculator Framework

Calculate your market-specific break-even requirements using these assumptions and formulas:

💰 YOUR MARKET CALCULATOR

Commission Structure:

- Average Commission Rate: 3% → Your Market: ____%

- Average Sale Price: $450,000 → Your Market: $______

- Your Brokerage Split: 80/20 → Your Split: /

Cost Factors:

- Tax Rate (estimated): 30% → Your Rate: ____%

- Zillow Flex Fee: 35% → Your Market Fee: ____%

Sample Calculation ($450,000 sale at 35% Flex fee):

- Gross Commission (3%): $13,500

- Zillow Flex Fee (35%): $4,725

- Post-Flex Commission: $8,775

- Your Split (80%): $7,020

- After Taxes (30%): $4,914 take-home

Monthly Break-Even Formula: (Fixed Expenses ÷ Net Commission per Transaction) = Required Closings

Use your actual numbers to determine minimum transaction volume needed for sustainable Flex participation in your specific market and business model.

Break-Even Performance Requirements

For Zillow Flex to generate positive ROI, agents must maintain specific conversion rates and transaction volumes. Industry benchmarks suggest successful Flex agents achieve 10-12% conversion rates from initial lead contact to closed transaction.

Minimum Performance Metrics:

- Lead response time: Under 5 minutes for optimal conversion

- Monthly transaction targets: Varies by market size and agent experience

- Customer satisfaction scores: Maintained above program minimums

- Follow-up consistency: Systematic nurturing of unconverted leads

ROI Calculation Framework

Use this formula to evaluate Zillow Flex profitability:

ROI = (Net Commission Income ÷ Time Investment Cost) – 1

Factor in your hourly rate for lead management, follow-up activities, and transaction coordination. If your net effective commission rate drops below your minimum acceptable threshold, consider alternative lead sources or renegotiate your business model.

Lead Quality Assessment and Market Changes

Current Lead Quality Challenges

Multiple industry reports and agent feedback indicate declining lead quality since Zillow Flex expansion. The increased competition for premium leads has affected overall program effectiveness across many markets.

Agents report receiving leads that multiple other agents have already contacted, reducing conversion potential. Some markets experience oversaturation as Zillow invites more agents to meet growing demand for Flex partnerships.

Compliance Risks and Performance Requirements

ZHL Integration and Consequences

Zillow increasingly requires agents to meet Zillow Home Loans (ZHL) engagement targets as part of Flex eligibility. Missing these benchmarks can reduce lead flow or trigger program disengagement.

Critical Compliance Areas:

- ZHL Pre-Approval Targets: Percentage of buyers you must refer to Zillow Home Loans

- Answer Rate Standards: Minimum response rates to Zillow lead calls and inquiries

- Engaged Transfer Rate: Successful handoff rate for qualified prospects

- Payment Compliance: Timely referral fee payments within program terms

Real Consequences of Non-Compliance:

- Reduced lead priority and fewer high-quality assignments

- Warning periods with increased monitoring and reporting requirements

- Program suspension with 30-60 day improvement period

- Complete disengagement with 12-month reapplication restrictions

2025 Market Context and Post-Settlement Dynamics

Since August 17, 2024, written buyer agreements are required before touring properties, and MLSs no longer publish buyer-agent compensation offers. These changes create new dynamics for Zillow Flex participation, particularly affecting buyer agents who must address commission arrangements during initial consultations rather than waiting until contract negotiations.

New Market Realities:

- Buyer representation agreements now required before property showings

- Commission negotiations occur earlier in the client relationship

- Lead qualification must include compensation discussion upfront

- Conversion timelines may extend due to additional agreement requirements

The rise of “exclusive inventory” and changing commission structures affect how Flex leads convert and close. Successful agents adapt by addressing commission arrangements and buyer representation terms during initial consultations, ensuring clients understand the full service model before beginning property searches.

Proven Conversion Strategies for Flex Success

The ALM Framework Implementation

Successful Flex agents use systematic approaches to maximize lead conversion. The Appointment, Location, Motivation (ALM) framework provides structure for initial lead interactions.

Appointment Setting:

- Secure definitive meeting times within 24-48 hours

- Confirm multiple contact methods for follow-up

- Set clear expectations for the consultation process

Location Identification:

- Determine specific neighborhoods and property preferences

- Understand commute requirements and lifestyle factors

- Identify deal-breakers and non-negotiable features

Motivation Assessment:

- Uncover timeline urgency and decision-making factors

- Understand financing readiness and budget constraints

- Identify emotional drivers behind the buying or selling decision

Advanced Qualification Techniques

Beyond basic ALM implementation, top-performing Flex agents employ deeper qualification strategies that improve conversion rates and reduce time waste on unqualified prospects.

Financial Readiness Verification:

- Pre-approval status and lender relationships

- Down payment availability and source verification

- Debt-to-income ratios and employment stability

- Investment property experience for investor clients

Decision-Making Authority:

- Identify all decision-makers in the buying process

- Understand spouse or partner involvement levels

- Clarify timeline pressures and external factors

- Assess competing priorities and alternatives

Team Systems and Scalability

Brokerages implementing Flex across multiple agents require systematic approaches to maintain consistent performance standards and lead management quality.

Essential Team Infrastructure:

- Standardized lead response protocols and scripts

- CRM integration with automated follow-up sequences

- Regular performance review and coaching sessions

- Clear escalation procedures for complex transactions

Training and Development Programs:

- New agent onboarding with Flex-specific requirements

- Ongoing education on market changes and best practices

- Role-playing exercises for challenging lead scenarios

- Performance analytics and improvement planning

Alternative Lead Generation Strategies

Google Ads vs. Facebook Advertising

Smart brokers diversify lead sources to reduce dependence on any single platform. Understanding the strengths and limitations of major advertising channels helps create balanced lead generation portfolios.

Google Ads Advantages:

- Higher intent traffic from active property searchers

- Faster conversion timelines due to immediate purchase intent

- Better ROI for experienced agents with optimized campaigns

- Cost range: $100-$500+ per qualified lead depending on market competition

Facebook Advertising Benefits:

- Lower cost per click enables broader reach and testing

- Superior targeting options for demographic and interest-based campaigns

- Excellent for brand building and long-term relationship development

- Better suited for nurturing potential clients over extended periods

Competitive Platform Analysis and Alternatives

Comprehensive Platform Comparison Matrix

PlatformTypical FeeLead TypeAvailabilityNotable RequirementsBest ForZillow Flex15-40% GCIBuyer/SellerInvitation-onlyZHL targets, strict KPIsHigh-converting agentsReadyConnect/Opcity30-35% GCIBuyer (concierged)Application processRelocation focusCorporate relocationHomeLight25-30% GCIBuyer/SellerOpen platformPerformance reviewsMid-market agentsRocket Homes35% GCIBuyer/SellerMortgage tie-inRocket Mortgage integrationMortgage-focused agentsAgent Pronto$50-200/leadBuyerPay-per-leadImmediate response requiredVolume-focused teamsUpNest30% GCISellerOpen platformCompetitive biddingPrice-competitive markets

Platform-Specific Considerations

ReadyConnect/Opcity Advantages:

- Concierged lead handoff with pre-qualification

- Focus on corporate relocations with higher close rates

- Less price sensitivity from employer-sponsored moves

- Longer transaction timelines allow for relationship building

Rocket Homes Integration:

- Mortgage pre-approval streamlines buyer qualification

- Cross-selling opportunities for refinancing and investment properties

- Technology platform includes CRM and transaction management

- Consistent lead flow in markets with strong Rocket Mortgage presence

HomeLight’s Differentiation:

- Performance-based matching system connects agents with suitable clients

- Transparent reviews and success metrics for consumer confidence

- Lower fees compared to Zillow Flex in many markets

- Flexible participation without exclusive territory restrictions

Building Organic Lead Generation

The most sustainable long-term strategy combines paid advertising with organic lead development through content marketing, referral systems, and community engagement.

Content Marketing Strategies:

- Local market analysis and trend reporting

- First-time buyer education and guidance content

- Seller preparation checklists and home improvement advice

- Investment property analysis and rental market insights

Referral System Development:

- Past client nurturing and re-engagement campaigns

- Professional network development with complementary services

- Community involvement and local business partnerships

- Social media engagement and thought leadership positioning

Market-Specific Considerations and Regional Variations

Flex-Only Market Implications

Atlanta and Phoenix represent the future direction of Zillow’s platform strategy. These markets no longer offer Premier Agent options, forcing agents to choose between Flex participation or complete platform exit.

This transition creates both opportunities and challenges. Agents in Flex-only markets may experience reduced competition from Premier Agent participants, potentially improving lead quality. However, the lack of alternatives increases dependence on Zillow’s ecosystem and limits negotiation leverage.

Flex-Only Market Strategies:

- Develop comprehensive backup lead sources before committing

- Negotiate performance metrics and expectations clearly

- Monitor market changes and competitor strategies closely

- Build direct relationships with past Zillow clients for future referrals

Regional Fee Variations

Different markets experience varying levels of competition and lead availability, affecting the practical value of Zillow Flex participation. High-demand markets with limited inventory may justify higher referral fees, while oversaturated markets require careful ROI evaluation.

Market Assessment Factors:

- Local competition density and agent market share

- Average days on market and inventory levels

- Price appreciation trends and market stability

- Consumer behavior patterns and platform preferences

Performance Optimization and Success Metrics

Conversion Rate Benchmarks

Industry data suggests successful Zillow Flex agents maintain conversion rates between 10-12% from initial lead contact to closed transaction. Agents performing below these benchmarks should evaluate their qualification processes, follow-up systems, and market positioning.

Key Performance Indicators:

- Lead-to-appointment conversion rate

- Appointment-to-under-contract rate

- Under-contract-to-closing rate

- Average time from lead to closing

- Customer satisfaction scores and reviews

Technology Integration Requirements

Modern lead management requires sophisticated CRM systems and automation tools to handle Zillow Flex volume and performance requirements effectively.

Essential Technology Stack:

- CRM with Zillow integration capabilities

- Automated email and text messaging sequences

- Calendar scheduling and appointment management

- Transaction management and documentation systems

- Performance analytics and reporting tools

Quality Control and Lead Management

Implementing systematic quality control processes helps maximize conversion rates and maintain Zillow’s performance standards while building sustainable business practices.

Lead Management Best Practices:

- Immediate response protocols with backup systems

- Detailed lead qualification and scoring systems

- Regular follow-up schedules with value-added content

- Client feedback collection and service improvement processes

Strategic Alternatives and Platform Diversification

Cost-Effective Lead Generation Models

Successful real estate professionals rarely depend on single lead sources. Building diversified lead generation portfolios reduces platform risk and improves overall business stability.

Hybrid Model Example:

- 30% Zillow Flex (high-intent, immediate conversions)

- 30% Google Ads (targeted local search traffic)

- 25% Referral and repeat business (past client nurturing)

- 15% Content marketing and social media (long-term brand building)

This approach balances immediate lead flow with sustainable business development while reducing dependence on any single platform’s pricing changes or policy modifications.

Building Direct Consumer Relationships

The ultimate goal involves creating direct relationships with consumers that bypass third-party platforms entirely. This requires consistent investment in brand building and community presence.

Direct Relationship Strategies:

- Local market expertise and regular market reports

- Educational content addressing common buyer and seller concerns

- Community involvement and professional networking

- Strategic partnerships with complementary service providers

Team Implementation and Scaling Considerations

Brokerage-Level Strategy Development

Brokers implementing Zillow Flex across multiple agents need comprehensive strategies that address individual agent performance while maintaining overall profitability standards.

Implementation Framework:

- Agent selection criteria based on experience and conversion history

- Performance monitoring systems with regular review cycles

- Training programs specific to Zillow Flex requirements

- Financial modeling to ensure brokerage profitability at scale

Individual Agent Assessment

Not every agent succeeds in performance-based lead generation environments. Brokers should evaluate agent fit before committing to Flex partnerships.

Agent Suitability Factors:

- Proven lead conversion experience and track records

- Financial stability to handle commission sharing requirements

- Technology adoption and CRM management capabilities

- Customer service skills and communication excellence

Future Market Predictions and Industry Trends

Platform Evolution Expectations

Based on current market trends and Zillow’s strategic direction, expect continued expansion of Flex-only markets and potential fee increases in high-demand regions. The company’s focus on performance-based revenue models suggests Premier Agent options may become increasingly limited.

Anticipated Changes:

- Additional markets transitioning to Flex-only models

- Potential introduction of performance bonuses or tier reductions for top agents

- Enhanced lead quality controls and qualification processes

- Integration with Zillow’s broader real estate service ecosystem

Competitive Response Patterns

Other major platforms are developing competing performance-based models in response to Zillow’s success. This competition may create new opportunities for agents seeking alternatives to traditional subscription-based lead generation.

Market Response Indicators:

- Realtor.com and other platforms testing commission-based models

- New entrants focusing on agent-friendly fee structures

- Technology improvements in lead qualification and distribution

- Increased emphasis on lead exclusivity and quality metrics

Frequently Asked Questions

How do I qualify for Zillow Flex invitation?

Zillow evaluates agents based on transaction history, customer satisfaction ratings, and demonstrated lead conversion capabilities. Most successful applicants have at least 12-24 months of consistent closing activity and maintain above-average customer reviews. The invitation process typically takes 30-60 days after initial application submission.

Can I negotiate Zillow Flex referral fees?

Zillow’s fee structure operates on standardized tiers without individual negotiation options. However, top-performing agents may receive priority lead assignment and enhanced support services that improve overall ROI. Focus on maximizing conversion rates rather than reducing fee percentages.

How does seller connection pricing differ from buyer connections?

Seller connections carry a flat 40% referral fee across ALL markets, regardless of property value or location. This creates dramatically different ROI scenarios compared to buyer connections with tiered pricing.

Listing Agent Scenario Comparison ($600,000 Property):

Seller Connection (Listing):

- Gross Commission (3%): $18,000

- Zillow Flex Fee (40%): $7,200

- Net Commission: $10,800

Buyer Connection (Same Price, Dallas Market):

- Gross Commission (3%): $18,000

- Zillow Flex Fee (35%): $6,300

- Net Commission: $11,700

The $900 difference per transaction adds up quickly for agents handling multiple deals monthly. Listing agents must factor this flat rate structure into their business planning and client acquisition strategies.

What are the ZHL pre-approval requirements and consequences?

Zillow ties Flex performance to Zillow Home Loans engagement targets, creating additional compliance layers beyond basic lead conversion. According to Zillow’s performance documentation, agents must meet specific benchmarks for mortgage referrals and client engagement.

Key ZHL Metrics:

- Pre-approval referral rate targets (varies by market)

- Client engagement with ZHL representatives

- Mortgage application completion rates

- Loan closing percentages through Zillow’s platform

Missing these targets can trigger lead flow reductions, increased monitoring, or program suspension. Agents report receiving fewer high-quality leads when ZHL referral rates fall below expectations, even if overall conversion rates remain strong.

Should new agents consider Zillow Flex?

New agents typically achieve better results starting with lower-cost platforms like BoldLeads or Market Leader to build experience and transaction history. Zillow Flex’s performance requirements and high commission sharing make it challenging for agents without established conversion systems and financial reserves.

What CRM systems work best with Zillow Flex?

Follow Up Boss, Chime, and Top Producer offer strong Zillow integration capabilities. Choose systems with automated lead assignment, customizable follow-up sequences, and detailed performance analytics. Ensure your CRM can handle Zillow’s specific data formats and reporting requirements.

How do referral fees affect my brokerage splits?

Most brokerages treat Zillow Flex fees as marketing expenses paid before calculating agent splits. Clarify this arrangement with your broker before joining Flex to avoid unexpected commission reductions. Some brokerages offer modified split structures for agents using performance-based lead generation.

Can I use Zillow Flex part-time or seasonally?

Zillow requires consistent participation and performance monitoring throughout your membership period. Seasonal or part-time participation typically results in program termination due to insufficient transaction volume and lead management consistency.

What backup plans should I have if removed from Flex?

Develop alternative lead sources before relying heavily on Zillow Flex. Maintain Google Ads campaigns, referral relationship systems, and content marketing efforts to ensure business continuity. Agents depending solely on Zillow often struggle significantly after program termination.

How do market changes affect fee structures?

Zillow adjusts fees periodically based on market conditions, competition levels, and lead availability. Monitor program communications and industry news for advance notice of changes. Consider fee increases when evaluating long-term business planning and profitability projections.

Should teams use Zillow Flex or individual agents?

Team implementation requires sophisticated lead distribution and performance monitoring systems. Individual agents often achieve better results due to direct accountability and personalized lead management. Teams succeeding with Flex typically have dedicated lead coordinators and standardized conversion processes.

What metrics should I track for Flex success?

Monitor lead response time, appointment setting rate, under-contract conversion rate, closing rate, and customer satisfaction scores. Track these metrics weekly and compare performance against Zillow’s requirements and your historical averages from other lead sources.

Implementation Roadmap and Action Steps

Phase 1: Preparation and Evaluation (Weeks 1-2)

Before pursuing Zillow Flex invitation, complete comprehensive preparation to maximize approval chances and early success.

Preparation Checklist:

- Review transaction history and customer satisfaction data

- Upgrade CRM system with Zillow integration capabilities

- Develop lead response protocols and follow-up systems

- Calculate current lead costs and conversion rates for comparison

- Establish financial reserves for commission sharing impact

Phase 2: Application and Onboarding (Weeks 3-6)

The application process requires detailed documentation of your business practices and performance history. Prepare comprehensive materials demonstrating your qualifications and commitment to program success.

Application Requirements:

- Complete transaction history for the previous 24 months

- Customer testimonials and satisfaction documentation

- Technology platform descriptions and lead management processes

- Financial statements demonstrating business stability

- Professional references from industry partners and clients

Phase 3: Launch and Optimization (Weeks 7-12)

Initial Flex participation requires careful monitoring and rapid optimization based on early results. Establish baseline metrics and adjust strategies based on lead quality and conversion performance.

Launch Strategy:

- Set up comprehensive tracking and analytics systems

- Implement immediate response protocols and backup procedures

- Begin systematic lead qualification and follow-up processes

- Monitor early conversion rates and adjust approaches accordingly

- Document lessons learned and successful practices for team training

Strategic Recommendations for Different Business Models

Solo Agent Strategies

Individual agents can succeed with Zillow Flex by focusing on personal efficiency and conversion optimization rather than volume-based approaches.

Success Factors:

- Develop deep local market expertise to differentiate from competitors

- Build systematic follow-up processes that maintain consistent contact

- Focus on customer service excellence to generate referrals and repeat business

- Maintain alternative lead sources to reduce platform dependence

Team and Brokerage Implementation

Larger operations require more sophisticated systems and clear performance accountability to make Zillow Flex profitable across multiple agents.

Team Management Requirements:

- Establish clear lead assignment and performance monitoring systems

- Develop standardized training programs for new team members

- Implement regular coaching and performance improvement processes

- Create backup lead generation systems for team continuity

Investment-Focused Strategies

Real estate investors and investor-focused agents face unique challenges with Zillow Flex due to different transaction patterns and client needs.

Investor Considerations:

- Higher transaction volumes may justify referral fee costs

- Focus on building relationships with serious investors rather than casual buyers

- Develop expertise in investment analysis and market forecasting

- Consider alternative platforms specializing in investment properties

Conclusion and Strategic Next Steps

Zillow Flex referral fees at 40% represent a significant cost that demands careful consideration and strategic planning. While the program offers access to high-quality leads without upfront investment, the commission impact requires exceptional conversion skills and systematic lead management to maintain profitability.

Key Success Requirements:

- Maintain conversion rates above 10-12% consistently

- Implement systematic lead qualification and follow-up processes

- Develop backup lead generation sources for business continuity

- Monitor performance metrics closely and adjust strategies based on results

Recommended Action Plan:

- Calculate your current lead costs and conversion rates for comparison

- Develop comprehensive CRM and follow-up systems before applying

- Build alternative lead sources to reduce platform dependence

- Apply for Zillow Flex only after establishing strong conversion capabilities

The future of real estate lead generation increasingly favors agents who can demonstrate consistent performance and provide exceptional customer experiences. Whether you choose Zillow Flex or alternative platforms, focus on building sustainable systems that deliver value to clients while maintaining profitable business operations.

Success in today’s competitive environment requires combining platform expertise with strong fundamental business practices. Use this guide as your foundation for making informed decisions about Zillow Flex participation and building a thriving real estate practice in 2025 and beyond.

3 Comments