NYC Buyer Agent Flat Fee vs Percentage Commission: The Complete 2025 Guide for Real Estate Professionals

Last updated: August 24, 2025

The way NYC buyers compensate their agents changed in 2024–2025. MLSs stopped publishing offers of compensation, written buyer-rep agreements became standard before touring, and NYC’s REBNY RLS aligned by removing compensation fields and formalizing buyer-rep requirements. For the first time, NYC homebuyers directly negotiate and pay their buyer agent flat fee NYC arrangements, creating both opportunities and challenges for real estate professionals.

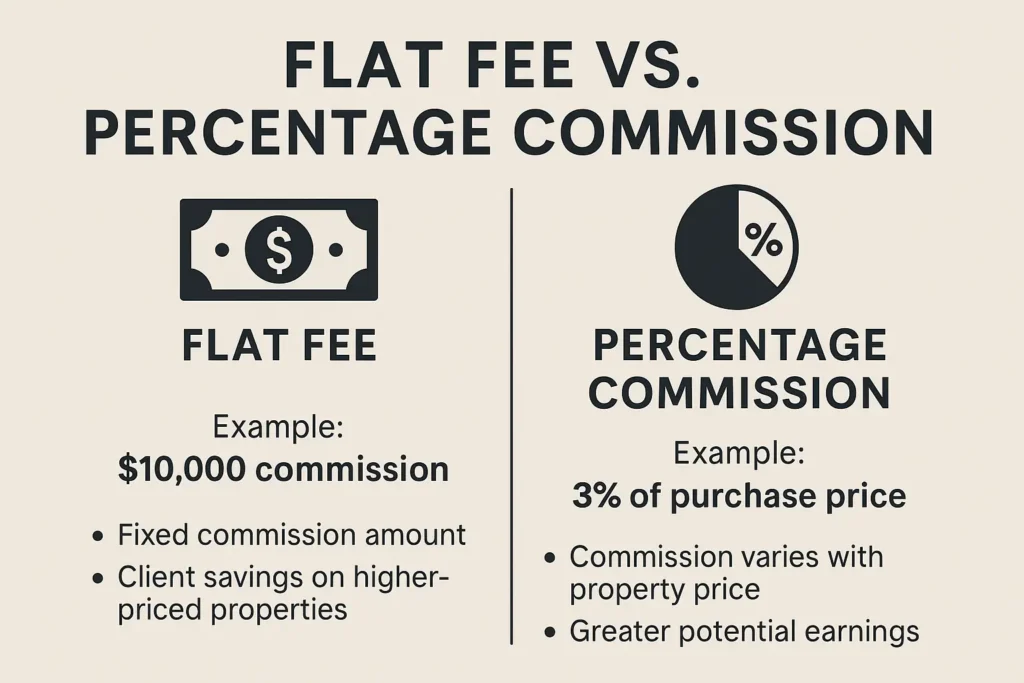

With Manhattan’s median roughly $1.0–$1.2M in Q2-2025 depending on cut and source, the choice between flat fee and percentage structures can mean the difference between a $5,000 commission and a $36,000 payday for identical services. In this guide, you’ll find exactly when to use flat, percentage, or hybrid pricing in Manhattan, Brooklyn, Queens, and beyond—with decision rules, scripts, and tools you can implement today.

NYC Rules at a Glance

OneKey MLS (Bronx, Brooklyn, Queens, Staten Island): No compensation fields, written buyer agreements before touring.

REBNY RLS (Manhattan Heavy): Compensation set outside the feed, written buyer-broker agreement before any showing.

New York State: Agency disclosure at first substantive contact; written buyer-rep comes from MLS or trade-association rules, not statute.

The Post-NAR Settlement Reality: What Changed for NYC Real Estate Professionals

The August 2024 NAR settlement fundamentally restructured how buyer representation works in New York City. The changes created new revenue opportunities while introducing fresh challenges for real estate professionals.

Key Changes Affecting Your Business

Elimination of Automatic Commission Splits: Seller’s agents can no longer automatically offer buyer agent compensation through the MLS. This means every transaction now requires direct negotiation between buyers and their representatives.

Mandatory Written Agreements: Buyers must sign representation agreements specifying compensation before viewing properties. This requirement creates new client conversion touchpoints and potential friction in the sales process.

Direct Fee Negotiation: Buyers now directly negotiate their agent’s compensation structure, putting agents’ value proposition under greater scrutiny than ever before.

Current NYC Market Data Snapshot (Q2-2025)

Post-settlement, local commission norms are in flux. Nationally the average buyer side hovers around 2.4% in Q2-2025, but borough-specific ranges swing deal-to-deal. Expect wide variation; anchor on value and written agreement terms.

Current Median Prices by Borough:

- Manhattan: Non-luxury median $1.03M; other sources report $1.21M overall median

- Brooklyn: Median flirting with $0.99–$1.02M

- Queens: Medians trending $650–$705K by source and cut

- Flat fee alternatives: $5,000-$15,000 depending on service levels and property price ranges

These figures represent current market snapshots, though significant variation exists based on agent experience, service levels, and specific neighborhood dynamics.

Understanding the Cost Structure Impact on Your Business

Enhanced Decision Framework for Fee Structure Selection

Formula: Flat Fee ÷ Percentage Rate = Breakeven Purchase Price

Fast Decision Rules for Daily Use:

Rule A (Price-Led): If price ≥ (Flat fee ÷ your realistic %), flat likely maximizes client savings while protecting margins when operations are efficient.

Rule B (Complexity-Led): If expected tours > 10 or co-op board package is heavy, use percentage or add a complexity surcharge to your flat model.

Example scenarios with new framework:

- $10,000 flat fee ÷ 2.5% = $400,000 breakeven point

- $15,000 flat fee ÷ 3% = $500,000 breakeven point

Properties purchased above these breakeven points generate higher client savings through flat fees, while properties below favor percentage structures or require complexity adjustments.

Financing Your Buyer Agent Fee: Who Can Pay and How

Seller-Paid Options Still Available

Fannie Mae / FHA Programs: Seller can still pay buyer-broker charges; these payments generally fall outside standard concession caps when customary and reasonable. This maintains financing flexibility for buyers while allowing sellers to offer competitive terms.

VA Loan Changes: Effective August 10, 2024, Veterans may now pay their own buyer-broker charges, and sellers can still cover these costs. VA lenders may request the buyer-rep agreement in the loan file for documentation purposes.

Three Common Payment Structures

Seller-Paid Credit at Closing: Negotiate seller contribution within program limits during offer negotiations. This approach maintains buyer cash flow while providing agent compensation certainty.

Buyer Pays Directly at Closing: Buyers include agent fees in their closing cost calculations. This provides complete fee control and transparency but requires additional cash preparation.

Hybrid Arrangements: Combine partial seller contribution with buyer payment, allowing flexible deal structuring based on market conditions and negotiation leverage.

Consider these real-world scenarios for a typical NYC agent:

Scenario 1: Manhattan Condo Purchase ($1.2M)

- Traditional 3% commission: $36,000

- Flat fee structure: $12,000

- Client savings: $24,000

- Agent opportunity cost: $24,000

Scenario 2: Brooklyn Brownstone Purchase ($750K)

- Traditional 2.5% commission: $18,750

- Flat fee structure: $10,000

- Client savings: $8,750

- Agent opportunity cost: $8,750

Scenario 3: Queens Coop Purchase ($400K)

- Traditional 2.25% commission: $9,000

- Flat fee structure: $8,000

- Client savings: $1,000

- Agent opportunity cost: $1,000

These calculations show why understanding your target market’s typical purchase prices is crucial for fee structure decisions.

When Flat Fee Structures Maximize Your Business Value

High-Value Property Focus Strategy

Flat fee structures become increasingly attractive as property values rise. Agents specializing in luxury markets can offer competitive pricing while maintaining healthy profit margins.

Optimal flat fee scenarios:

- Properties above $800,000 (significant client savings)

- Cash purchases (streamlined transaction process)

- New development sales (standardized procedures)

- Investment property acquisitions (repeat client potential)

- Experienced buyer clientele (reduced hand-holding requirements)

Service Efficiency Advantages

Flat fee structures reward operational efficiency. Agents who streamline their processes can serve more clients while maintaining quality standards.

Core services typically included in flat fee arrangements:

- Property search coordination and scheduling

- Offer preparation and negotiation support

- Purchase contract review and guidance

- Inspection coordination and oversight

- Closing process management

Additional services often charged separately:

- Extensive market education for first-time buyers

- Attorney and mortgage broker referrals

- Complex board package preparation for co-ops

- Post-closing property management coordination

Building Scalable Revenue Models

Flat fee structures enable more predictable revenue forecasting. Agents can calculate exact earnings based on transaction volume rather than hoping for high-value deals.

Monthly revenue calculation example:

- 3 transactions × $12,000 flat fee = $36,000 monthly revenue

- Versus variable percentage outcomes: 1 × $30,000 + 2 × $15,000 = $60,000 (or 3 × $7,500 = $22,500)

This predictability helps with business planning, team scaling, and marketing budget allocation.

Percentage Commission Strategies That Still Work

When Percentage Structures Provide Competitive Advantages

Despite flat fee growth, percentage-based commissions remain optimal for specific market segments and service models.

Scenarios favoring percentage structures:

- First-time buyer specialization (extensive education requirements)

- Complex transaction expertise (co-op board approvals, new construction)

- Full-service market positioning (comprehensive support throughout process)

- Lower-priced property markets (under $600,000)

- Relationship-based business models (referrals and repeat clients)

Service Differentiation Through Percentage Models

Percentage-based agents can justify higher compensation by providing deeper service levels and taking on more transaction risk.

Value-added services that support percentage pricing:

- Comprehensive neighborhood market analysis

- Financing pre-approval coordination

- Multiple property tours and showings

- Extensive negotiation support and strategy

- Post-closing relationship maintenance

Incentive Alignment Benefits

Percentage structures create natural alignment between agent and client interests. Higher purchase prices benefit both parties, encouraging agents to help clients find the best possible properties within their budget range.

Hybrid Fee Models: The Emerging Middle Ground

Tiered Flat Fee Structures

Many successful agents are developing tiered flat fee models that balance predictability with value-based pricing.

Example tiered structure:

- Properties under $750K: $7,500 flat fee

- Properties $750K-$1.5M: $12,000 flat fee

- Properties above $1.5M: $18,000 flat fee

This approach provides cost certainty while scaling compensation with property complexity and value.

Performance-Based Fee Combinations

Innovative agents combine base flat fees with performance bonuses to align incentives while maintaining predictable minimums.

Example performance model:

- Base flat fee: $8,000

- Bonus for closing under asking price: $2,500

- Bonus for closing within 45 days: $1,500

- Maximum total compensation: $12,000

Commission Rebate Programs

Some agents maintain traditional percentage structures while offering substantial rebates at closing, effectively creating hybrid pricing models.

Rebate structure example:

- Standard 2.5% commission collected

- 40% rebate returned to buyer at closing

- Effective rate: 1.5% of purchase price

- Client benefit: Reduced cash requirements at closing

Implementation Strategies for Real Estate Professionals

For Brokerage Owners and Team Leaders

Developing Fee Structure Policies:

- Analyze your market’s typical transaction values

- Survey client price sensitivity and service expectations

- Calculate breakeven points for different fee structures

- Train agents on value articulation for chosen models

- Create standardized service delivery processes

Technology and Systems Requirements:

- Customer relationship management (CRM) systems that track fee structures

- Automated agreement generation for different compensation models

- Performance tracking dashboards for fee structure effectiveness

- Client communication tools that explain value propositions clearly

Implementation Tools: Copy-Ready Resources for Your Team

Service Level Menu Template

Base Package ($X,XXX flat fee):

- Property search coordination and scheduling

- Offer preparation and negotiation support

- Purchase contract review and guidance

- Inspection coordination and oversight

- Closing process management

Complex Co-op Add-on (+$2,500):

- Board package preparation and review

- Board interview preparation

- Financial document coordination

- Building management liaison

Speed-to-Close Add-on (+$1,500):

- Expedited document processing

- Daily progress monitoring

- Vendor coordination acceleration

- Emergency troubleshooting support

Post-Close Concierge (+$1,000):

- Utility transfer coordination

- Contractor and service referrals

- Warranty issue management

- 90-day support availability

Offer Readiness Checklist

Pre-Underwritten Letter: Complete financial verification from qualified lender Attorney Engaged: Buyer’s attorney identified and retained Building Diligence: Financial statements, bylaws, and board minutes reviewed Board Questionnaire Draft: Application materials prepared for co-op purchases Insurance Quotes: Homeowner’s insurance estimates obtained Inspection Contacts: Qualified inspectors identified for quick scheduling

“First Call” Presentation Outline

- Market Overview: Current conditions and timeline expectations

- Service Options: Base package and add-on services explanation

- Pricing Transparency: Fee structure comparison with examples

- Performance Guarantees: Service level commitments and satisfaction policies

- Timeline and Process: Step-by-step transaction walkthrough

- Next Steps: Agreement terms and immediate action items

Addressing Client Objections: Proven Scripts That Work

“Why Should I Pay When Sellers Used to Cover This?”

Memorizable Response: “Two things changed. First, MLSs no longer publish or require offers of compensation. Second, you now choose what you pay for advocacy. Here’s how our fee translates into saved time, fewer risks, and negotiated dollars. If you want predictability, here’s a flat fee option; if you want aligned upside, here’s percentage with a performance kicker.”

Follow-up Value Demonstration: Present specific examples of money saved through skilled negotiation that exceeds the fee investment, showing net positive outcomes.

“Will a Listing Agent Ignore Us If We Use Flat Fee?”

Professional Standards Response: “Professional standards require agents to present all offers. We focus on complete, clean offers and proactive communication so your offer competes on merit.”

Service Level Assurance: Share your internal service level agreement: response within X hours, complete documentation checklist, and immediate lender introduction for serious offers.

“How Do I Know You’ll Work Hard for a Flat Fee?”

Process Transparency: “Our flat fee includes the same comprehensive service process we provide all clients. Here’s our step-by-step timeline with specific commitments and performance guarantees.”

Satisfaction Guarantee: “We offer clear satisfaction guarantees and termination clauses if service levels aren’t met. Our reputation depends on successful outcomes regardless of fee structure.”

Legal and Compliance Considerations

New York Compliance and Legal Framework

Agency Disclosure Requirements: New York State requires agency disclosure forms at first substantive contact with prospects. The written buyer-representation requirement comes from NAR policy and REBNY practice rules, not state law.

Professional Standards: REALTORS® must present all offers per the Code of Ethics; REBNY participants have parallel duties under their rules. This protects buyers regardless of their agent’s compensation structure.

Commission Rebate Legality: New York is commission-rebate friendly under Real Property Law §442. You can legally structure rebates and performance bonuses as part of your service offering.

Legal and Tax Considerations Box

Commission Rebates: NY allows rebates under RPP §442; you can legally rebate and structure performance bonuses.

Tax Basics: Buyer-paid commissions for primary homes are generally not deductible currently but increase basis, potentially reducing future taxable gain. Investors capitalize into basis. Always recommend clients consult their CPA for specific tax guidance.

This information is for general guidance only and does not constitute legal or tax advice. Consult qualified professionals for specific situations.

Documentation Requirements

Essential Agreement Elements:

- Clear service definitions and deliverables

- Fee structure and payment timing

- Termination procedures and conditions

- Dispute resolution processes

- Professional liability coverage information

Avoiding Discrimination Issues

Listing agents cannot legally discriminate against buyers based on their agent’s compensation structure. However, practical challenges may arise:

Best Practices for Smooth Transactions:

- Choose agents with established industry relationships

- Ensure professional presentation and communication standards

- Maintain transaction momentum through efficient processes

- Address any discrimination concerns through proper channels

Market Trends and Future Outlook

Industry Evolution Patterns

The shift toward buyer-paid commissions is accelerating across major metropolitan markets. Industry observers expect continued growth in alternative fee structures throughout 2025 and beyond.

Emerging trends include:

- Technology-enabled flat fee services with app-based coordination

- Subscription-based buyer representation models

- À la carte service pricing for specific transaction components

- Corporate relocation programs adopting standardized flat fee structures

Competitive Landscape Changes

Traditional full-service brokerages are adapting by:

- Developing dual fee structure options for different client segments

- Investing in technology to improve service efficiency

- Creating premium service tiers that justify higher percentage rates

- Building referral networks that support various compensation models

Client Expectation Shifts

Buyers are becoming more sophisticated about agent compensation and service value. This trend favors professionals who can clearly articulate their value proposition regardless of fee structure.

Key client expectations for 2025:

- Transparent pricing with no hidden fees

- Service level guarantees and performance metrics

- Technology integration for communication and document management

- Expertise in navigating the new commission landscape

Measuring Success Across Fee Structures

Key Performance Indicators (KPIs)

For Flat Fee Models:

- Transaction volume (monthly/quarterly deal count)

- Client satisfaction scores and referral rates

- Average days from listing to closing

- Service delivery consistency metrics

For Percentage Models:

- Average commission per transaction

- Client lifetime value through repeat business and referrals

- Market share in target price segments

- Conversion rates from initial consultation to signed agreement

Universal Metrics:

- Client retention and referral generation

- Professional reputation and online review scores

- Market knowledge demonstration through successful negotiations

- Compliance and legal issue avoidance

Financial Planning Implications

Different fee structures require different financial management approaches:

Flat Fee Considerations:

- More predictable monthly revenue streams

- Lower per-transaction income requiring higher volume

- Upfront payment timing improving cash flow

- Simplified commission split calculations with brokerages

Percentage Considerations:

- Variable monthly income requiring stronger financial reserves

- Potential for high-earning months from luxury transactions

- Payment timing dependent on closing schedules

- Traditional commission split structures with brokerages

Frequently Asked Questions

How do I determine the optimal flat fee amount for my market?

Research your area’s median transaction values and calculate breakeven points against typical percentage rates. Survey competitors’ pricing and service levels. Test different price points with willing clients and measure conversion rates, client satisfaction, and referral generation. Most successful flat fee agents price their services at 60-80% of equivalent percentage commission costs for their target market segment.

Will listing agents refuse to work with my flat fee buyer clients?

While some initial resistance exists, professional listing agents understand that buyer agent compensation structures don’t affect their responsibilities or earnings. Choose reputable flat fee agents with established industry relationships. Any systematic discrimination based on buyer agent compensation is unethical and potentially illegal. Document any instances of unfair treatment and address them through appropriate professional channels.

Can VA buyers work with me on a flat fee?

Yes. Veterans can now pay their own buyer-broker fees as of August 10, 2024, or sellers can still cover these costs. Include the buyer-representation agreement in the loan file for lender documentation. This change gives VA buyers complete flexibility in choosing their preferred agent compensation structure.

Can a seller still pay my fee and keep it financeable?

Yes, for Fannie Mae, Freddie Mac, and FHA programs when the payment is customary and reasonable. These seller contributions generally don’t count against standard concession limits, maintaining financing flexibility. Always verify current guidelines with lenders as policies can evolve.

Are commission rebates legal in New York?

Yes, under Real Property Law §442, New York permits commission rebates. You can legally structure rebates and performance bonuses as part of your service offering. This flexibility allows creative compensation arrangements that benefit clients while maintaining competitive positioning.

Do I need a signed buyer-rep agreement to show properties in NYC?

For NAR-MLS participants and REBNY RLS participants, yes – written agreements are required before touring properties. New York State law requires agency disclosure forms, but the written buyer-rep requirement comes from professional association policies, not state law.

What if my buyer won’t sign an agreement yet?

Offer a limited-scope preview agreement with short duration and capped showings (typically 3-5 properties over 7-14 days). This allows relationship building while maintaining compliance. Convert to full representation agreements once trust and value are established through initial service delivery.

What’s the best way to handle fee collection with flat fee clients?

Establish clear payment terms in your representation agreement before beginning any services. Common approaches include: payment at agreement signing, payment at contract execution, or payment at closing. Some agents use split payment schedules (50% at agreement, 50% at closing). Consider offering multiple payment options including credit cards, bank transfers, or certified checks. Build late payment penalties and collection procedures into your agreements.

Should I adjust my flat fee based on property types or complexity?

Many successful agents develop tiered flat fee structures that reflect genuine service complexity differences. Co-op purchases requiring board packages may justify higher fees than straightforward condo transactions. New construction purchases with extended timelines might warrant different pricing than resale properties. However, ensure your pricing structure remains simple enough for clients to understand and doesn’t become overly complicated to administer.

How do I compete with agents offering commission rebates?

Focus on the total value equation rather than just upfront costs. Commission rebates typically come from percentage-based agents who may charge higher initial rates. Calculate the true cost difference and emphasize the benefits of predictable flat fee pricing. Highlight service quality, expertise, and client outcomes rather than engaging in pure price competition. Consider whether offering your own rebate programs makes sense for your business model.

What insurance and liability considerations apply to flat fee arrangements?

Maintain identical professional liability insurance coverage regardless of your fee structure. Some insurance providers offer specific coverage options for alternative fee arrangements. Ensure your errors and omissions insurance covers all services you provide to flat fee clients. Consider higher coverage limits if you’re handling more transactions due to flat fee volume advantages. Consult with insurance professionals familiar with real estate industry requirements.

How can I scale my business using flat fee models?

Flat fee structures can enable business scaling through predictable revenue and higher transaction volume. Invest in technology systems that streamline client communication and transaction management. Consider hiring transaction coordinators or assistant agents to handle routine tasks. Develop standardized processes for common transaction types. Build referral networks that understand and support your fee model. Focus on client satisfaction and repeat business generation to create sustainable growth.

Conclusion: Positioning Your Business for Success

The transformation of NYC’s buyer agent compensation landscape represents both challenge and opportunity for real estate professionals. Success in this new environment requires understanding when flat fee structures provide competitive advantages and when percentage-based models remain optimal for your target market and service approach.

For properties above $600,000, flat fee arrangements typically offer significant client savings while maintaining healthy profit margins for agents who operate efficiently. However, first-time buyers, complex transactions, and lower-priced properties often benefit from traditional percentage structures that align agent incentives with extensive service delivery.

The key to thriving in this evolving market is developing clear value propositions, implementing efficient service delivery systems, and maintaining flexibility to serve different client segments appropriately. Whether you choose flat fee, percentage, or hybrid approaches, focus on demonstrating tangible value that justifies your compensation structure.

As the industry continues adapting throughout 2025, professionals who master these new commission dynamics while maintaining high service standards will build sustainable competitive advantages. The buyers who now control agent compensation decisions will reward those who provide clear value, transparent pricing, and exceptional outcomes regardless of fee structure.

Ready to optimize your fee structure strategy? Start by analyzing your current client base, calculating breakeven points for different pricing models, and developing service packages that align compensation with value delivery. The agents and brokerages that adapt quickly to these new realities will capture market share while others struggle with outdated approaches.