Homes.com vs Zillow vs Realtor.com vs Redfin (2025): Traffic, Lead Quality, Costs & ROI

Last updated: August 16, 2025

If you’re choosing between Homes.com vs Zillow vs Realtor.com vs Redfin in 2025, this no-BS guide shows what actually drives ROI—lead cost, referral fees, conversion quality, and the systems that turn portal clicks into closings. You’ll get a side-by-side fee/lead table, a quick verdict by agent type, and a simple calculator to compare cost-per-appointment and cost-per-closing. We’ve also included the follow-up scripts and FAQ buyers ask this year, so you can pick one platform, master it, and scale with confidence.

Quick Verdict (2025)

New or budget-tight? Start with pay-at-close (Zillow Flex / Redfin Partner / ReadyConnect). Low risk; success = speed-to-lead.Solo/teams with systems? Test ZPA or Connections Plus in 2–3 ZIPs; scale only if cost-per-closing ≤ 25% of gross commission.Early-adopter metros? Try Homes.com where territorial/exclusivity options exist; lower volume, less agent competition.Bottom line: Track cost per appointment and cost per closing—not just CPL.

Need help picking the right portal for your market? Book a 15-minute ROI audit.

2025 Snapshot: Traffic, Users & What That Means for Leads

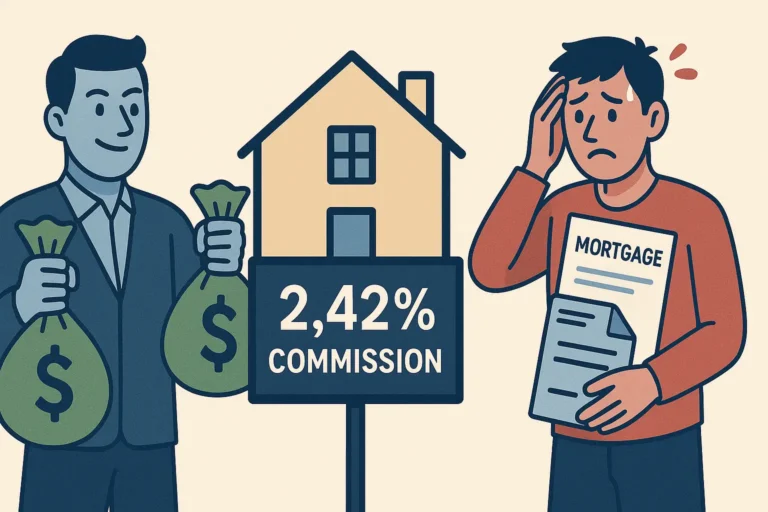

The real estate lead generation landscape has transformed dramatically in 2025. With Homes.com backed by CoStar’s $1.2 billion investment challenging traditional players, the 2024 NAR settlement reshaping commission structures, and AI revolutionizing lead qualification, agents can no longer rely on outdated strategies to build their businesses.

According to recent investor reports, the competitive landscape reveals significant shifts:

- Zillow: 243M average monthly unique users in Q2 2025; 2.6B visits in Q2 2025

- Homes.com (CoStar network): ~111M average monthly unique users in Q2 2025 (network total)

- Realtor.com: News Corp reported average monthly unique users down ~6% YoY in fiscal Q2 2025; performance varies by metro

Sources: Q2-2025 investor/IR reports for Zillow Group, CoStar Group (Homes.com network), and News Corp (Move/Realtor.com). Figures are directional and vary by metro.

Takeaway: Eyeballs matter, but ROI matters more. The 2024 NAR settlement fundamentally altered how agents generate and convert leads, with buyer representation agreements now requiring explicit consent before showing properties. This creates a more competitive environment where speed-to-lead and systematic follow-up have become essential.

Pricing & Fees at a Glance (Flex, ZPA, ReadyConnect, Connections Plus, Redfin Partner, Homes.com)

| Platform | Model | Typical Fee / Cost | Lead Type | Best For |

|---|---|---|---|---|

| Zillow Flex | Pay at close | ~20–35% referral | Buyer-heavy | Newer agents; low upfront |

| Zillow Premier Agent | Upfront | Varies by ZIP | Buyer & seller | Teams with cash flow |

| Realtor.com ReadyConnect | Pay at close | ~30% referral | Pre-screened | Quality over volume |

| Realtor.com Connections Plus | Upfront | $200–$1,200+ / month | Buyer & seller | Established solo/teams |

| Redfin Partner | Pay at close | ~25–40% referral | Pre-qualified | Service-driven agents |

| Homes.com | Pay at close | ~25–35% referral (geo options) | Buyer & seller | Early adopters; territories |

Note: Fees vary by market and program; confirm current pricing with each platform.

Exclusivity and screening differ by program; confirm availability and terms in your ZIPs.

Understanding the Cost Structures

Zillow Premier Agent & Zillow Flex

Best for: High-volume teams (ZPA) or risk-averse newer agents (Flex)

Risk: ZPA requires upfront investment; Flex takes larger commission cut

Premier Agent uses traditional upfront subscription pricing with costs ranging from $139 in smaller markets to over $500 in competitive metros. Zillow Flex eliminates upfront costs but requires 20-35% commission splits.

Realtor.com Connections Plus & ReadyConnect

Best for: Agents wanting MLS authority and data accuracy

Risk: Connections Plus needs monthly budget; ReadyConnect has 30% referral fee

Connections Plus requires monthly investments starting around $200 in smaller markets but reaching $1,200+ in competitive areas. ReadyConnect Concierge operates on a 30% commission split with no upfront investment.

Redfin Partner & Homes.com Programs

Best for: Service-focused agents (Redfin) or early adopters wanting exclusivity (Homes.com)

Risk: Performance monitoring (Redfin); smaller lead volume (Homes.com)

Redfin Partner Program demands 25-40% splits but includes performance monitoring and pre-screening. Homes.com’s pay-at-close model (25-35% commission) includes geographic exclusivity in many markets.

Lead Quality & Conversion: What Real Agents Report in 2025

Industry conversion rate benchmarks reveal significant variations:

Excellent Performance:

- Response rate: 40%+

- Appointment rate: 25%+

- Conversion rate: 8%+

- Average response time: Under 3 minutes

Good Performance:

- Response rate: 25-39%

- Appointment rate: 15-24%

- Conversion rate: 4-7%

- Average response time: 3-10 minutes

Needs Improvement:

- Response rate: Under 25%

- Appointment rate: Under 15%

- Conversion rate: Under 4%

- Average response time: Over 10 minutes

Platform-Specific Quality Insights

Zillow: Massive traffic volume attracts both serious buyers and casual browsers. Lead quality varies significantly, with agents reporting prospects ranging from highly motivated to those already working with other agents. The “My Agent” feature provides valuable insights into browsing behavior for participating agents.

Realtor.com: Direct MLS connection attracts higher-intent prospects who value data accuracy. Real-time updates (every 15 minutes) from over 580 MLS databases create quality advantages, though lead exclusivity remains challenging without premium rights.

Redfin: Pre-screening by internal teams results in higher-quality prospects. The company’s revenue dependence on successful transactions incentivizes qualified lead provision rather than high volumes of unqualified inquiries.

Homes.com: CoStar’s commercial expertise provides richer lead context including employment data and demographic trends. Early adoption advantages include reduced competition and more professional client interactions.

Official product explainer; pairs with your exclusivity note

Who Wins for Buyers vs Sellers vs Teams? Our Verdict

For New Agents (Less than 2 years experience)

Recommended: Zillow Flex or Redfin Partner Agent

Why: No upfront costs, built-in training, performance-based fees align with limited budgets and developing skills.

For Experienced Agents (2-5 years experience)

Recommended: Realtor.com ReadyConnect + Zillow Premier Agent

Why: Combination of pre-qualified leads and high-volume traffic, with budget flexibility for upfront investments.

For High-Volume Teams (5+ years experience)

Recommended: Multi-platform approach with Zillow Premier Agent as primary

Why: Leverage team members for rapid response across platforms with sophisticated CRM systems.

For Luxury Market Specialists

Recommended: Realtor.com Connections Plus with exclusivity + Homes.com

Why: Higher-end buyers prefer accurate MLS data and exclusive agent relationships.

Typical Buyer-to-Seller Mix (varies by market)

- Zillow: 70% buyers, 30% sellers – highest volume potential

- Realtor.com: 70% buyers, 30% sellers – MLS authority attracts serious shoppers

- Redfin: 85% buyers, 15% sellers – pre-qualified focus

- Homes.com: 50% buyers, 50% sellers – balanced distribution with growth trajectory

Mix reflects common patterns reported by platforms/agents; verify in your target ZIPs.

Calculator: Cost-Per-Appointment & Cost-Per-Closing (2025)

🏠 Portal ROI Calculator (2025)

🏠 Portal ROI Calculator (2025)

Key Metrics to Track:

- Cost per lead by platform

- Cost per appointment

- Cost per closing

- Return on investment (ROI) by platform

- Average days to conversion

Target benchmarks: Aim for cost-per-closing ≤ 15-25% of gross commission. For a $10k commission, stay under $1.5k-$2.5k all-in costs.

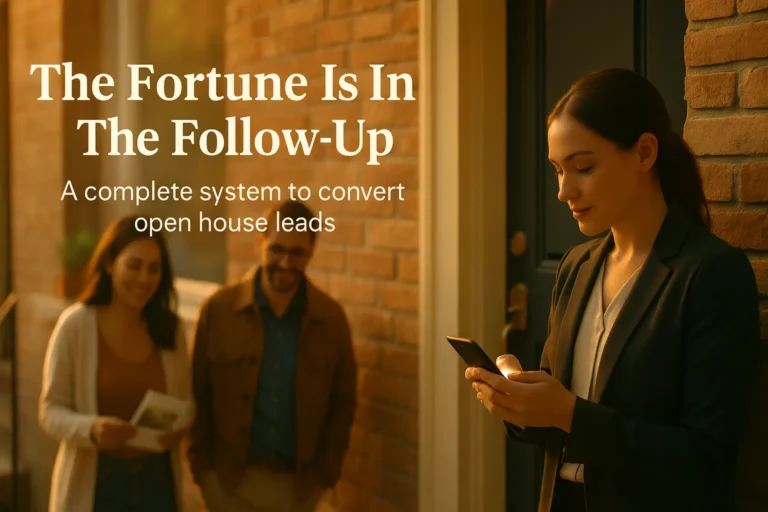

Playbook: Speed-to-Lead, Scripts, and a 7-Touch Follow-Up

Goal: respond under 5 minutes, 7 touches in 14–30 days.

The Critical 5-Minute Window

Research consistently shows leads contacted within 5 minutes are 9 times more likely to convert. After 30 minutes, conversion rates drop by 50%. Here’s your systematic approach:

The 7-Touch Follow-Up System

Touch 1: Immediate Response (Within 5 minutes)

Phone script: “Hi [Name], this is [Agent] with [Brokerage]. I saw you were interested in [Property Address]. I’m actually in the area and could show you this property today if you’re available. What’s the best number to reach you?”

Touch 2: Two Hours Later

Text message: “Hi [Name], [Agent] here. I left you a voicemail about [Property Address]. I found 3 similar properties that just came on market. Here’s the link: [Custom property search]. When’s a good time to chat?”

Touch 3: Next Day

Email with market analysis: “Hi [Name], I’ve prepared a custom market report for [Neighborhood]. This shows why properties like [Original Property] are selling quickly. I’d love to discuss your timeline and help you stay ahead of the competition.”

Touch 4: Day 3

One-minute personalized video: Record a video walking through the original property’s neighborhood, highlighting amenities, schools, and value proposition specific to their inquiry.

Touch 5: One Week Later

Handwritten note: “Hi [Name], I know you’re busy, but I wanted to follow up on your interest in [Neighborhood]. The market is moving quickly, and I’d hate for you to miss out on the perfect property.”

Touch 6: One Month Later

Quarterly market update: “Hi [Name], here’s what’s happened in [Neighborhood] since we last spoke. [Include specific statistics and new listings]. I’m still here when you’re ready to make a move.”

Touch 7: Quarter 1

Holiday card with referral request: “Hi [Name], I hope you’re doing well. I’m still helping buyers find great properties in [Area]. If you know anyone looking to buy or sell, I’d appreciate the referral.”

AI-Powered Lead Qualification: The Modern Advantage

Modern AI tools analyze prospect behavior, response patterns, and demographic data to assign lead scores. Systems like FollowUpBoss Autopilot and Verse.io process initial inquiries, ask qualifying questions, and schedule appointments with high-probability prospects.

Agents using AI qualification report 40-60% higher contact rates because they focus time on prospects most likely to convert. The technology provides 24/7 availability, ensuring no lead goes unanswered regardless of timing.

Technology Stack for Maximum Efficiency

Essential Tools (Under $200/month):

- CRM: FollowUpBoss ($69/month) for advanced automation

- Text Messaging: SimpleTexting ($29/month) for bulk messaging

- Video Creation: Loom ($12.50/month) for personalized videos

- Email Marketing: Mailchimp ($13/month) for automation

- Social Media: Hootsuite ($49/month) for management

Advanced Add-ons:

- AI Lead Qualification: Verse.io ($150/month)

- Virtual Staging: Virtual Staging Solutions ($39/month)

- Market Analytics: Cloud CMA ($29/month)

FAQs: Zillow vs Realtor.com vs Redfin vs Homes.com (2025)

Which portal gives the best ROI in 2025?

There isn’t a universal winner. For low risk, start with pay-at-close (Zillow Flex, Redfin Partner, ReadyConnect). For scale and lower cost per closing, experienced teams can layer ZPA or Connections Plus if their conversion systems are strong.

What’s a good cost-per-closing target?

Aim for ≤ 15–25% of gross commission. For a $10k commission, try to beat $1.5k–$2.5k all-in.

Is Homes.com worth testing now?

Yes in metros offering exclusivity/territories. Expect fewer total leads than Zillow, but less agent competition per lead.

Zillow Flex vs ReadyConnect—key difference?

Both are pay-at-close. Flex is high-volume, speed-sensitive; ReadyConnect focuses more on pre-screening and lead quality.

How fast should I respond to portal leads?

Under 5 minutes. Pair an instant text with a call, then a 7-touch sequence over 14–30 days.

Buyers vs sellers—who wins where?

Zillow = sheer buyer volume; Realtor.com = MLS-tight data that attracts higher-intent shoppers; Homes.com = balanced but metro-dependent; Redfin Partner = pre-qualified buyers.

What’s the realistic conversion rate I should expect?

Expect 2-4% for most agents, 7-9% for top performers. If you’re converting less than 2%, focus on improving your systems and scripts before buying more leads. If you’re above 5%, you’re performing well and should consider scaling efforts.

Are shared leads worth buying?

Shared leads can work if you have superior systems and response speed. However, exclusive leads convert at 2-3 times higher rates. If budget allows, exclusivity is worth the premium.

What’s the biggest mistake agents make with online leads?

Giving up too quickly. Most agents make 1-2 contact attempts and move on. The money is in systematic follow-up over 14+ days. Research shows most prospects don’t convert until the 7th contact.

Should new agents use online leads?

Yes, but with realistic expectations and proper preparation. New agents should focus on pay-at-close models to minimize financial risk. Build systems and conversion skills before investing in expensive upfront programs.

Can I use multiple platforms simultaneously?

Yes, but only after mastering one platform completely. Managing multiple lead sources requires sophisticated systems and significant time investment. Most successful agents dominate one platform before expanding.

How do I handle lead quality complaints with platforms?

Document everything. Track conversion rates, response times, and lead characteristics. Present data-driven feedback to platform representatives. Many platforms will adjust targeting or provide credits for documented quality issues.

Your Path to Lead Generation Mastery

The real estate lead generation landscape in 2025 requires understanding each platform’s unique dynamics, implementing sophisticated systems, and maintaining realistic expectations about conversion rates and timelines.

Success depends more on your systems and follow-up consistency than the platform itself. The best agents use online leads as one component of a diversified lead generation strategy, focusing on value demonstration and systematic follow-up to thrive in the new commission structure landscape.

Remember: you’re not just buying leads; you’re buying the opportunity to demonstrate your value to potential clients. Make that opportunity count with professional systems, rapid response, and genuine value delivery. Choose your platform wisely, implement proper systems, and commit to consistent execution.

Get the free follow-up scripts + ROI calculator sheet.

About the Author

[Author Name] is a real estate marketing strategist with 10+ years helping agents and brokerages optimize their lead generation ROI across multiple platforms. Specializes in conversion systems and performance analytics. Connect on LinkedIn.

Sources

- Zillow Group Q2 2025 shareholder letter and investor presentation

- CoStar Group Q2 2025 remarks on Homes.com network metrics

- News Corp FY 2025 disclosures for Move Inc. (Realtor.com)

- BBB National Programs’ NAD decision regarding Homes.com advertising claims

6 Comments